The Man Who Nailed the 2008 Financial Crisis & Dotcom Bubble Predicting Similar Imminent Market Fate

Howard Marks of Oaktree Capital Group LLC (NYSE:OAK) isn’t just some guy. He’s one of the most respected and insightful investors around. He gained his following by issuing contrarian memos right before the 2008 financial crisis and dotcom bubble crashes. Of course, his prescient predictions saved investors tens of millions of dollars. Market conditions are such that he’s warning investors again.

The Howard Marks memo cautions that the conditions responsible for the last two financial crises are present again. Marks uses the word “convinced” to describe his belief that “willing risk-taking, funding risky deals and creating risky market conditions” has made a comeback. (Source: “‘I’m going to issue a warning’: Howard Marks’ outlines the dangers of today’s market,” Yahoo! Finance, July 26, 2017.)

More specifically, Marks sees the unshakable “this time is different” mentality taking over Wall Street. This is manifesting itself in sky-high valuations seen in the technology leaders, where investors assume their leading position will never be challenged. This leads to a virtuous cycle where investors purchase these “super stocks” at any price, believing their dominance will carry on forever.

But just because the tech leaders dominate their respective space now, doesn’t mean it will continue. History is littered with spurts of unfettered optimism that eventually went bust. The so-called “Nifty-Fifty” stocks in the 1960s; Tech stock in the late 1990s (only a few leaders are around today); bank stocks in the late 2000s. History tells us clearly that no industry can fend off challengers and maintain market positioning forever. But stocks are being priced as such.

Marks hammers home this point by referencing Jeff Bezos’s 1997 letter to Amazon.com, Inc. (NASDAQ:AMZN) shareholders. In it, Bezos talked about forging important, business-changing relationships with the likes of America Online, Yahoo!, Excite, Netscape, GeoCities, AltaVista, @Home, and Prodigy. But how many of those company are around or relevant today?

Exactly.

Legendary Investor Howard Marks Issues a Dire Warning for Markets

Howard Marks predictions of caution are focused on four noteworthy aspects of current market conditions, all of which don’t bode well for stocks going forward. They are:

- an unusual amount of uncertainties surrounding macro economic policies (i.e. secular economic growth, Central Bank policies, interest rates etc.)

- Extremely low prospective future returns

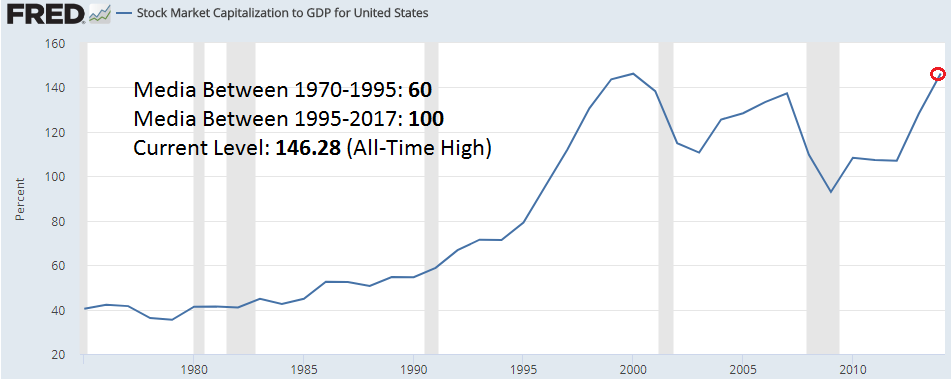

- High asset prices across the board

- Pro-risk behavior which is commonplace

(Source: “There They Go Again… Again,” Oaktree Capital Management L.P., July 26, 2017.)

Marks delves into the particulars of each area, but the bullet points tell the story. Most stock market participants will be familiar with them. These are only being overlooked because of the tidal wave of liquidity flowing from world central banks.

But it is, in effect, a false paradigm. Not only because it isn’t sustainable, but because the markets aren’t “free.” Asset-intrinsic values are at levels being driven by liquidity rather than fundamental factors. Rate-bearing assets don’t provide much yield, so investors have gone all in on riskier assets. This is a situation that never ends well.

Marks’s next financial crisis prediction is not about timing. This much he makes abundantly clear. But he would rather be a few months too early than a few months too late. Once the next financial crisis 2017 (or beyond) starts, it already too late to avoid a big portion of the losses.

Many investors believe they can exit the market first and avoid the big pain to come. This is dangerous thinking. No matter how much you think you’re ready for it, investors have been conditioned to buy (or hold through) the dip. And there’s no question that doing so has served investors well.

But as the endgame approaches, this mentality becomes increasingly risky. When the big fracture does occur, many bagholders will get stranded at the market top. Years of gains (if you bought earlier this decade) will get flushed down the toilet. Even worse for more recent purchasers. As Kenny Rogers once said, “You gotta know when to hold ’em, know when to fold ’em…”

As Howard Marks proclaims, it’s getting quite close to do the latter.