Stock Market Could Crash This Year: Here’s Why

Three key indicators are saying that a stock market crash in 2017 is a real possibility. Warning bells are ringing for the historically correct price-to-earnings (P/E) multiple, stock market margin debt, and investor sentiment.

First, let’s start with the P/E multiple. As it stands, investors are not paying enough attention to how much they are willing to pay for every dollar of earnings that a stock delivers.

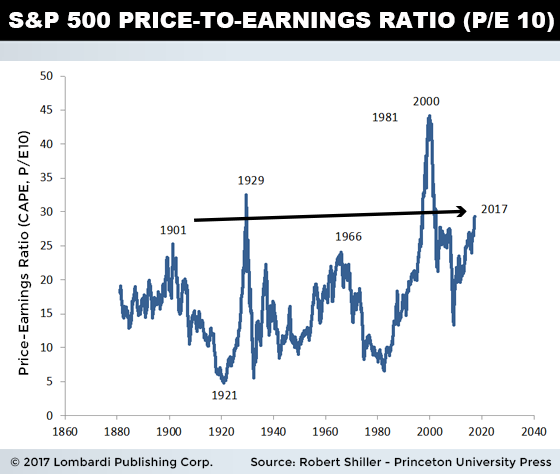

The chart below plots the P/E multiple of the S&P 500 companies, adjusted for cyclicality and inflation.

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

Take out the tech bubble of 2000, and stocks are more expensive today than at any other time since just before the 1929 stock market crash!

Investors are willing to pay $29.30 for every dollar of earnings. This is ridiculous. The historical average since 1881 for the P/E multiple has been 16.74. Simple math suggests that S&P 500 companies are overvalued by 75% from the historical average!

Second, let’s move to stock market margin debt.

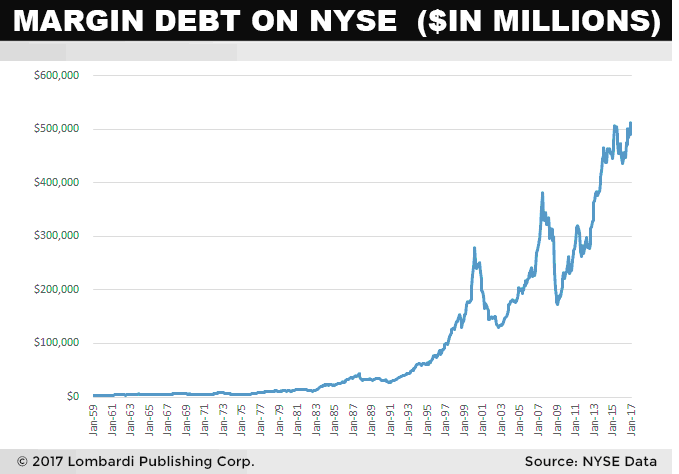

As the below chart shows, margin debt on the New York Stock Exchange (NYSE) has reached a new record of $513.27 billion. (Source: “Securities market credit ($ in mils.), 2017,” Intercontinental Exchange, Inc., last accessed March 27, 2017.)

Why does margin debt matter? Rising margin debt means investors are willing to risk more to buy stocks. But, historically, when investors borrow too aggressively in order to buy stocks, a stock market crash usually follows. We saw this happen in 2000 and 2007.

Third, there is no fear in the market. If there’s one thing that’s very common before a stock market crash, it’s investor complacency. Look back at any previous broad market sell-off, and you will see this phenomenon prevail.

Also Read: Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

The amount of money invested in funds that bet against stocks rising has fallen to a record low, as evidenced by the chart below.

Chart courtesy of StockCharts.com

Assets in bearish stock market funds keep declining. The chart above screams that investors are far too complacent and are way too focused on the stock market going higher.

As my long-term readers know, I haven’t been too optimistic about the stock market. I see the historically accurate fundamentals that guide the market turning more bearish with each passing day.

Sure, irrationality can go on for a while, but not forever. I continue to suggest capital preservation as your best investment strategy. Taking profits off the table—or at the very least, moving the stops higher—doesn’t hurt at all. And it could save your portfolio in the case of a massive stock market crash.