Why Are Americans Leaving the Big Cities?

Many U.S. citizens are fleeing the big cities. Some may attribute this phenomenon to the fact that many of those who voted for Hillary Clinton overwhelmingly live in the big cities. But this appears to be an experience so sudden and new that deeper reasons must be sought. That deep reason might be a sharp decline of optimism among the middle class.

In fact, optimism left the proverbial building years ago, with the subprime mortgage fallout. The resulting subprime crisis was deeper than anyone could have expected. So, the first place to start looking for answers to the question “why are Americans leaving the big cities?” must be sought in the Great Recession.

The U.S. financial system is largely to blame for a number of negative social and economic trends over the past decade. The fact that this demographic shift has been happening in California, New York, Arizona, and Michigan clearly demonstrates that reverse urban migration is a widescale American problem.

In periods of vibrant economic growth, anywhere in the world, the trend is always of large population movements from small towns and rural areas to large urban centers. The current trend of Americans fleeing big cities points to a reversal of fortune for the middle classes. Trump’s immigration policy means, moreover, that there will be fewer buyers for vacant properties.

Americans Fleeing Big Cities and the End of the American Dream

Once-important American cities like Detroit, the former American car empire, now seem like relics of a past that will never return. The new “Motown,” judging by stock valuations, should be Palo Alto or San Francisco, where Tesla Inc (NASDAQ:TSLA) has its headquarters. In a matter of just two weeks, Tesla has surpassed both General Motors Company (NYSE:GM) and Ford Motor Company (NYSE:F) in market capitalization.

Many of Detroit’s once-busy factories and workshops, which fueled a massive urban and suburban development around the automobile, have experienced major decline. The big three automakers suffered major losses after the financial crisis of 2008. Many needed government loans to survive. In return, they had to cut jobs and divisions, causing tremendous social damage.

The recession has left many U.S. cities with deserted houses, abandoned streets, and squatters who have taken possession of houses that others were either forced—or wanted—to leave. Detroit is only the most striking example of this phenomenon. Its population made it the fourth-largest city in America in the 1950s, with a population high of 1,850,000. The population was down to 677,116 in 2015.

But it’s not just Michigan or Detroit. The financial crisis wiped out housing prices in the United States. While the real estate sector has made big gains in certain areas, potentially causing a new housing bubble, other areas are still economically depressed. There are residential “white elephants” even in states like California.

It’s hard to believe, but the Great Recession even reached the West Coast. The Great recession brought construction to a halt in California. There are thousands of incomplete homes dotting the California landscape. The effects of the recession are such that developers are hesitating to build new houses, even in places like Sacramento. (Source: “Natomas loses its housing mojo as developers hesitate to build,” The Sacramento Bee, March 30, 2017.)

Would you believe that none other than “Sin City” (Las Vegas, Nevada) has seen a huge rise in the number of foreclosures in the past few years. Indeed, in the poorest neighborhoods north of Las Vegas, it was reported that one in five houses was foreclosed. House prices have fallen by 60% since the peak in 2006.

In the wake of the 2008 financial crisis, as many as 70% of residents who bought properties in the subprime boom found themselves paying a mortgage much higher than the value of the property. There has been a mild recovery since then, but the number of evictions has risen, fueling the urban displacement problem. (Source: “Foreclosures plummet but evictions spike,” Herald-Tribune, January 7, 2017.)

Then there’s Arizona. After Nevada, Arizona is the U.S. state where owners faced the highest number of foreclosures. Fleeing owners abandoned homes in droves in September 2008 to look for jobs elsewhere. Roads and sidewalks became empty, sending a chilling message that the American dream went up in smoke.

The same happened in Florida. Unemployment and foreclosures became the norm in the aftermath of the 20o8 financial crisis.

Then there’s the special case of Cleveland, Ohio. Cleveland, like Detroit, saw a major hemorrhage of residents. Many people moved there in the 1950s to find jobs in the manufacturing sector. Cleveland was one of the most affected by the Great Recession. While home ownership has declined, demand for rental housing soared as Americans try to cope with lower salaries. In some cases, people have been leaving the large towns simply out of fear of the future.

Many are concerned about a major economic collapse, sparking an unprecedented wave of unrest and crime. If that sounds far-fetched, it is not. Many have attributed the Syrian civil war to a sharply rising economic disparity that was emerging in that country in the 2000s. (Source: “Thousands of Americans are Leaving Big Cities,” Zero Hedge, March 27, 2017.)

The urban rioting that became rather visible in places like Baltimore (and many other areas) in 2016 signaled the risk to many Americans that the deeper socioeconomic rifts could spark a wave of violence not seen since the Civil War. The 2016 presidential election, like few others in the entire history of the United States, highlighted just how divided Americans are.

The contradictions of the U.S. financial system might help to explain the trend, but the problem is bigger than that. For instance, the fear of a U.S. dollar collapse—and the very real possibility of more job cuts in 2017—doubtless have contributed to this growing trend of escape from the cities.

Major Problems Ahead for the U.S. Economy in 2017

Urban emigration represents a warning for the United States and its economy. Far from rosy, the U.S. economic outlook for 2017 is fragile, at best. It may not have become obvious to everyone yet. The markets continue to trade at unprecedented heights. The Dow Jones average went above 21,000 in February 2017, setting successive records.

But that was before President Donald Trump started to move away from his stated geopolitical agenda. Slowly, but surely, Trump has taken a different and more belligerent course. He has gone where Obama never dared, launching a missile strike against Syria. Far from bridging the U.S. relationship with Russia (a nuclear superpower), Trump has raised tensions to levels seen in the Cold War and the Cuban Missile Crisis.

The chance for a “black swan” event in 2017 to trigger a major collapse of the current economic system, not just a stock market crash, has increased exponentially. In a matter of days, Trump has overturned the geopolitical balance and his campaign promises. The Syria airstrike has not had any direct consequences yet, but, it’s just a matter of time.

Trump has proven to be more belligerent in foreign relations than Hillary Clinton might have been, had she become president. The markets, and not just the American ones, are faced with an unexpected problem. Investors, globally, must now deal with the risk equivalent of a wrench being thrown against the wheel. If there’s one certainty about the markets, it’s that they don’t like uncertainty.

While the markets have masked the economic slowdown—the recession, if you will—there is something wrong. The fact that people are leaving the big cities in droves is an important symptom of the economy that has not recovered in the true sense. Many Americans have been left behind. City living in the United States has become expensive.

The low labor force participation—that is, unemployment and underemployment—have magnified the challenges of education and infrastructure. Simply put, there are fewer people working in well-paid full-time jobs; what we used to call “middle-class” jobs.

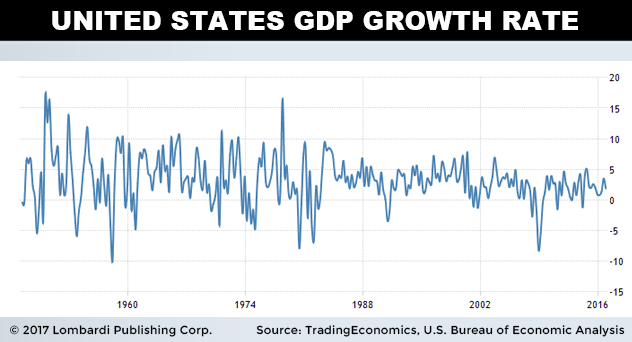

Therefore, municipalities, states, and the federal government have fewer tax dollars to fund the necessities that allow the private sector to thrive. Meanwhile, gross domestic product (GDP) growth has declined sharply in the past decade, and has barely recovered to the level of the 1992 recession.

Donald Trump Has Forgotten about Putting America First

Soon after Donald Trump was elected as president, he appeared to have stimulated growth and jobs. But, in practice, what he has actually done is awakened optimism and confidence in the economy in his first month in office. But, in the past few weeks, the president appears to have forgotten why he was voted into office.

It was to put “America first.” That’s what has driven the Dow Jones Industrial Average (DJIA) to record highs. Yet, these same markets will wake up to the realization that something is wrong. Trump has suddenly made a major policy shift. He has sent warships toward North Korea. He seems ready to put the United States on a new political and military adventure that could end up costing billions of dollars.

It’s true that some stocks could continue to make handsome gains; for instance, the defense sector. But what about the average American? Consider that wars cost billions of dollars to run. Even the 59-missile strike against Syria on April 6 may have cost as much as $100.0 million in rockets alone.

Renewed large-scale military campaigns will exacerbate the already-rising national debt. Thus, more wars will prevent Trump from executing the kinds of tax reforms he promised when he delivered his inauguration speech. Many businesses have noted that corporate tax in the United States is too high.

The U.S. corporate taxation rates are driving foreign capital and brains away. Ironically, so are Trump’s migration policies. Many of the top industrialized countries have reduced corporate taxes over the last decade. The United States remains at the highest levels, harming economic growth.