Could Overvalued U.S. Stocks in 2017 Terrify Janet Yellen?

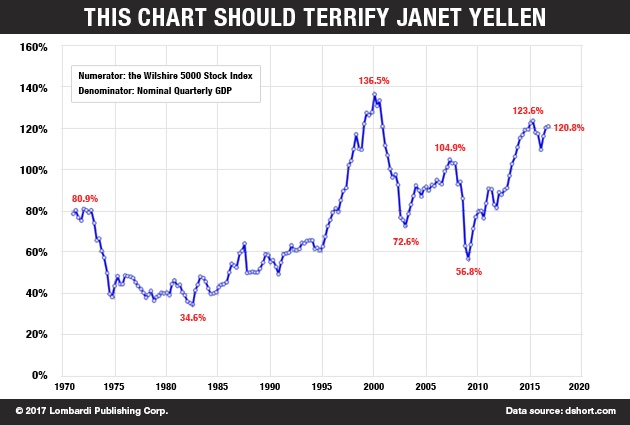

Wall Street is struggling to understand what its true price is. In fact, Wall Street is experiencing a veritable existential crisis. It doesn’t know if it’s a stock market or the MGM Grand Las Vegas Casino. Paul Tudor Jones, who predicted the crash of 1987, warns Fed Chair Janet Yellen that market capitalization in relation to the economy is reaching levels similar to those just before the Internet bubble.

Looking at it closely, there is ample evidence of a stock market bubble in 2017. Wall Street did not stop even in the face of the European elections. The latter could produce hugely disruptive political and financial effects. Instead, U.S. stocks continue along an unabated bullish course, compared to bonds.

To speak of an upcoming stock market bubble is deceitful. We’re already in a bubble. It’s hardly a matter of “upcoming!” Such market Price to Earnings (P/E) ratios as 22 times for the S&P 500 are at the highest in almost a decade. (Source: “Hedge fund legend Paul Tudor Jones says this ‘terrifying’ chart should freak out the Fed,” CNBC, April 21, 2017.)

Paul Tudor Jones’s prediction is dire and to the point: The U.S. stock market has reached an unsustainable level:

Low interest rates, hints Paul Tudor Jones the trader, have inflated stock valuations. But Tudor Jones is merely one of many asset managers, who have started to warn the market. They are like Cassandra, the mythological Greek figure who predicted the destruction of Troy in time to save it. But the Trojans did not believe her because of a curse afflicting Cassandra herself.

In the case of the markets, the signs of a market crash in 2017 are everywhere. Paul Tudor Jones is but one of many voices of gloom and doom. But investors don’t want to believe the warnings signs and their messengers pointing to the overvalued stocks. Even if the earnings season has gotten off to a favorable start, it’s nowhere near enough to warrant the analysts’ bullish revisions of their estimates.

Higher-Than-Expected Earnings Without Revenue Gains Signal Trouble Ahead

At first glance, the results of the S&P 500 companies that have recently posted earnings, three-quarters got better earnings than expected. That’s great. But, fewer of these showed higher revenues than earnings according to Zacks Investment Research. Perhaps, the explanation is that the tax reform might be starting to have an impact. (Source: “Earnings Growth Accelerates in Q1,” Zacks Investment Research, April 21, 2017.)

A tax reform would necessarily have a stronger impact on profits than growth. But it’s also a warning sign. The tax reform effect might come once or twice, but the true sign of economic health is higher revenues. That’s what points to a general optimism in the economy and the prospect of a sustained higher earnings season.

That said, Trump’s fiscal reform has yet to show its full effects. It has not even started yet. The recent successive wave of market rallies, even in the face of trouble brewing in North Korea, Syria, and the European elections should have prompted at least some caution. Instead, the markets keep rallying in expectation of a “miraculous” plan to cut taxes.

This would explain how the multiples could go so high. It’s time for investors to remember stock market bubble consequences. But it’s not too late for them to realize that there will be a significant market downturn in 2017. It may wait until the end of year, when the markets will have absorbed the fantasy of Trump’s “tax cut and infrastructure spend” plan. But a crash is inevitable.

The low interest rates have fueled a stock market valuation trend, unable to keep up with reality. The reality is that, sooner or later, the market will notice that the U.S. economic outlook for 2017 is hardly favorable. Paul Tudor Jones is but one observer who could not fail to notice the warnings signs.

So far, the stock market has gone up. That’s undeniable. But too many, from investors to some media pundits and politicians, have mistaken the stock market’s performance with economic outlook.

Economic outlook is a much wider and more democratic concept that includes such variables as income pro-capita, unemployment, and overall confidence in the future. The very confidence that even low-income people may experience as they decide to buy a house or a new car without resorting to questionable loans and interest rates.

The United States, and indeed most of the world, is way off from that kind of confidence. The new headlines are replete with stories about newly minted billionaires and millionaires. Indeed, the numbers of the super-rich have been increasing. All that shows is that the rich have found better ways to accumulate wealth. But they have not found better ways to spread that wealth.

Some Pessimism Is in Order; It Might Already Be Too Late to Prevent the Market Bubble from Bursting

The wise, those who have pondered over the Cassandra warnings, may have realized some well-placed pessimism might be in order. The moment analysts miss on one or two key earnings forecasts—later this year, perhaps in the summer or the fall—the S&P 500 could fall. A bubble, no matter how large, merely needs but one prick for it to burst.

Some experts are already betting on a falling S&P 500, which could begin with a 10% price correction for equities. (Source: “Is the US S&P 500 (SPY) Due For A Correction?,” BNL Finance, April 15, 2017.)

But this market crash has the potential to bring the whole house of cards down. As Tudor has noted, the stock rally will continue, fueled by investors entering the market with borrowed money. (Source: CNBC, op cit.)

It remains to be seen how Trump is developing an economic policy and who will benefit from it in the end. The direction for the financial markets is clear; the destination is out of control. With the markets, it’s always, as the Shirley Bassey song says, a case of a little “history repeating.” Almost exactly ten years ago, the American real estate bubble exploded.

It produced the most dramatic and long-lasting crisis that the entire history of capitalism has ever had the misfortune of experiencing. The Great Recession, as it has been called, has had deeper and wider effects than the Great Depression, triggered by the Great Crash of 1929. The current stock market, just as in the months preceding the 2007/2008 crash, was encouraged—if not directly triggered—by a rapid deflation of a real estate bubble.

The Market Crash Checklist Sends a Dire Warning

If you were to compile a checklist of basic conditions to notice before a market crash, the current situation contains key triggers. Is there an overheating real estate market? Check. Is globalization continuing unabated, with jobs flowing from “rich” economies to the developing world? Check. Have the market regulators taken steps to prevent another Great Recession? Yes and No.

Yes, because Congress passed the Dodd–Frank Wall Street Reform and Consumer Protection Act legislation to prevent commercial banks from speculating in the financial markets. No, because Trump’s big idea of market reform is to scrap that very Dodd–Frank financial regulatory reform, which would in practice give a green light to the kind of unfettered investing that always ends in a crash.

There is nothing to stop a repeat of the last financial crisis. The process always begins with a market bubble, just like the very kind that is inflating now. In the 2007 case, the U.S. real estate market collapsed first. Then the investment banks that had securitized debt in the form of subprime mortgages discovered that modern finance is like alchemy.

In the Middle Ages, alchemists tried to convert base metals like lead into gold. In the present era, alchemists are the investment bankers and financial engineers, who bet on bets, through the financial “products” they call derivatives. When Lehman Brothers Holdings Inc. collapsed in September of 2008, average investors found out that alchemy is as much of a hoax in the 21st century as it was in the 16th.

The toxic securities infected the system and thousands of billions went up in smoke. Millions of families worldwide went bankrupt. Chronic unemployment set in. People weren’t earning, so people weren’t buying, setting off a vicious circle of recession, suicide, depression, and drug and alcohol abuse. Many of you who are reading this know this is no exaggeration. The U.S. economy has not really improved enough to generate a real recovery. What there has been is a Wall Street recovery, which has masked the much harsher reality that the real economy has not improved quickly enough.

The record high Dow Jones index has not changed the structural nature of the economic system at the root. The root is rotten and it stems from a process of globalization gone wild without any criteria or rules. Imports have hurt industry and the economies of developed markets like a poison.

That’s why Trump won the 2016 presidential election. But instead of confronting the actual causes of the enduring recession, Trump has gone off doing exactly what he accused Hillary Clinton of planning: getting involved in overseas military adventures. Two are brewing: one in Syria and the other in North Korea.

All it takes to trigger another global economic collapse is the current market bubble bursting. The ratio between share prices and S&P 500 company earnings is very high. It’s at the same level as it was in 2008 and 1929. There may be a bubble ready to burst. Today, there is risk from the outcome of the elections in France. But the key variable, the unpredictable or Black Swan event that could burst the bubble, could be the effects of the Federal Reserve lifting U.S. rates.

The key point is to determine if the current market values have any rational basis for being. That said, investors worrying about previous bubbles did find rational justifications for what was happening. In 2000, they reasoned that dot-com companies would change the world. Thus, those stocks were different.

Today, as an example of a stock that’s taken off beyond the wildest rationale, Tesla Motors (NASDAQ:TSLA) is rising because all cars will be electric. In, 2008, it was normal to have growth without inflation. But the mortgage crisis exploded. It should have opened everyone’s eyes. But it has not, apparently, and we’re headed straight into another crisis blindfolded.