Still Bullish? Beware Ray Dalio’s Economic Predictions for 2017

Many are not yet clear on what’s happening in the world now. There are threats of conventional wars and nuclear wars. These grab headlines. What’s less visible in the eyes of the public is the prospect of another financial catastrophe. Don’t take my word for it; Ray Dalio’s economic predictions for 2017 suggest that investors should expect to be disappointed.

Dalio, who founded Bridgewater Associates, the largest investment fund in the world, was previously optimistic about the U.S. economy. Dalio had a pleasant 2016/2017 New Year’s Eve, because he expected President Donald Trump to turn the economy around. More recently, Ray Dalio’s prediction for the economy changed virtually overnight.

Trump’s inauguration speech on January 20 gave few hints of the files he would choose to tackle first. But Dalio and other fund managers saw plenty of references to the fact that Trump wanted to put “America First.” By that, they expected Trump would give up on foreign military interventions and focus the White House’s gaze on the domestic economy.

After all, that was the very point of the 2016 election campaign! Hillary Clinton was going to drag the U.S. into more useless wars overseas. Trump was going to improve the fortunes, not just of those on Wall Street, but of those in the lower and middle classes—the very same people who suffered the most after the stock market crash of 2008.

These include the factory and mine workers that got the proverbial “shaft,” even if they had no investments to lose. They lost jobs in coal mines or on the factory floors. It took but nine days for Dalio to shift his outlook from optimism to pessimism. Dalio exchanged the bull for the bear when Trump seemed to worry more about keeping certain foreign visitors/immigrants out than about delivering on his economic growth promises.

Dalio wasn’t worried so much about his personal fortune. Ray Dalio’s net worth is some $17.0 billion, while his Bridgewater Associates firm manages assets of over $120.0 billion. Indeed, Bridgewater Associates is one of a handful of hedge funds whose assets have risen in the period from 2016–2017.

Many others, including Och-Ziff Capital Management Group LLC (NYSE:OZM), which lost a third of its value, experienced a decline. The biannual “Billion Dollar Club” report recently showed that the largest 309 hedge funds lost about 0.2% of their value from the beginning of January 2017, compared to January 2016. (Source: “Big hedge funds see assets shrink for the first time since financial crisis: Billion Dollar Club survey,” Financial Post, April 27, 2017.)

Trump Has Disappointed Dalio’s Expectations

Trump has thrown Ray Dalio’s economic predictions in turmoil. When Ray Dalio criticizes Trump, understand that it’s not coming from a position of envy or resentment. It’s coming from a position of concern. Dalio wants to keep his wealth safe from economic and financial shocks. He also wants to enjoy his wealth; that means not having to pay excessive attention to his—and his family’s—personal safety.

Dalio does not want the United States to become Brazil, where a small, but fabulously wealthy, minority live amid a huge underclass. Consider that Brazil, especially its financial capital, Sao Paulo, has the world’s highest per-capita number of helicopters. Wealthy people prefer these to cars. (Source: “Sao Paulo’s millionaires use helicopters to avoid traffic jams,” South China Morning Post, April 26, 2013.)

Brazil’s upper class can move from their homes to their offices while bypassing city streets, where they could get robbed at gunpoint. According to one narrative during the 2016 U.S. election campaign, the “liberal elites,” typified by the likes of Hillary Clinton, seemed to have forgotten about the problems of the average person. Trump, meanwhile, presented himself as a protagonist of a new political class.

Trump seemed to be the president who had the will and the capacity to turn back the clock on globalization. Not all aspects of globalization, mind you—only the ones that have benefited the financial elite at the expense of other Americans. Yes, the “financial elite” would include people like Dalio but, even the billionaires—when they’re smart—realize that, in order to keep their fortunes, they must pay attention to the risks of disparity. As the chart below shows, American income has not recovered since the 2008 market crash.

Anyone who has been paying attention knows that, in the past 25 years or so, the developed countries have spawned two groups of people: two classes, if you will.

In one corner is a small ruling class that has made its fortunes and, if you think it’s all because of hard work, I have a rare Michelangelo statue for sale.

In the other corners are the many people who have gotten nothing out of globalization. That is why the so-called populist movements have risen in Europe and in America. These are the people for whom the traditional parties, like the establishment Democrats and Republicans, appear to be one and the same. The political parties might vary in degree, but both have no solutions to the current problems.

The Problem Is Populism, Says Dalio

Dalio actually has quite a lot at stake in this puzzle. Ray Dalio is a billionaire. He is the 69th richest person in the world by some counts. Still, he’s right to fear that, if the status quo remains, he could drop in those rankings. He may end up being relegated from billionaire to mere millionaire.

In an 81-page paper published in March, Ray Dalio described the history of populist movements as they emerged in 10 developed (i.e. rich) countries. Dalio looks at the appeal of many leaders who have been misunderstood, at best, by those navigating in the traditional power circles. (Source: “Ray Dalio Says Populism May Be a Bigger Deal Than Monetary and Fiscal Policy,” Bloomberg, March 22, 2017.)

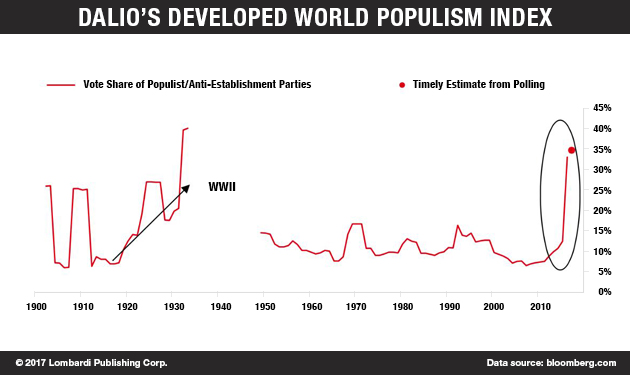

Dalio’s paper considers such leaders as Venezuela’s Hugo Chavez. He also looks at U.S. President Franklin Delano Roosevelt, who was considered a populist, though he’s more often presented as a liberal Democrat. Dalio says, and shows, that populism today has achieved its highest point since the 1930s.

Dalio, who works with numbers and charts every day, has even come up with an index to measure populism. The logic behind this index (the Developed World Populism Index) is the number of votes received by anti-establishment parties or leaders.

This index has now reached a 35% peak. It’s not at its highest though. That dubious honor is found in 1938, when the Developed World Populism Index shows a designation of 40%. That’s a scary prospect, given what followed. Could Dalio’s index also be a harbinger of a double whammy of catastrophes: economic collapse and World War 3? The current geopolitical climate is just as uncertain as the economic and financial one. Thus, let us hope that Dalio’s index is severely flawed.

Are We Heading Toward Another Stock Market Crash of 1929?

Dalio avoids talking about the eventuality of another stock market crash of 1929. Nor does he see the U.S. experiencing a 21st century version of the Great Depression. For starters, that already happened—in 2008. But Dalio does suggest that populism is bad for multinational corporations.

Given that multinational corporations dominate the world’s major stock indices, it follows that populist movements are bad for the stock market outlook for 2017. Dalio may have purposely chosen to avoid being alarmist, given his weight in the market. If he were to speak publicly, expressing fears of a stock market crash, it could happen.

On the practical side, according to Dalio, to ensure that the markets perform well, Trump has to avoid the populist urge. Dalio argues that Trump should worry less about immigrants and focus more on making his economic plan work. So far, the plan has produced a tax reform proposal that has little chance of passing in Congress, despite a Republican majority in both houses of government.

Trump’s tax reform policy cuts taxes and looks beautiful on paper, but it might just be too nice to work. Trump has promised much, but he hasn’t convinced us how the tax reform will pay for itself. As it stands now, the tax cuts could make the already-rising national debt explode. Ray Dalio’s economic predictions have started to come to terms with Trump’s populist appeal.

Even they might look at it with the skepticism that says: it’s good, but maybe too good to be true. The megastars of the finance world have no intention of losing; they will mobilize to launch a counteroffensive. The Ray Dalio portfolio was conceived to be bulletproof or, as Dalio calls it, an “all-weather portfolio.”

Ideally, the Ray Dalio portfolio will protect investors from major shocks. It consists of a mix of assets arranged as follows: 30% stocks, 15% intermediate-term bonds, 40% long-term bonds, five percent gold, and five percent commodities. (Source: “What Does the World’s Largest Hedge Fund Manager Say to Do Now?,” ValueWalk, April 27, 2017.)

I am not privy to Ray Dalio’s stock picks, but you can rest assured that the boss of Bridgewater Associates has lost his enthusiasm for Trump. Chances are, he might be considering boosting the gold component of his portfolio. That’s because it looks like a Category 8 hurricane is about to strike the markets if Trump focuses more on pursuing a populist agenda than on strengthening the economy.

The point that Dalio makes—and the “peak populism” in 1938 gives him some validity—is that nationalism and protectionism are pushing the United States toward conflict. Sooner or later, major investors will come to appreciate and share Dalio’s sentiment. When that happens, the effect on the stock markets could be heavy. Consider Dalio’s concerns to be a guaranteed seat on the lifeboat aboard the Titanic—before it hit the iceberg.