Here’s Why U.S. Dollar Collapse Could Happen

A U.S. dollar collapse could come into play sooner, rather than later. Be very careful; if this happens, it could have dire consequences. Not only it would take a toll on the wealth of Americans, it would create a significant amount of uncertainty across the globe.

As it stands, as interest rates are expected to go higher in the U.S. and the economy is doing fine relative to other major economies, a U.S. dollar collapse prediction may sound bold. But, if you pay attention to the fundamentals and how the dollar is being perceived, you could agree with this.

It’s important for investors to pay attention to three indicators that lead to this dire forecast for the dollar: 1) central banks are looking to acquire alternative assets to the U.S. dollar, 2) there is a significant amount of political uncertainty, and 3) the current price action isn’t liked by investors.

Are Central Banks Starting to Fear the U.S. Dollar Collapse?

Let’s get this straight: central banks aren’t outright saying they don’t like the U.S. dollar. But, if you look at their actions, they are speaking louder than words.

Go back to the 1970s, when central banks decided to ditch the gold standard. They bought into the idea that they should hold the U.S. dollar in their reserves. Great. This worked for awhile, and not many questioned this. Over time, the U.S. dollar made up a huge portion of their reserves.

Now, if you look closely, central banks are looking to diversify their reserves. This leads to questions about whether the dollar could become a problem down the road.

Consider this: central banks are buying gold. It’s almost as if they are getting ready for a U.S. dollar collapse. Know that gold helps central banks reduce volatility in their reserves. The first quarter of 2017 marked the 25th consecutive quarter when central banks added gold to their reserves. (Source: “Gold Demand Trends Q1 2017,” World Gold Council, May 4, 2017.)

Also, know that if you look at the central banks who already hold significant amounts of gold, they are hoarding it, not selling it, whatsoever.

Furthermore, there’s an emergence of a new currency that could be held in central banks’ reserves: the Chinese renminbi. So, central banks could be looking to buy the Chinese currency. At the end of the fourth quarter of 2016, the renminbi made up only $84.51 billion of all the reserves. (Source: “IMF Releases Data on the Currency Composition of Foreign Exchange Reserves Including Holdings in Renminbi,” International Monetary Fund, last accessed March 31, 2017.)

Mind you, the renminbi was just added to a basket of currencies called “special drawing rights” (SDRs). In the third quarter of 2016, it wasn’t held by central banks.

Over time, it will be interesting to see how central banks acquire the Chinese renminbi. Would they be selling the U.S. dollar or other currencies? It wouldn’t be shocking to see them sell the dollar.

Political Uncertainty and Soaring Deficits

Its also critical to understand how political uncertainty and the government’s inability to control its expenses could destroy a currency.

Sadly, this is very visible in the U.S., and this could really hurt the value of the dollar.

On political uncertainty, listen to any political analyst or guru. They are, at the very best, confused. They are having a very rough time trying to anticipate what could be the next move by the current U.S. presidential administration. They are asking if the administration will be able to stick with its promises.

When looking at the U.S. Congress, it appears that there’s a lot of unwillingness or outright deadlock. No matter how you look at it, this is slowing down the legislation process dearly.

This is not good.

For instance, there were problems repealing Obamacare. It took two tries in Congress, and we still don’t know if it will be fully gone just yet.

At the same time that the government is unable to control its expenses, the new U.S. administration is working on a tax plan that’s expected to include one of the biggest cuts in the history of the United States. It’s very critical to understand that tax cuts mean a reduction in government revenue. Right now, the hope is that lower taxes would boost the economy, and, therefore, neutralize the tax revenue—meaning it won’t impact it much.

But, it must be questioned: what if this doesn’t work as expected? You see, lower revenue for the government means that it would need to borrow more money to spend. At the time of writing this, the U.S. national debt stood at $19.84 trillion. Keep in mind, the U.S. has the biggest national debt (in monetary terms) than any other country in the world. (Source: “The Daily History of the Debt Results,” TreasuryDirect, last accessed May 8, 2017.)

Soaring national debt leads to currency devaluation, and eventually outright collapse. Don’t forget, over the course of history, we have seen this over and over again. Don’t for a second think it will be any different for the U.S. dollar.

Price Action Suggests a Significant Amount of Pessimism

While the fundamentals are making a solid case for the dollar collapse, if investors pay attention to the price action, they will see that it’s telling them that severe pessimism is building up against the greenback.

Economics 101: as interest rates go up and the economy performs well, currency moves higher. With this, one would assume that the U.S. dollar would be soaring.

Sadly, this is not the case.

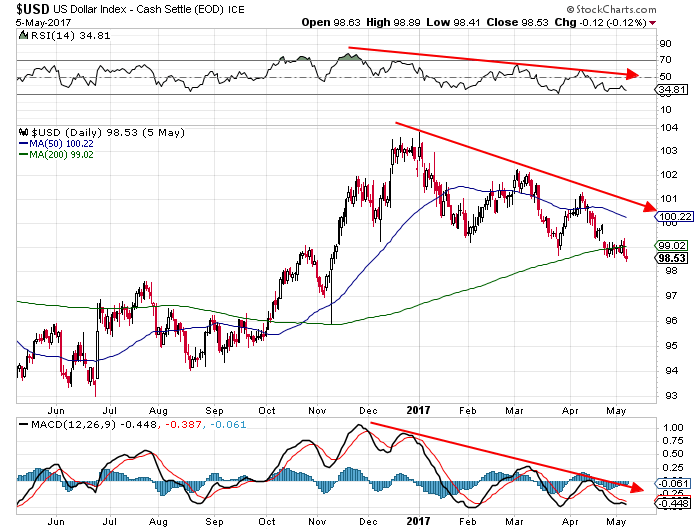

Please look at the chart below of the U.S. Dollar Index (the value of the U.S. dollar relative to the major global currencies) and pay close attention to the lines drawn.

Chart courtesy of StockCharts.com

At the turn of the year, something happened. It looks like the bullish run for the dollar since mid-2014 snapped.

If you look closely at the chart above, you will notice that the trend is pointing downward, making lower lows and lower highs since the beginning of 2017.

Don’t just stop there; look at the 50-day moving average (blue line) and the 200-day moving average (green line) on the above chart. At their very core, these moving averages give an idea about how the trend looks in the intermediate and longer terms.

Currently, as those moving averages are above the price, it suggests that the intermediate and long-term trends for the U.S. dollar have turned against the bulls. With this, remember: trend is your friend until it’s broken. Also, keep in mind that, when it comes to currencies, trends tend to continue for awhile. So, this downward move in the U.S. dollar could continue.

In addition to this, look at the moving average convergence/divergence indicator, commonly known as “MACD,” at the bottom of the chart above, and the relative strength index (RSI) indicator at the top of the chart. Essentially, these are momentum indicators that tell which direction investors are favoring the trade.

Both of these indicators are pointing downward, and this suggests that bearish sentiment is prevailing. Saying the very least, it shouldn’t be taken lightly, whatsoever. It makes a U.S. dollar collapse a real possibility in 2017.

Gruesome Outlook Ahead for the Greenback

Dear reader, understand that there are essentially two things keeping the U.S. dollar together: belief across the board that it’s a safe-haven currency, and that other major currencies performing poorly. There isn’t really much to it than that.

Unfortunately, with the fundamentals of the U.S. dollar going haywire, it must be questioned whether a dollar collapse is possible. Data and indicators suggests that it could be possible sooner, rather than later.

If investors believe this is something that could come into play, as I said earlier, it could have dire consequences.

For instance, what could happen to the purchasing power of average Americans? Since the U.S. imports a lot of goods from around the world, all of a sudden the prices on those imports could shoot through the roof. This means that Americans’ purchasing power could tumble severely in a very short time.

Also, if investors hold the U.S. dollar, they could find themselves holding something that’s worthless, or learn that there are better alternatives.

Furthermore, the dollar collapse would also result in a lot of uncertainty across the globe. Know that the U.S. dollar dominates world trade; trading around the world is done in dollars. So, all of a sudden, countries and businesses could be scrambling to find alternative ways to trade or to value their goods.

How to Prepare for U.S. Dollar Collapse

If the U.S. dollar collapses, it might be a good idea to pay attention to precious metals, be it silver or gold. These precious metals have a history of storing wealth in times of currency devaluation and uncertainty.

What’s the best part? These precious metals, given their fundamentals, are selling at a deep discount. Investors are ignoring them because they believe they have no use in their portfolios. In a dollar collapse situation, metals could be very helpful.

If investors are looking to profit from a possible U.S. dollar collapse, they could pay attention to exchange-traded funds (ETFs) like the Powershares Db Us $ Index (NYSEARCA:UDN), also known as PowerShares DB US Dollar Index Bearish Fund. At its most basic level, this ETF increases in value as the U.S. dollar declines in value.

Also, investors could look at other ETFs, like the Guggenheim CurrencyShares Swiss (NYSEARCA:FXF), also known as CurrencyShares Swiss Franc ETF. This ETF lets investors profit from the Swiss franc; it increases in value as the franc appreciates. If the U.S. dollar collapses, there could be a possible scenario in which investors run toward the Swiss franc, another well-known safe-haven currency. Obviously, this ETF would rise in value.