Ignore Interest Rate and U.S. Dollar Talk: Silver Prices Setting Up to Soar in 2017

Year-to-date, silver prices are up roughly 7.05%. Could these gains sustain? Yes, we could see another stellar year for silver, and more gains could be ahead.

These days, we are told silver isn’t even worth a look because interest rates are expected to go higher and the U.S. dollar is going through the roof.

Here’s the thing: Those who say that could really be out of touch with reality.

How High Could Interest Rates Really Go?

Yes, the Federal Reserve is set on raising interest rates, and we could see several rate hikes this year. But, it must be asked how far the Federal Reserve could really take rates.

If you look at the Federal Reserve projections, by 2019, interest rates are expected to go up to about three percent from just one percent today.

Now, it must be asked if the U.S. economy could actually handle three-percent interest rates in the next few years.

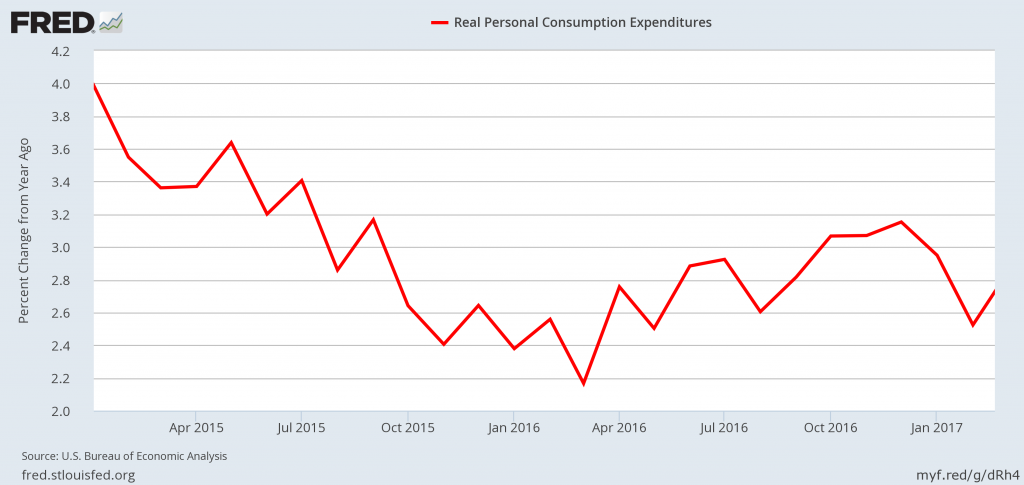

Before you answer, look at the chart below. It shows the year-over-year percentage change in monthly real personal consumption expenditures since the Federal Reserve started to move interest rates.

You see, as it’s said, a picture is worth a thousand words. Since the Federal Reserve starting increasing rates, consumption has been sliding.

What does this mean? You see, consumption makes roughly 70% of U.S. gross domestic product (GDP). If consumption is starting to look like its decelerating when interest rates just moved from 0.25% to 1.00%, what would happen when they go to three percent?

So, those who say silver prices could decline after interest rates move higher need to re-think their narrative. Interest rate hikes could actually send the U.S. economy into a recession, and this would make silver an even better opportunity.

U.S. Dollar Trending Lower

How about the U.S. dollar? It’s skyrocketing, right?

Again, don’t pay too much attention to the noise. Please look at the chart below of the U.S. dollar index. It essentially tracks the value of the U.S. dollar relative to other major currencies.

Chart courtesy of StockCharts.com

On the chart above, pay attention to the 50-day moving average (blue line) and 200-day moving average (red line), and their locations. At the very core, these two moving averages tell where the intermediate-term and the long-term trends are pointing.

With both of these averages above the price, it suggests the intermediate-term and long-term trends are pointing to the upside.

Keep in mind, when it comes to the currency markets, trends tend to continue. With this, it wouldn’t be shocking if the U.S. dollar continues to decline in value relative to other major currencies. This is very bullish for silver prices.

Silver Prices Outlook for the Rest of 2017: Bullish

Dear reader, over the years, there’s one thing I have learned: If an investor ignores the short-term noise and doesn’t get too boggled up by opinions, they could really make a killing just by paying attention to basic things.

As it stands, one of the biggest reasons silver prices are down is because overall sentiment is that the gray precious metal isn’t worth it.

But it must be understood that the fundamentals of the silver market are improving and calling for much higher silver prices.

So far in 2017, silver prices have been strong. It wouldn’t be shocking to see the trend continue for some time.

I am going to be bold here and say this; we could see 2017 be another year when silver prices rise for the second year in a row. We could be seeing another silver bull market in the making this year.