As bold as it may sound, it wouldn’t be shocking to see oil prices crash to $20.00 a barrel (or even less). Why could this happen? Simply, there’s too much oil in the world, and there’s declining demand for it.

How bad is the situation?

Major Shift in the Oil Market

In the past, the price of oil was highly affected by what happens in the Middle East, since it’s a major oil-producing region. Today, the situation in the oil market is so poor, even bad news coming out of the Middle East has next-to-no impact on oil prices.

Last week, we saw a lot of news about how Saudi Arabia, United Arab Emirates, Bahrain, and Egypt cut their diplomatic ties with Qatar—another big oil-producing country.

In the past, when we saw news like this, a pop of $5.00 or more per barrel of oil would have been expected. But on this news, nothing happened to oil prices.

Oil Prices: Crash Began in 2014

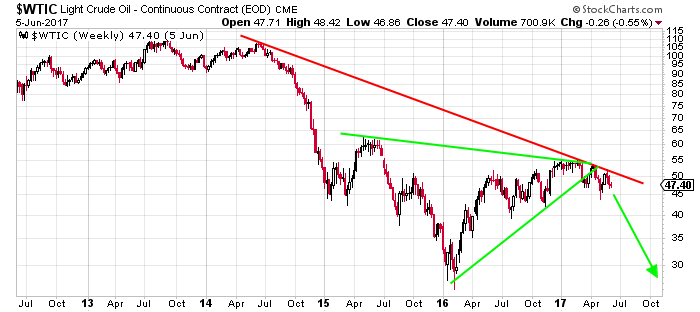

The chart below clearly shows the crash in oil prices that started in the summer of 2014.

Chart courtesy of StockCharts.com

After hitting a low in early 2016, oil prices started to move up. The pop in the price of oil since early 2016 is what I call a “dead-cat bounce.” After crashing about 75%, investors saw oil as a bargain, so they came in and start buying the depressed commodity. I believe that the dead-cat bounce in oil prices is now over, and that oil is headed back down to $20.00 a barrel.

In the chart above, pay close attention to the green lines. Oil prices are forming a chart pattern called a “symmetrical triangle.” At its core, this pattern is formed when there are two contracting trend lines, and the price revises direction every time it hits those trend lines. The price of oil has broken to the downside of the triangle, which means the new trend is down.

Oil to Hit $20/Barrel?

The crash in oil prices to the $20.00/barrel level that I am expecting will negatively impact energy companies in the U.S., as well as our economic growth as measured by gross domestic product (GDP).

Over the last few years, the U.S. has become a substantial oil producer, employing a large number of Americans. If, all of a sudden, American oil companies find they can’t produce oil profitably, the impact on the economy will be felt.

Crashing oil prices…just another reason why I’m so bearish on the stock market and the economy.