This Is a Big Driver for Silver Price Forecast in Second Half of 2017

Silver investors are at a loss. Certain truisms exist in the market which don’t quite add up. If supply is decreasing and demand increasing, why are these fundamentals not reflected in spot silver prices? It’s a vexing question, but it does have an answer. It relates to the market’s infatuation with technology and other “risk-on” assets. But it may be coming to an end. Our silver price forecast for Q3 2017 reflects the fact that the winds of change are blowing, and that sector rotation in precious metals may finally jump start price for a prolonged ride north.

The five-year silver price trend has been incredibly frustrating for investors. Silver spot has bounced between $14.00-$21.00 an ounce, with large supply in paper markets suppressing price at every turn. How do we know it’s the “paper market” where this is occurring? Because in the world, demand is outstripping supply.

Data in 2016 shows that mined silver output declined for the first time in 14 years. The reason? According to the Silver Institute’s World Silver Survey 2017, less production of other base metals is to blame. Since around 70% of all mined silver is a result of byproduct production, less mining of base metals equals less silver. With the U.S. and Chinese economies losing stream rapidly, this doesn’t bode well for increased supply in the near future. (Source: “Silver Supply Deficit Rises in 2016,” Money Metals Exchange, May 15, 2017.)

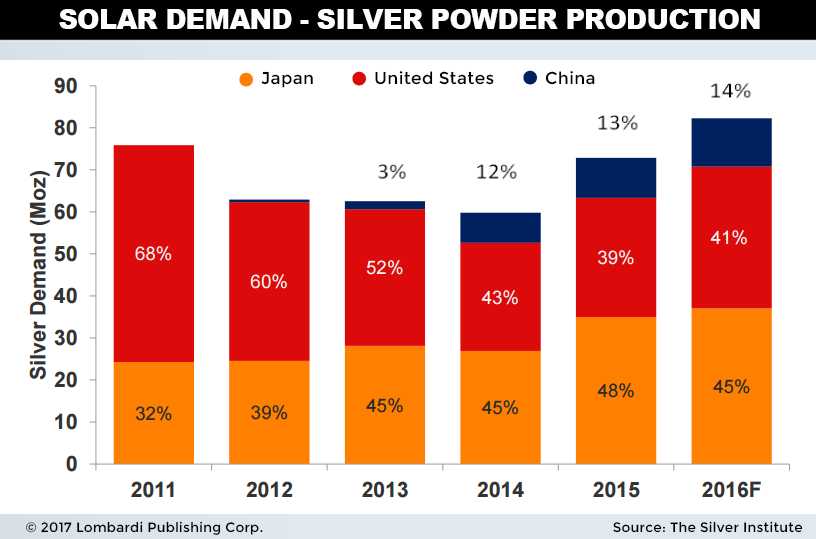

All the while, demand for things like cell phones, solar panels, and emerging tech keeps rising. According to global research company Gartner Inc (NYSE:IT), smartphone unit sales alone topped 9.1% in the first quarter of 2017. Similar growth in other industries requiring mandatory silver usage is taking place. (Source: “Gartner Says Worldwide Sales of Smartphones Grew 9 Percent in First Quarter of 2017,” Gartner Inc, May 23, 2017.)

Nor will the lack of price traction incentivize silver producers to keep mills running in overtime. The fact is, not everyone is making money at $16.50/ounce of silver. And the ones that are aren’t incredibly intent on mining their highest grade ores. Unless forced to, miners will prefer to keep these underground until prices are much more lofty to maximize earnings.

Silver Price Forecast for Q3 2017

Although the silver price today belies the fact that favorable supply/demand dynamics have existed for the past couple years, the “spark” to ignite prices higher has been lacking. Having the proper conditions is one thing, having investors vote with their wallet is something completely different. But we may be heading into a time where investors take notice.

The pervasive overvaluation in the U.S. equity market is just begging for a widespread sector rotation in silver to take place. Not just silver, mind you; other precious metals and value stocks that have been neglected by the market. As a record amount of investor capital has been diverted into tech names like Amazon.com, Inc. (NASDAQ:AMZN) and Alphabet Inc (NASDAQ:GOOG), should recession or slow growth strike, the neglected names should benefit most in a rotation.

Our silver price forecast 2017 reflects that silver’s favorable supply/demand dynamics, coupled with its semi-safe-haven status as a precious metal will play well for investors looking for shelter from the equity price bubble. No doubt demand will be hit somewhat should global growth fall, but silver’s use in tech isn’t going to crash. Until prices sustain higher, the supply constraints will continue.

Our bet is that investors will rediscover silver’s true worth once the equity valuation bubble corrects. Some would argue that silver is cheaper now than 10 years ago at $5.00. We all saw what transpired. The market may be poised for a repeat performance in the coming months.