U.S. Stocks Hit All-Time Highs, Signifying the Frothy Conditions Ripe for a Stock Market Crash

U.S. stocks are at or near all-time highs, which should signal that all is well with the economy. But underneath the veneer of stability, trouble awaits. Growth is tepid, the Federal Reserve is slowly withdrawing support for asset prices, and the business cycle is long in the tooth. While all of the stars have yet to align for a major decline, a possible stock market crash is coming.

Forget about all the economic data (which is mostly mixed) for a second. Forget about this technical indicator or that technical indicator (again, mostly mixed). Let’s just focus on simple logic.

Also Read:

Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

Warren Buffett Indicator Predicts Stock Market Crash in 2017

A record 83% of fund managers think the stock market is overvalued. These are the supposed experts in their field, and the same people who always think the stock market is a “buy.” A Bank of America analyst says, “Stocks remain stretched vs. history on the majority of metrics we track, in fact, the only way stocks still look cheap is relative to bonds.” When four out of five Wall Street experts agree that the market is overvalued, it raises red flags. (Source: “A record number of market pros believes stocks are too expensive,” CNBC, April 19, 2017.)

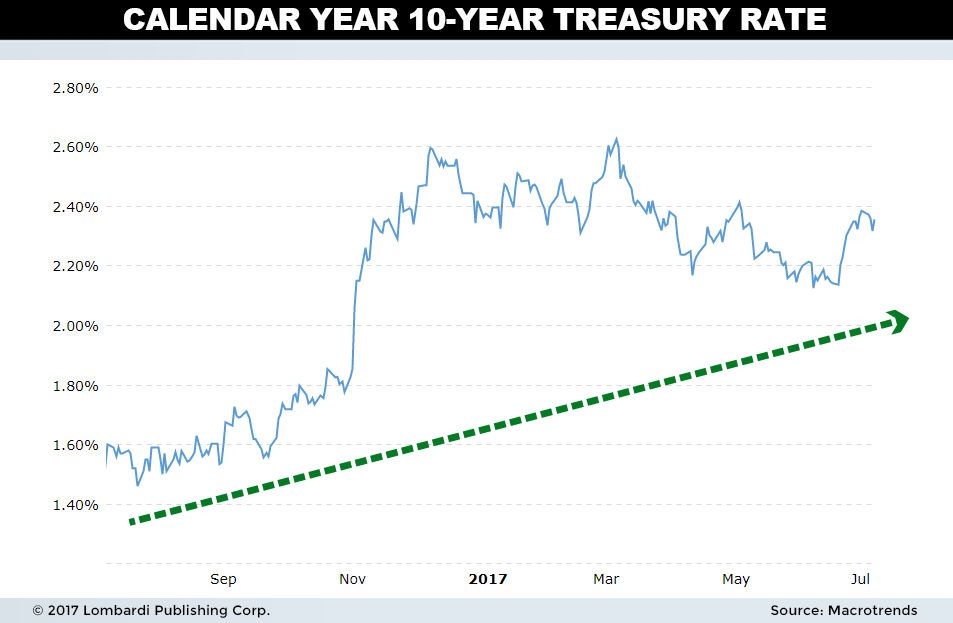

While some perceive stocks to be relatively inexpensive compared to ultra-low yields in bonds, that dynamic could be changing. Ten-year bond yields have risen 85% off the lows from their 2017 high point, and they remain 90 basis points higher today. The Federal Reserve is embarked on a rate hiking cycle that could easily carry 10-year yields closer to three percent or beyond.

Not only will those rate hikes make stocks look more expensive relative to bonds, they could also cause a recession. U.S. GDP growth is only around two percent—barely above the rate of inflation. In effect, it’s not really growing at all. Now imagine how businesses and consumers will respond to a Fed Funds Rate that’s 100 basis points higher? Lending is already being hobbled with slightly-upward growth in interest rates. Imagine what will happen to earnings, which haven’t grown since 2012 even in favorable economic conditions.

U.S. Stock Market Is Triple-Digit Percent Higher

Since the U.S. Housing bubble lows, the NASDAQ is 455% higher; the S&P 500 is 367% higher. All other major North American indexes are up a similar amount. The reason for such substantial increases is not rocket science. The rebound of earnings growth due to an improving economy is part of it. But so are Federal Reserve stimulus programs. The problem with the latter is, once the Fed pulls back, the economy will pull back in lock-step. That could cause a stock market crash now, tomorrow, or next month. Nobody knows exactly, but it won’t be kind to the unprepared.

By hiking rates into a so-so economy, the Fed is practically telling investors it wishes to take the luster off stocks. At least, that’s the way Societe Generale strategist Albert Edwards sees it. Edwards cites recent hawkish statements from the Business of International Settlements (BIS) regarding instability caused by asset bubbles (and other data) to conclude that the Fed wants to cap the stock market bubble before it does further damage. Whether the motivation is arresting wealth inequality or protecting the economy from an asset bubble fallout, the Fed’s rate hike cycle makes little sense unless viewed from that perspective. (Source: “Albert Edwards: ‘Something Smells Different This Time‘,” Zero Hedge, July 6, 2017.)

The old axiom “Never bet against the Fed” applies here. If the Fed is determined to stop (or slow down) an asset bubble, it will. There may be a lag between the time it takes for higher rates to kick in. The effects of liquidity draining from the system might also take a few months. But happen it will, because the Fed controls the levers of monetary flows. The investing public can view this lag as a gift to reposition their portfolios accordingly.

After all, a stock market crash warning never overtly appears. Nobody rings a bell at the top telling you it’s time to sell. Investors must be proactive, reading the tea leaves and adjusting accordingly.