Perpetual Myth of Plentiful Sidelines Cash Is Bogus

The old adage about plenty of sidelines cash rushing to enter the market is as old as Wall Street itself. It’s the straw man line that investment bankers have used forever to keep investors from selling the market, lest they see their shares snapped up by “sideline money.”

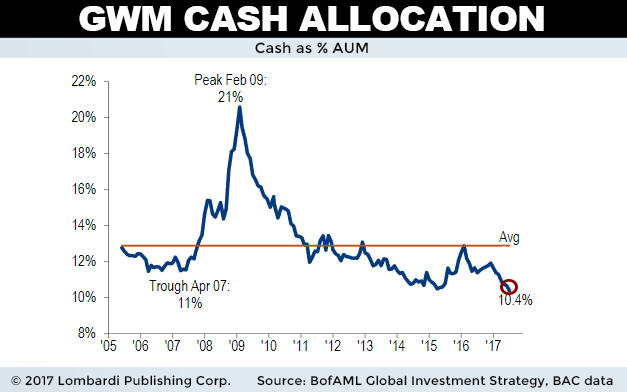

After all, who wants to give up windfall gains to someone else? But, while this has been true on occasion, it’s decidedly not true today. Private client cash has just hit a record low, and this has investors wondering who’s left to buy the market. It’s yet another market concern that bulls have to reconcile.

According to Bank of America Corp’s Michael Hartnett, private client cash held by high net worth individuals is the lowest on record. It has just taken out the previous low, which occurred just prior to the last market peak. Equity allocation in this group is 60.3%, which is far above the 56% it was at before the U.S. Housing Bubble. (Source: “No More ‘Cash On The Sidelines’: Private Client Cash Levels Drop To Record Low,” Zero Hedge, July 21, 2017).

Add Another Market Concern Onto the Pile

The lack of available “sideline” cash is troubling for obvious reasons. For this historic rally to continue, institutional buyers must continue to shovel capital into the market. Retail investors contribute, but they aren’t the primary market movers. But new data is showing this pool of funds drying up. Not only is sideline capital low, the big fish are fully invested. This means they’re more likely to sell than to buy, and with greater force. Throw in the record New York Stock Exchange (NYSE) margin debt, and a troubling market concern emerges.

That’s one in which the market careens lower after some type of inflection point occurs. What could that look like? I hypothesize that the trigger could be a terrible gross domestic product (GDP) number (or another economic indicator) that decidedly tells the market that we’re headed for a recession. Call it the “no doubt” moment.

I’ve theorized all along that, once the market believes that a recession is imminent, volatility will sustain at higher peaks and the stampede to the exits will commence. Investors will act to preserve almost a decade of gains, as they’re well aware that earnings will collapse and, with it, valuations.

Sure, big institutional money can hedge with options, but why would they? Options cost money and there’s a risk of imperfect hedge protection. Anyway, the coming recession will be the “no-doubt” moment that it’s time to move back to the sideline.

Perhaps after a recession, sideline capital will build back up. But right now, the tank is empty. Despite the Wall Street myth that buyers are always omnipresent, this is untrue today. Don’t get sucked in by the hype.