Higher Short-Term Rates Would Lead to a Recession

According to the “bond guru,” Bill Gross, rising interest rates could spark another U.S. recession. In fact, Gross thinks it could lead the entire world economy to recession. The reason is simple. Increasing interest rates will raise the cost of short-term debt for businesses and individuals. In the United States alone, the amount of household debt could exceed $12.7 trillion. (Source: “Household debt just surpassed the record level reached during the 2008 financial crisis,” CNBC, May 17, 2017.)

Corporations, meanwhile, are carrying close to $13.7 trillion in debt, according to Federal Reserve estimates. (Source: “Bill Gross is worried that central banks will lead the world into recession,” CNBC, July 20, 2017.)

Also Read:

Money Manager Bill Gross Predicts Crisis Levels Similar to 2008 Financial Crisis

The Upcoming Economic Recession in 2017 Has Already Begun

In other words, households and businesses, already trying or struggling to pay off the debt, will be spending more to service that debt. The Federal Reserve may have begun the process of normalizing the cost of money by bringing it into the range of one percent to 1.25%, but it may also be triggering the next U.S. recession.

Bill Gross’s outlook can hardly be more pessimistic. As the Fed raises its interest rates, so has the European Central Bank. It might be an effort by the central banks to enforce a change of pace. But the effects could kill whatever recovery was taking place in the United States or Europe. Except, Europe can still save itself.

Indeed, Bill Gross’s predictions of recession might concern the United States alone for the time being. The European Central Bank will continue pushing its stimulus plan in accordance with the target already set. That means it will last until the end of 2017. Not only that, should economic conditions worsen, the European Central Bank and Mario Draghi have noted their willingness to adopt additional support strategies.

The Federal Reserve, meanwhile, cannot go back. To retract the interest rate hikes so far would spell disaster. It would send the message that the U.S. economy is too weak to handle the normalization of the cost of money, after all. The bull market needs a good dose of positive psychology to continue galloping along.

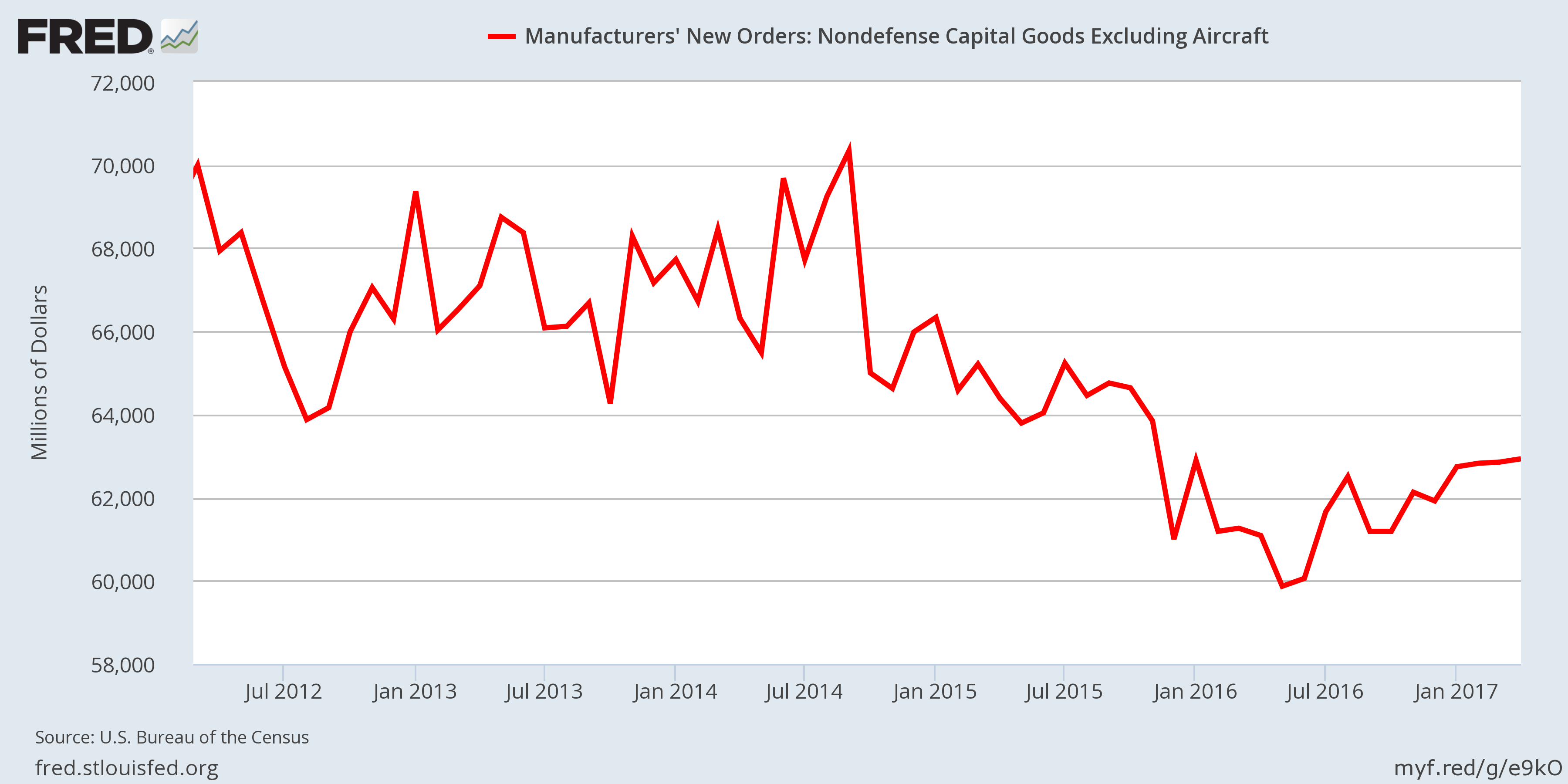

But, as you can see below, the declining capital goods orders could be interpreted as a U.S recession chart. Bill Gross was one of the first money gurus to lose confidence in the Trump economy. While many were pumping money into the stock market based on Trump’s tax plan, the repeal of Obama-era banking restrictions and Obamacare itself, Gross took a different view. He warned investors not to rush buying stocks or corporate bonds because there was a good chance that Trump would fail to get his economic growth plans to pass Congress.

It’s true that the New York Stock Exchange has reached record levels since Donald Trump’s victory in the U.S. presidential election on November 8. But the president has promised massive cuts in taxes, deregulation measures, and huge spending on infrastructure. None of this has actually come to fruition yet, nor are the political signs pointing to this happening anytime soon.

The U.S. economy is plagued by debt, as noted above. Thus, one tweak too many—as the Fed has been testing—and the interest rates will cause chaos in the system, warns Bill Gross. After all, in 2007-2008 it was one too many interest rate hikes that pushed the subprime crisis into full swing. Interest rate hikes show just how tough or, more often, how weak an economy really is. It might be too early to subject the U.S. economy to such a test now.