New EU Rules Propose Account Freezes to Halt Banking Crisis; America Already Has These Rules on the Books

Yes, it’s true. The European Union is considering rules to stop people from withdrawing their own money during a banking crisis. The aim is to stop a bank run before it begins, right at the source. But if you thought this was just a European phenomenon, think again. These rules are already in place right here in the good ol’ U.S. of A.

The new proposal coming from Europe is a reminder that powerful people are thinking about such possibilities five steps ahead. The EU document, which has been in the works since the beginning of 2017, spells out rules that would lock depositors’ money in for up to 20 days in “exceptional circumstances.” (Source: “EU explores account freezes to prevent runs at failing banks,” Reuters, July 28, 2017.)

Also Read:

Could the Looming Economic Collapse Trigger a Banking Crisis in 2017?

The Big American Banks in 2017 Are Weak, Sparking a Banking Crisis

If you think this is some precautionary measure with little chance of being used, think again. Bank runs have already happened several times in Europe. If these new rules are enacted, depositors may not be able to access funds the next time around.

The latest high-profile bank run occurred in June 2017, when struggling Spanish bank Banco Popular Español experienced a run on deposits to the tune of $2.2 billion a day. On June 6, it was found to be “failing or likely to fail” by the Single Resolution Board (SRB). Shortly thereafter, it was sold to Banco Santander, S.A. (BME:SAN) for $1.10/share, which promised to raise $7.7 billion in capital to help absorb Popular’s property-related losses. (Source: “Banco Popular fails and is bought by Santander,” The Economist, June 10, 2017.)

Banco Popular customers were the lucky ones. At least, they could access their funds before the bank got swallowed up by the largest bank in Spain. The Banco Santander takeover was lauded as a “successful” way to stop a banking crisis without involving tax payer money.

But what about going forward? If these new rules come into place, depositor money could be frozen in for up to a month.

Americans Deposit Regulations Are Already More Onerous

Most Americans have no idea that regulations in place right now are more onerous than the restriction the EU is proposing. That’s quite a scary thought. At least with the European proposals, bank customers would receive their insured portion of the deposits back… eventually. But under Dodd-Frank Wall Street Reform and Consumer Protection Act regulations, depositor money could be converted into equity during a banking crisis, forcing customers to become shareholders. That’s not something most people signed up for.

The Dodd-Frank sub-regulation is called the “Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in Resolution” (approved on November 16, 2014). Basically, it allows distressed banks to confiscate customers deposits and convert them to equity capital (shares) to prevent the bank from failing. In other words, it’s a forced bail-in. (Source: “A Crisis Worse than ISIS? Bail-Ins Begin,” Public Banking Institute, January 5, 2016.)

The “shares” may eventually be worth something or not. But that’s not really the point. The disconcerting part is that depositors’ hard-earned cash can be taken away if the bank makes too many bad derivative bets or engages in other folly. Whereas most people believe their deposits are exclusively theirs, Dodd-Frank suggests otherwise. Deposits are treated as bank property; unsecured obligations the bank owes back to their customers at a later date.

This begs the question, if government trustees are allowed to deny you your own money, do you really own it at all? Ironically, depositor money is considered just a loan to the bank. This money is considered unsecured, thus, regular folks are last in line to receive any assets assigned during a liquidation. Meanwhile, those trillion-dollar, off-balance-sheet, derivatives bets by your bank enjoy superior legal standing on the payback pecking order. The banking lobby is a well-oiled machine.

None of this is well publicized, and that’s exactly the point. If people came to understand they could lose everything in a banking crisis, what incentive would there be to hold large amounts or savings at a bank? Not only does this put the Federal Deposit Insurance Corporation’s (FDIC) $250,000 deposit insurance in question, people generally don’t make any interest income on their deposits anyway. The customer takes all the risk, yet reaps little reward.

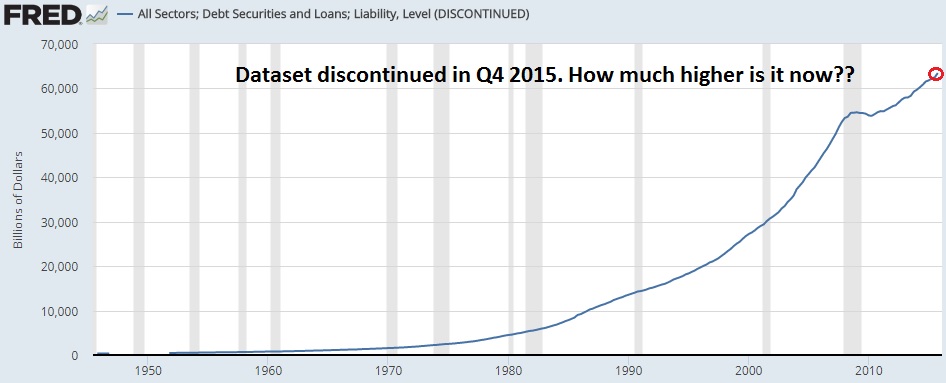

As a reminder, there’s over $2.0 quadrillion in world bank derivative exposure in the world today. We have raging asset price bubbles in world equities and unprecedented balance sheet buildups of Central Banks throughout the world. During the last crisis, two legendary investment banks folded, and other banks were on the ropes. There’s precedent and there’s a massive credit bubble which has the potential to cause unruly damage.

We’re not calling for a disorderly unwind, where bank customers lose all their deposits. But where there’s smoke, there’s fire. The Banco Popular fiasco, along with EU regulations to prevent withdrawals are bringing banking safety issues to the forefront. The Fed says every American bank passed their “stress test,” but we’re not so sure. Did the Fed test for improbable scenarios that could occur during a full-scale banking crisis?

Color us skeptical. And save accordingly.