Stock Market Rally Under Siege from High Valuations, Increasing Volatility And Tighter Liquidity Conditions

Cracks are starting to appear in this current stock market rally. The massive “wall of worry” might finally be crumbling down. The sheer weight of negative factors is becoming too much for the market to overcome. High valuations, increasing volatility, and tighter liquidity conditions will be defining factors of the coming carnage.

So, where do we start? Looking at the daily charts of major exchanges, all seems relatively normal. The exchanges are less than two percent off their all-time highs. But leadership is lagging in some key stocks, which doesn’t bode well for the U.S. stock market rally.

The so-called “FANG” stocks—Facebook Inc (NASDAQ:FB), Amazon.com, Inc. (NASDAQ:AMZN), Netflix, Inc. (NASDAQ:NFLX), and Google, which is now called Alphabet Inc (NASDAQ:GOOGL)—are starting to break down. They are currently trading at three-week lows, having erased all the gains from Netflix’s earnings rocket ride higher.

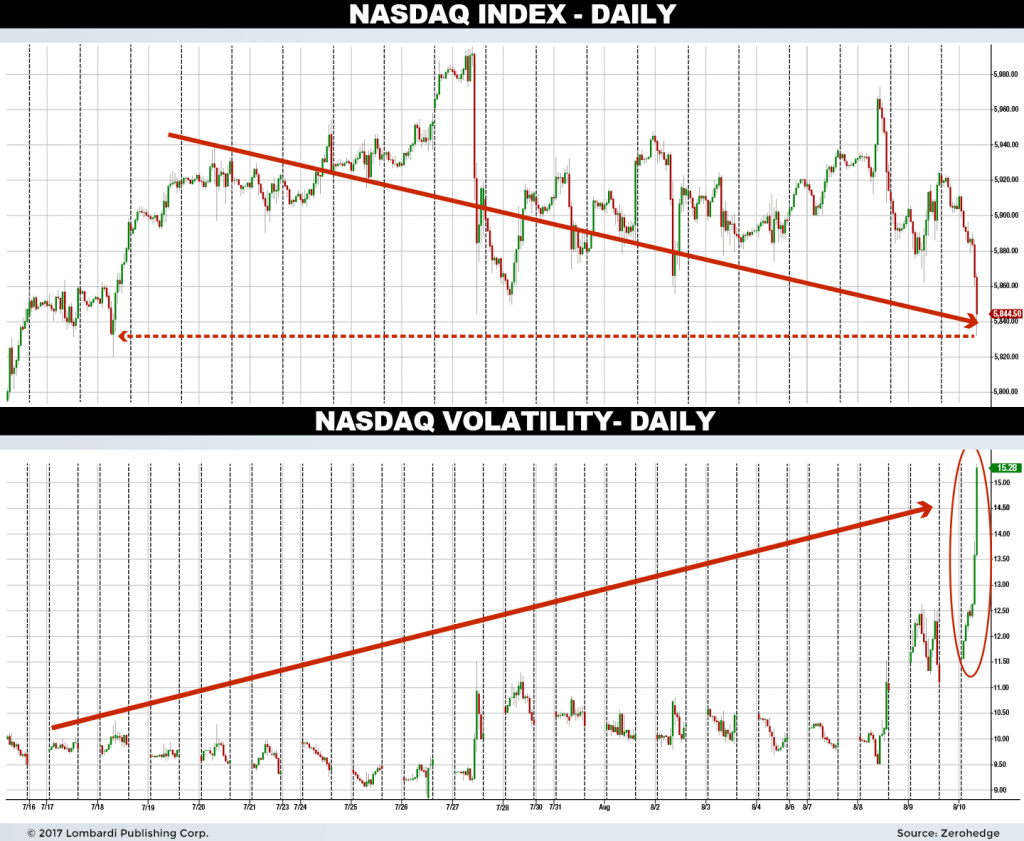

NASDAQ just broke below its 50-day moving-average for the first time in a month, while the S&P 500 is approaching that level. Perhaps more tellingly, the NASDAQ has dropped about 2.5% since Donald Trump worded his “fire & fury” comments directed towards North Korea. It seems the wall of worry is scalable after all. (Source: “Nasdaq Tumbles Below Key Technical Support,” ZeroHedge, August 10, 2017.)

Once again, leading the impetus for decline are rising volatility levels. Although theoretically, rising volatility can increase during periods of panic buying, this hasn’t been the recent pattern. The stock market has been rising via low-volume melt-up for years. Most of the higher-than-average volume days have involved equity market declines on spiking volatility. But markets have rebounded because consistent selling has been fleeting. Could this all be changing? Famed Fund Manager Jeff Gundlach of Doubleline Capital thinks so.

Also Read: Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

Gundlach is betting that higher volatility will rule the day. In fact, he calls it his “highest-conviction trade right now.” He is putting his money where his mouth is by shorting the S&P 500 via five- and eight-month bearish put options. Although he isn’t calling for a crash (yet), he’s selling risk assets. Should volatility spike higher, as anticipated by several respected market analysts, the crash could come sooner rather than later. (Source: “Gundlach Is Quietly Heading For The Exit: “Volatility Is About To Go Up”,” ZeroHedge, August 8, 2017.)

It’s an uncomplicated equation in today’s market environment. Higher trend volatility equals higher volume. Higher volume generally means more red days.

Will the Stock Market Rally Possibly Continue in August?

Anything is a possibility. But it’s hard to fathom what the driver might be. Not only are stocks the second-most expensive in history, the endless supply of negative catalysts looms on the horizon. We’ve touched on the shocking escalation in North Korea and normalizing volatility. But perhaps the most important factor is tightening monetary conditions.

In September 2017, the Fed is halting bond purchases and reinvestments, as it attempts to reduce its bulging balance sheet. The plan is to reduce the balance sheet by $10.0 billion per month, rising to perhaps $50.0 billion per month by the end of 2018. When this happens, capital flowing into equity markets via money received by the big banks (courtesy of the Fed) will dry up. The banks don’t let idle money sit around—they reinvest it in stocks for higher returns. Not just in America, mind you. In Milan, Frankfurt, London—equity markets around the world. The European Central Bank is scheduled to follow suit on a similar reduction early in 2018.

Now, the effects of tightening monetary conditions may not manifest in August 2017. But the impact of central bank balance sheet reductions is compounding by the day. A stock market crash coming is a logical conclusion combined with the other negative catalysts mentioned above. And we haven’t even talked about other critical factors, like the possibility of a U.S. default if the debt ceiling isn’t lifted. Numerous Trump opponents might attempt to engineer a domestic crisis to kick-start impeachment justification! Expect September and October to be harrowing months indeed.

In light of this, our stock market crash predictions are decidedly bearish. I believe the S&P 500 index could trade down to the 2,300 area in August 2017 (5.85% lower as of this writing; 7.59% off its all-time high). Should this happen, the S&P 500 would have its first five-percent “mini-correction” since the June 2016 Brexit vote. The current period of market movement without a five-percent peak-to-trough decline is one of the largest on record. The market is long overdue for a correction, and August may be the month the streak ends.

Position accordingly.