Possible Credit Rating Crisis If Debt Ceiling Negotiations Turn Sour

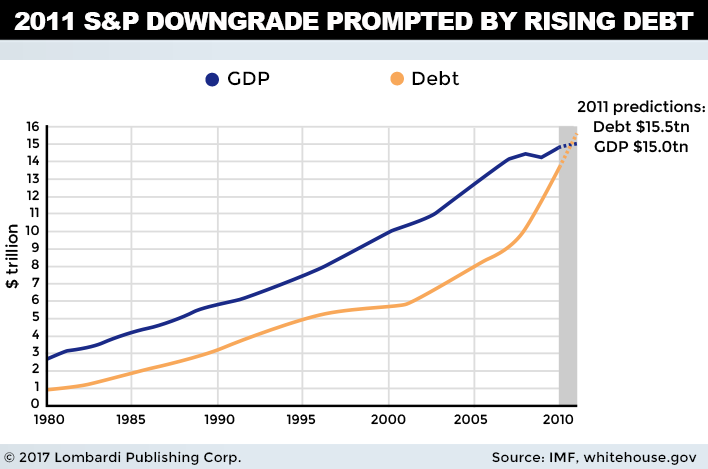

Here we go again. Different scenario, but same precarious place. Just like in 2011, a major credit rating agency (CRA) is threatening to undermine America’s pristine “AAA” rating. It caused a credit rating crisis back then, and it may do the same soon if Washington doesn’t get its act together. No one is holding their breath.

Of course, the upcoming debt ceiling negotiations are no standard affair. For better or for worse, Donald Trump has alienated many constituencies during in his run in office. One of the ill-gotten consequences of this has been the lack of legislative success regarding GOP priorities. The administration has failed (twice) to replace the Affordable Care Act—which was a major campaign promise. Tax reform has gone absolutely nowhere. Neither has funding for the wall along the southern border. About the only “legislative” success has been the forty-two Executive Orders Trump has signed during his first 200 days in office. In case you’re wondering, yep, that’s a record.

Also Read: How Much Is the U.S. Debt Ceiling & How High Will It Go Under Trump Presidency?

Now, America’s embattled 45th president will be trusted to bring both political sides together to raise the debt ceiling limit before the late September deadline. What could possibly go wrong? Turns out, everything.

Besides the GOP’s lack of legislative prowess to date, it turns out Trump and Senate Majority Leader Mitch McConnell aren’t even speaking! It’s being reported that these two key power brokers haven’t spoken in almost two weeks, with McConnell privately questioning Trump’s competency. The relationship has been going downhill since Trump reportedly berated McConnell during an August 9 telephone call, which devolved into a profane shouting match. “What was once an uneasy governing alliance has curdled into a feud of mutual resentment and sometimes outright hostility,” reported The New York Times. (Source: “Trump, McConnell not on speaking terms: report,” MarketWatch, August 22, 2017.)

Without McConnell’s leadership in the Senate, all bets are off. McConnell has publicly stated that there’s “zero” chance the debt ceiling limit won’t be raised. But in this quagmire we call the “White House,” we have our doubts.

Whether it stems from personal animosity or McConnell’s globalist leanings, debt ceiling negotiations are far from a done deal. There’s even speculation the issue could be used as a battering ram to create domestic economic chaos, adding to the narrative that Trump is “unfit” for office. Perhaps that’s why Goldman Sachs Group Inc (NYSE:GS) and other investment banks are sounding the alarm on the issue. There’s a palpable sense of sabotage hanging in the air.

Nothing would surprise us at this point.

Fitch Speaks Out

Another organization taking debt ceiling negotiations seriously is Fitch Ratings Inc. It is considered one of the major CRAs in America. It has issued a warning; one that could have grave consequences if debt ceiling negotiations go awry.

Fitch has publicly stated that a failure to raise the U.S. debt ceiling “in a timely manner” would cause a U.S. sovereign rating review; one “with potentially negative implications.” In other words, Fitch could be persuaded to downgrade its Triple-A rating if debt ceiling negotiations fall flat.

Perhaps more significantly, Fitch said that prioritizing debt service payments to creditors “may not be compatible with ‘AAA’ status.” That statement splashed cold water on those who believe the government could “payment prioritize” their way out of a crisis. (Source: “Fitch: US ‘AAA’ rating at risk if debt ceiling not raised,” CNBC, August 23, 2017.)

Also Read: How Much Is the U.S. Debt Ceiling & How High Will It Go Under Trump Presidency?

Why is it so important to avert a credit rating crisis? Because the potential for economic carnage is real. The economic impact of shuttling other spending to prioritize debt repayment could hamper the reputation and creditworthiness of Uncle Sam. In turn, this could roil markets and lead bond yields to spike. If the cost of borrowing increases for Americans and American businesses, it could nudge the economy into recession. Everyone knows America runs on credit. And then there’s the U.S. stock market.

During the 2011 credit rating crisis, when the S&P lowered its rating to Double-A, the markets tanked (if only temporarily). In the first day of trading post-downgrade, the Dow Jones Industrial Average lost 635 points or 5.6%; the S&P 500 lost 6.7%. Although stocks recovered the majority of losses the next day after dovish Fed jawboning, the selling may last longer this time around. We’re coming from much loftier valuations, and past prime business cycle. Many pundits are calling for a market crash even without these types of harrowing events.

So as we can see, the stakes are immense come September. The GOP will need fight hard to avoid a debt ceiling fiasco. Failure to do so will cause a credit rating crisis, which could easily lead to the negative downstream effects mentioned above. The lack of GOP legislative “wins” inspires little confidence that debt ceiling negotiations will play out positively. If there were ever a time for Trump to summon his “Art of the Deal” traits, this is it. But actually talking to your colleagues might be a helpful first step.

Buckle up your seat belts, folks.