U.S. National Debt Could Spike to $65 Trillion by the End of 2017

A financial autumn storm is brewing over Washington. It’s not like Hurricane Harvey and it won’t flood the city. But it will cause fiscal chaos and could bring the U.S. government to a shrieking halt. Another war could do it, but the main cause now is the U.S. gross national debt.

The gross U.S. national debt implies the combination of federal government debt with the debt from the financial-business sector. The latter might include loans or “capital advances” to serve the needs of industry and speculation. It might also include such banking products as mortgages and insurance.

The national debt, when isolated from that of the financial-business sector, is “manageable” from a relative perspective. How much is the national debt? The national, as in public, debt is about $12.0 trillion. It’s a huge number, but based on the public debt levels of other industrialized countries, it’s not the most troubling component of debt. That’s because the $12.0 trillion refers solely to federal debt. Yes, it’s huge, but not even close to the overall debt.

Also Read: How Much Is the U.S. National Debt?

Federal Debt Is Just the Tip of the Crisis

Federal debt is not what is causing Washington officials to lose their sleep at night. The sum is actually low compared to other countries. In percentage terms, it’s about 85% of GDP. Consider that Japan’s government debt to GDP is closer to 250% and you see what I mean. The dilemma that the United States must face is a phenomenon that has no peer. The gross national debt reaches the sum of some $63.0 trillion! (Source: “Global borrowing hits record as big central banks prepare to tighten credit,” The Business Times, June 28, 2017.)

Again, by comparison, the total U.S. national debt is about four times gross domestic product (GDP). In 2016, GDP was $18.6 trillion. Such a disparity between what Americans borrow, on the whole, and what they produce points to a net decrease in consumption and savings (for Americans, a real curse). Then, you have to consider that American federal debt (the “manageable” portion) is owned by foreign powers.

Some of these powers are already hostile to the United States—see China, for example. Clearly, this limits the tools that American governments can deploy to deal with the debt. Other states can retaliate against the U.S. All China has to do is dump—that is, sell—its quantities of U.S. dollars to raise the value of the yuan against the dollar. China would like to replace the dollar with the yuan as the world’s international currency of choice. (Source: “U.S. Debt to China: How Much Does It Own?,” The Balance, July 20, 2017.)

Don’t Assume U.S. Debt Has Increased Steadily

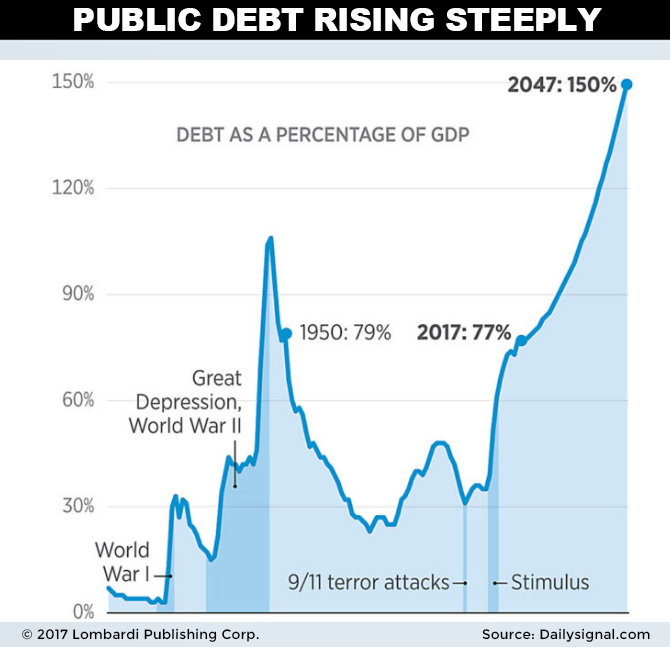

It might be instinctive to assume that U.S. national debt by year has steadily increased. That’s not the case. Expressed in terms of the debt-to-GDP ratio, there were long periods of history when the trend for U.S. debt was down. It seems hard to believe now, but from 1949 to 1981, U.S. federal debt to GDP went from about 90% to 31%. The current level of debt is much closer to the period 1944-1949, coinciding with the massive World War II spending effort and the related reconstruction as the U.S. debt chart shows.

At the end of September, the U.S. Congress will have to approve the bill on increasing the national debt ceiling. Otherwise, the country’s economy is in danger of a catastrophe. If the deadlines were exceeded, the consequences would be catastrophic for the federal government, the U.S. economy, and the global financial system.

Also Read: How Much Is the U.S. Debt Ceiling & How High Will It Go Under Trump Presidency?

How high is the national debt then? Washington will be forced to confront the debt ceiling crisis. Essentially, should Congress decide to cause Trump a problem, it can do so very easily. All that the good folks on Capitol Hill must do is to provoke a debt ceiling crisis. Essentially, such is the level of U.S. spending that if Congress doesn’t agree to take on more debt, the government will collapse. If the debt ceiling were not increased, the federal government would no longer even be able to repay the interest on the debt.

This would trigger a series of default events. One of these concerns investors directly: the U.S. Department of Finance. A default could lead to the collapse of the stock markets. It would also see Moody’s Corporation (NYSE:MCO) and other rating agencies lower America’s credit rating. That means paying much more for credit even as other countries, which typically look to the U.S. for economic inspiration, become less confident in U.S. businesses.

Most congress participants are aware of the possible consequences of refusing to increase the public debt ceiling. But, many fiscal conservatives object. During the Obama years, the Republicans regularly advocated reducing spending rather than accumulate more debt. The United States lost its AAA status in 2011, under Barack Obama.

The rating agency Standard and Poor’s then lowered the sovereign debt rating of the United States, effectively reducing the highest possible rating. The situation had already been problematic for the markets at the time. Interest rates on U.S. borrowing would increase and, with them, those of other countries. Higher interest rates and more difficult borrowing would spiral into the bigger chunk of debt—the one owed by private citizens and companies!

The Secretary of State for the Treasury, Steven Mnuchin, has already asked for this ceiling to be raised but only Congress can make this decision. With the relationship between the Trump administration and Congress, despite its Republican majority, being tense, Fitch Ratings Inc. fears that the debt ceiling will not be raised in time. The debt ceiling crisis could climax into another financial storm such as what happened in 2008.