Ratings Agency Says Debt Ceiling Crisis 2017 Could Be Catastrophic

Standard & Poor’s isn’t taking any chances. They’re warning that the debt ceiling crisis 2017 could be more devastating than the Lehman Brothers collapse if it is not resolved. That’s an iffy proposition in today’s sordid political climate.

The Treasury “X” date is coming fast. By the end of September, that date will pass and the U.S. will be in technical default if the debt ceiling isn’t raised. It becomes even more urgent when you consider that Congress only convenes on September 5, and is adjourned from September 18–22. That leaves only 12 business days for the House to act, let alone get eight Democrats in the Senate to side with Trump. Despite the urgency, that somehow seems implausible.

Perhaps that’s why Standard & Poor’s is sounding the alarm. Chief economist Beth Ann Bovino just warned of the grim consequences for the U.S. economy if a debt ceiling crisis 2017 comes to fruition. That would involve a partial government shutdown and “technical” default, which could have grave consequences for the U.S. economy. Bovino even goes as far as saying that a default would be worse than the collapse of Lehman Brothers in 2008—a collapse that brought down the century-old investment bank, and almost the entire financial system. (Source: “S&P warns of dire impact on U.S. economy from any shutdown, default,” CNBC, August 30, 2017).

Also Read: Debt Ceiling Crisis 2017: Profound Consequences If No Solution Found

Even more worrying for investors, Bovino believes that a government shutdown could pull the economy into recession. In today’s parlance, a recession would lead to a nasty stock market correction as corporate earnings tank, leading to a valuation correction. “The economy would fall back into a recession, wiping out much of the progress made by the recovery,” said Bovino. (Source: Ibid).

She could be right. A government shutdown could lop off 0.2 percentage points ($6.5 billion) of gross domestic product (GDP) per week. Standard & Poor’s derived those figures from the lost economic activity in prior shutdowns. But the real danger isn’t from this relatively menial total—$6.5 billion/week of lost GDP is just a drop in the bucket in a $18.5-trillion economy. The recession danger stems from the negative economic momentum that a shutdown could cause.

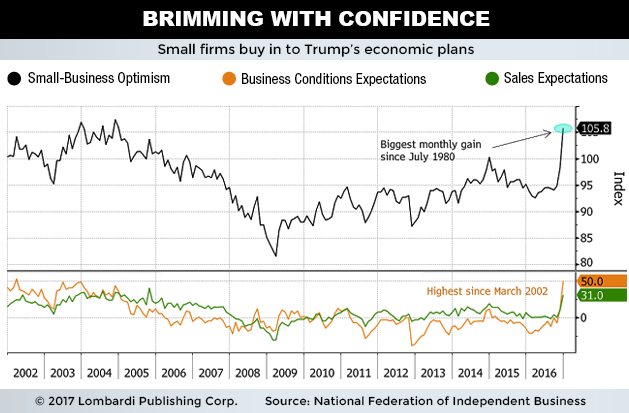

Chances are, business and consumer confidence could take a hit. If the U.S. credit rating is downgraded, borrowing costs could spike. This would lead to greater debt servicing burdens on consumers. Tens of thousands of government paychecks won’t get cashed, and there will be spillover effects on retail outlets. Then we have the indecision with economic activity that’s directly tied to government contracts.

Momentum has a way of overshooting in unforeseen ways. For a business cycle past its peak, it won’t take much to kick the gear of recession into reverse. To quote Bovino, “There will be blood.”

Debt Ceiling Crisis 2017 Expectations

Bovino is careful to point out that an impasse is not a foregone conclusion, although she also says that “..betting on a rational U.S. government can be risky.” (Source: Ibid.)

Others, too, place even higher odds of a crisis occurring. Count Lombardi Letter among this group.

Axios can also be counted among this group. It recently reported that Goldman Sachs Group Inc (NYSE:GS) placed 50/50 odds of a federal shutdown occurring. A top Republican source put the odds as high as 75%, saying, “the peculiar part is that almost everyone I talk to on the Hill agrees that it is more likely than not.” (Source: “Government shutdown chances rising by the day,” Axios, August 24, 2017.)

And that was before Trump’s big speech in Phoenix, Arizona, in which he demanded funding for a border wall with Mexico as a condition for averting a government shutdown. (Source: “The Odds of a Government Shutdown Next Month Are Skyrocketing, Vanity Fair, August 24, 2017).

And why wouldn’t the odds be high? Congress has done virtually nothing in Trump’s 200 days in office. Help from Democrats will be required to thrust a bill through the Senate. Trump badly needs a legislative win to appease his base.

In a recent Consult/Politico poll, 51% of Republican respondents supported forcing a shutdown in order to secure funding for the border wall; 26% of those Republicans “strongly support” such a measure. If Trump rolls “snake eyes” on wall funding, he risks widespread erosion of support. (Source: “GOP Voters Don’t Want Shutdown – Unless It Funds Border Wall,” Morning Consult, August 30, 2017.)

It’s absolutely critical that Trump wins on this issue. The fly in the ointment? Democrats will never go for it. They’ve repeatedly and publicly slammed the door on abetting funding for “The Wall.” Trump’s biggest demand is also the opposition’s biggest non-starter.

Thus, the stage is set for the biggest game of budgetary chicken that Washington has seen in decades. On one side, you have Trump and the “Deplorables.” On the other side, seemingly everyone else.

Expect September fireworks in both equity and money markets. Whether this portends a broader decline depends on the actions of the “Great Disrupter” in the White House.