Insurance Stocks Reeling from Double Blow of Hurricane Harvey and Irma

After avoiding major hurricane-induced losses for over a decade, U.S. insurers’ luck has run out. Hurricane Harvey fired the first salvo, but Hurricane Irma promises to deliver the knockout blow. Insurance stocks are already reeling from the news, but reinsurers may take the biggest direct hit.

The damage from Harvey was certainly spectacular. In some areas, more than 50″ of rain fell, breaking records for the most rainfall from a continental storm in the United States. That’s more rain than many non-coastal areas receive in a year. Forecasters estimated that Hurricane Harvey rained down about 15 to 20 trillion gallons of water across the state of Texas. Many counties are still under water a week later. (Source: “Hurricane Harvey: Five Mind-Boggling Statistics,” CBS Chicago, August 30, 2017.)

As intense as Harvey was, it was mostly a rain event. From an insurer’s perspective, that’s good news, insofar as overland flooding is not covered under many private home insurance policies. Considering that Harvey was a Category 4 major hurricane with up to 140 MPH winds, it could have been much worse. As such, total insurance claims may not exceed $30.0 billion dollars (although totals of $100.0 billion have been bandied about).

Of course, Harvey’s destruction wasn’t great news for the insurance industry, but the costs are manageable if claims are limited to the low-end estimates. Unfortunately, however, Hurricane Irma is barreling straight toward Miami, Florida and it is already being proclaimed the strongest Atlantic hurricane on record.

Presently, the maximum sustained wind speeds from Hurricane Irma are a mind-boggling 180+ MPH, with gusts that are even faster and more powerful. Compared to some areas in Irma’s path, the potential for wind damage and storm surges is far greater to metro Miami, which is located directly on the coastline.

Hurricane Irma Damage Potential

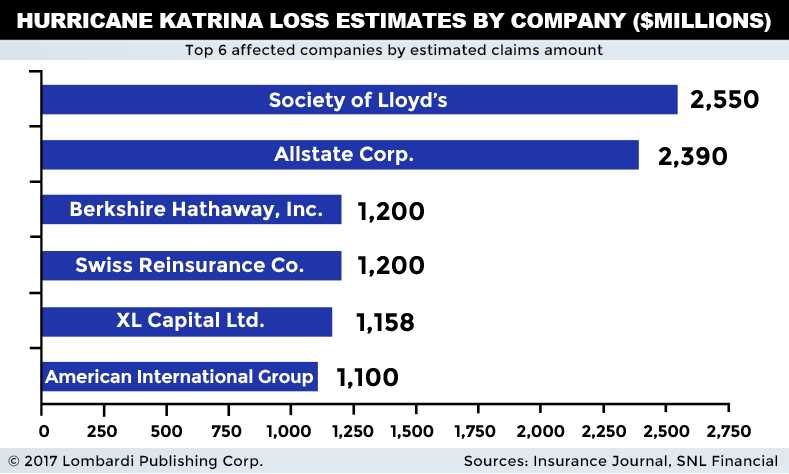

Barclays Research is already predicting that Hurricane Irma could be the most damaging storm in U.S. history. It estimates that the damage could exceed that of the 2015 superstorm, Hurricane Katrina, which cost insurers about $50.0 billion. “[We] think Irma’s insured damage in Florida could be the largest ever in the US perhaps equivalent to Hurricane Katrina,” wrote Jay Gelb, of Barclays. (Source: “Hurricane Irma’s damage could be most ever, topping Katrina, Barclays predicts,” CNBC, September 5, 2017.)

Other estimates are more dire, however.

Catastrophe modelers AIR Worldwide and Karen Clark and Company estimate that Hurricane Irma could cause $125.0 to $130.0 billion of insured damage in the worst-case scenario. That would entail something akin to a repeat of the 1926 Miami hurricane, which devastated the surrounding landscape. (Source: Ibid.)

Insurance stocks are taking it on the chin as a result. Specifically, reinsurers (the insurer’s insurers) are particularly exposed. Reinsurance company stocks fell five percent in September 5 trading, as it became clear that Irma would strike Florida. Collectively, the S&P Insurance Industry Index had its worst day since the June 2016 Brexit vote.

Looking forward, Irma’s destruction will be the final arbiter on how far insurance stocks can buckle. There’s still room for more downside, but, keep in mind, reinsurers Like Validus Holdings Ltd. (NYSE:VR) and American Insurance Group—part of American International Group Inc (NYSE:AIG)— are already trading at one-year lows. Much of the market reaction has already taken place.

Everybody in the insurance industry will be watching Irma with great intensity. The hope is that book values won’t be devastated too badly. The insurance industry builds up for those rainy days, which come along every so often.