Any Hope GOP Would Control Rising U.S. National Debt Is Quickly Squashed

If Republican voters thought a White House and Congressional-controlled GOP would control soaring U.S. national debt, they’re sorely mistaken. Debt growth rates are set to rocket skyward, as Trump’s tax plan seeks to lower corporate tax rates. The money has to come from somewhere.

That money certainly isn’t coming from a drastic increase in corporate or public tax receipts. For one, the business cycle should be winding down relatively soon. For another, GDP growth since 2010 is about equal to inflation, meaning little organic growth is happening at all.

No, instead, the money to subsidize tax cuts is going to come from debt financing. Same as it ever was.

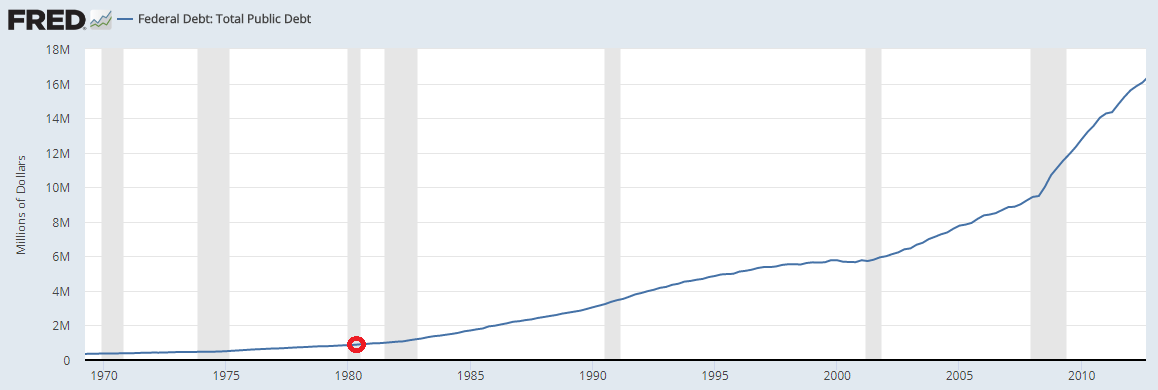

Now, President Trump and the GOP will claim otherwise. They’ll argue that lowering corporate tax rates from 35% to 20% will boost growth. But didn’t Ronald Reagan claim the same thing in 1980? It’s debatable how much trickle-down economics helped growth back then, but what we do know is that debt has exploded upwards since then.

(Source: “Federal Debt: Total Public Debt,” Federal Reserve Bank of St. Louis, last accessed October 4, 2017.)

Back in 1980, the total U.S. national debt was around $900.0-billion. Fast forward 37 years, and it’s past $20.0-trillion. To be fair, the U.S. national debt really started to dislocate once Nixon fully removed the U.S. dollar for the Gold Standard. This allowed the government to print an unlimited amount of dollars without having them called in for a fixed amount of gold.

Also Read: U.S. Gross National Debt Could Hit $65 Trillion by the End of 2017

But still, it’s clear that slashing corporate tax rates did the U.S. deficit no favors. Trump seeks to emulate the trickle-down economics model.

How About Personal Taxes?

Recent evidence suggests that slashing personal taxes hurts the U.S. national debt more than it helps.

This evidence comes courtesy of President George Bush’s tax cuts in 2001 (Economic Growth and Tax Relief Reconciliation Act of 2001—EGTRRA), and 2003 (Jobs and Growth Tax Relief Reconciliation Act of 2003—JGTRRA). Combined, both Acts lowered the marginal tax rates for nearly all U.S. taxpayers (although a reduction in deductions disfavored the upper-middle class).

In the post-mortem analysis, the Congressional Budget Office (CBO) has concluded that EGTRRA and JGTRRA added about $1.5-trillion to the debt pile from 2002–2011, excluding interest. Furthermore, the CBO estimated in January 2009 that the combined Acts would add approximately $3.0-trillion in debt in years 2010–2019 if extended to all brackets (which they mostly were), including interest. Finally, the CBO estimated that the Bush tax cuts at all income levels would increase the annual deficit from 1.7% GDP to 2.0% GDP by 2019. (Source: “Changes in CBO’s Baseline Projections Since January 2001,” Congressional Budget Office, June 7, 2012.)

So as we see, even the perpetually optimistic CBO had some bearish projections about what tax cuts would mean to the U.S. national debt back then. Keep in mind, interest liabilities are much greater now, and it takes more stimulus dollars now to exact positive a GDP effect than it did 15 years ago. In other words, Uncle Sam must undertake even more deficit spending to extract a similar economic benefit.

Sensing this potential fiscal calamity, Moody’s Investor Services anticipates Trump’s tax proposal could weigh on the U.S. government’s credit outlook. In their view, “tax cuts would not be offset by equivalent cuts to spending.” (Source: “Trump Tax Plan Probably Credit Negative for U.S., Moody’s Says,” Bloomberg Markets, October 2, 2017.)

So there you have it. The impartial number crunchers at Moody’s are forecasting a swelling Federal deficit if Trump’s tax legislation is passed. So much so that it may affect the U.S. credit rating. But is anyone surprised?

The “King of Debt” is now calling the shots. And he wouldn’t have it any other way.