How High Could Interest Rates Go?

Fact: Interest rates in the United States are increasing, and are expected to go higher.

The Federal Reserve has made it very clear that it wants to raise the interest rate at which it lends money to banks: the federal funds rate (FFR). Currently, the rate set by the Fed stands at 1.25% and, according to the Federal Open Market Committee (FOMC) members, it could go as high as three percent by 2020; that’s 140% above where it currently stands.

The interest rates at which banks lend to each other are increasing as well. One of the best indicators of this is the London Interbank Offered Rate (LIBOR). Look at the chart below; it’s soaring.

Chart courtesy of StockCharts.com

Since late 2015, LIBOR has increased roughly 350%, and the rate stands at its highest level since early 2009.

If the FFR increases to three percent, you could almost bet that the LIBOR would even soar even higher. Then, as these two interest rates rose, the rates for consumer and business loans and credit would go higher as well.

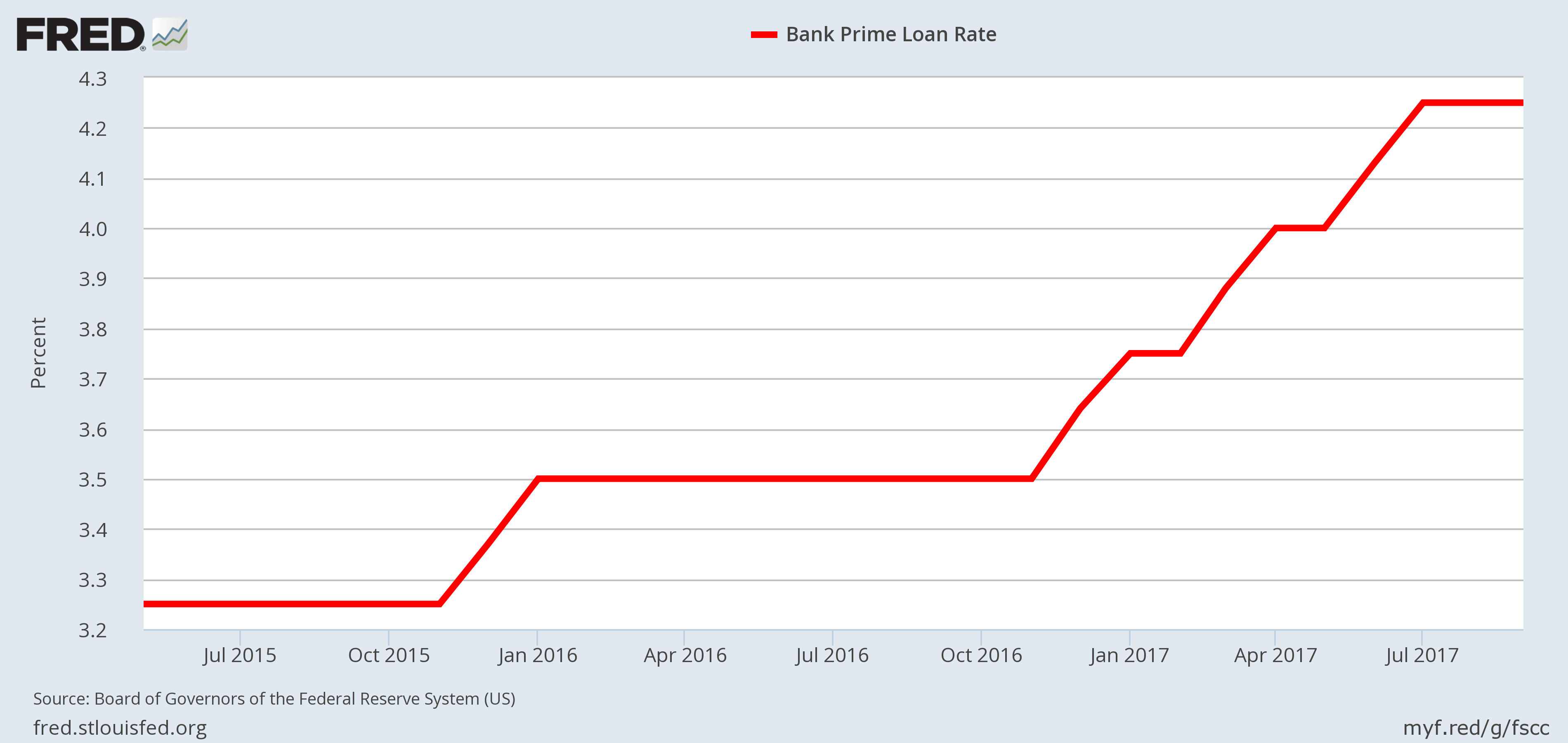

We are starting to see this happen already. To give some perspective, look at the chart below. It shows the U.S. banks’ prime loan rate, which is the rate on short-term business loans.

In late 2015, the prime loan rate was around 3.25%. Now, this interest rate is at 4.25%. This represents an increase of close to 31%.

5 Possible Victims of Higher Interest Rates (and One Winner)

Dear reader, no one seems to be asking one critical question: Could the U.S. economy, bonds market, stock market, banks, businesses, and consumers handle higher interest rates?

Beginning with consumers, higher rates could really take a toll on their spending. All of a sudden, they could be forced to make higher payments to service their debts, and not spend on things they want. Discretionary spending could take a hit.

Businesses could be impacted by higher interest rates too. Their costs of borrowing would also increase. Their return on capital would then have to be much higher in order for them to justify spending. It wouldn’t be shocking to see businesses rethink their spending practices.

The bond market is also highly reactive to interest rates. Bond prices drop as rates move higher. Over the past few years, investors have rushed to buy bonds, and the market has become overcrowded. Higher interest rates could cause a sell-off in the bond market.

Higher rates could impact the earnings of companies, too. Think of a company that has a big loan or a line of credit with a bank. It will have to pay higher interest payments, and this impacts profitability directly. So, its stock price could come under fire because of this.

If higher rates impact negatively across the board, the U.S. economy could have a very difficult time sustaining itself. This sounds bold, but the U.S. economy could witness a recession as a result of soaring interest rates.

The banks could be the only winner here. As interest rates go higher, banks could lend at higher rates. This increases their interest income and, ultimately, their bottom line. Mind you, investors have caught on to this already. If you look at bank stocks, they are soaring. It wouldn’t be shocking if more gains follow.