Disparity Between Indices and Constituents Foretells Stock Market Crash Ahead

Key stock indices continue to soar. However, getting too complacent could be a big mistake. There’s still the possibility of a stock market crash ahead.

In this day and age, when stock markets are making all-time highs, investors aren’t looking at everything that matters.

Let’s get this straight: for the stock market to rally, you want companies across the board moving higher. If this is not happening, investors should question the upside move. It could mean a stock market crash ahead.

Currently, we are seeing a disparity that spells trouble ahead.

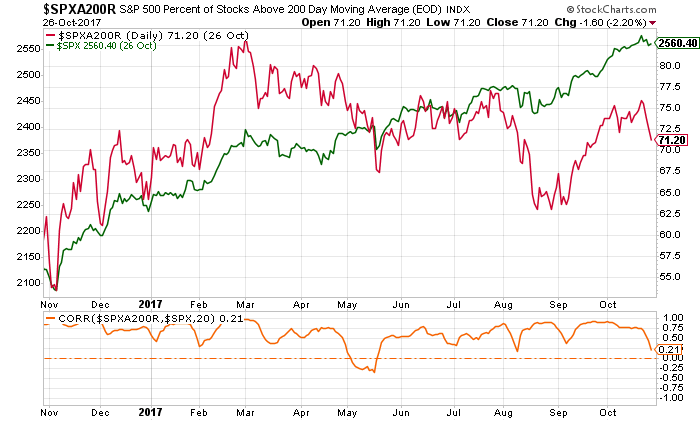

Look at the chart below. We have plotted the S&P 500 (in green), the percentage of the S&P 500 stock trading above 200-day moving average (in red), and the correlation between these two (in orange, at the bottom of the chart):

Chart courtesy of StockCharts.com

You see, the 200-day moving average is considered a trend indicator. If a stock price is trading above this moving average, one could say the trend on the stock is pointing upwards.

Now, if you want the S&P 500 to move higher, you want companies making up the index to trend higher as well. This is simple and doesn’t really require rocket science.

This is not reported in the mainstream much, but a noticeable number of companies on the S&P 500 continue to trend lower as the overall index is pointing upwards. In early 2017, 83% of the companies on the index were trading above the 200-day moving average. That number is just 71.2% now, and it dropped as low as 62% not too long ago. The correlation between the S&P 500 and its constituent trending higher is completely broken too.

Dear reader, this is what’s really happening. Key stock indices are skyrocketing because a few of its components have too much weight and are driving them higher. One has to wonder how long could this go on for.

Here’s what also must be understood: if these few companies face scrutiny from investors, we could see a stock market crash.

Investment Management 101

In the wake of all that’s happening in the markets, I thought I’d take some time and talk about some basic investment management techniques that individual investors often forget. Below are five things to keep in mind:

- Never try to predict tops or bottoms. At times, investors may think about going against the market in order to reap big rewards. This could end very badly. The best thing to do is to trade the market, changing positions as the overall market turns.

- Never risk more than you can afford to lose. This is self-explanatory. This rule is talked about a lot, but at times investors ignore it completely.

- Use stop-loss no matter what. Stops essentially help in case there’s a sell-off, acting as an insurance policy for positions.

- Don’t listen to the noise. Do your own research. Sometimes, hype about something may make an investor buy into a poor stock or commodity. It’s important for investors to do their own research before buying.

- Taking some profits off the table doesn’t hurt. Investors often forget to take profits, setting in a mindset that their position could continue to go higher. And it could, but selling a portion of the position locks in profits and raises cash for one’s portfolio. The last thing investors could do is give their gains away.