Money Managers Ditching Stocks Could Mean Stock Market Crash Ahead

A stock market crash could become reality sooner than many think. There are several indicators flashing red, and investors don’t seem to be paying attention to them. If you are long on stocks, be very careful.

If you want to know where the markets are headed, it’s important to pay attention to the so-called “smart money”—institutional investors. These investors have massive buying powers and can really move the markets if they sell or buy.

Currently, their actions are saying they are bearish on stocks and a stock market crash could be ahead.

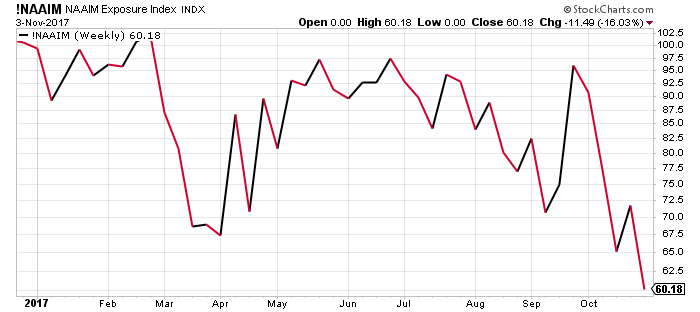

Please look at the chart below. It shows the National Association of Active Investment Managers (NAAIM) Exposure Index. This is not new to long-term Lombardi Letter readers.

This index essentially shows what percentage of active managers’ portfolios consists of stocks.

Chart courtesy of StockCharts.com

There’s something interesting happening among active money managers. They have been reducing their exposure to stocks.

Currently, according to the Exposure Index, 60% of their portfolios consist of stocks—this is the lowest level of equity exposure since the beginning of 2017. In the last one month especially, these investors have slashed their stock positions significantly.

Is this indicator saying something? Looking at the chart above, one could say it looks like money managers are getting nervous and outright dislike stocks.

When Will the Sell-Off Strike?

Dear reader, it makes sense why money managers could be getting nervous.

It can’t be stressed enough; valuations are getting extremely extensive. This has been discussed in these pages several times already. There’s one thing we have seen happen repeatedly; it’s that markets tend to fall back to or close to their long-term average valuations. If we see key stock indices move towards historical average valuations, there could be a massive and rigorous stock market crash.

The most basic fundamental need for a stock market rally isn’t as strong either, and there are concerns if it could sustain corporate earnings. To give you perspective; the fourth quarter of 2017 isn’t done yet, but companies are issuing dire warnings about their earnings already. As of November 3, there were 51 S&P 500 companies that had issued negative guidance and just 26 companies that issued positive guidance. In other words, for every one positive guidance, there are almost two negative guidances. (Source: “Earnings Insight,” FactSet Research Systems Inc, November 3, 2017.)

Going beyond this, keep political uncertainty in mind as well. Political uncertainty is one of the most hated things by investors. Currently, in the U.S., we have a significant amount of political uncertainty. There are too many things happening at the same time to mention here. But know this; even a tweet can spark a sell-off.

Keeping all this in mind, I will repeat what I have been saying all along; sure, the market could go higher. I know predicting tops and bottoms is a big mistake. But investors have to question how far will this go.

It might not be a bad idea to focus on capital preservation so in case there’s a stock market crash, investors don’t give away gains.