Are We Really In a Giant Bubble?

No matter where you look in the economy, there are extraordinary things happening.

Consider the stock markets, for example. The valuations are extreme. Look at the cyclically-adjusted price-to-earnings (CAPE) ratio of the U.S. stock markets. It stands at its highest level since 2000/2001. That was when we were witnessing the tech bubble. Prior to this, valuations were higher in 1929, before the Great Crash.

Talk to anyone about valuations and they will try to convince you, “This time around it’s different.” The mainstream media will have you convinced that stocks are still worth the investment.

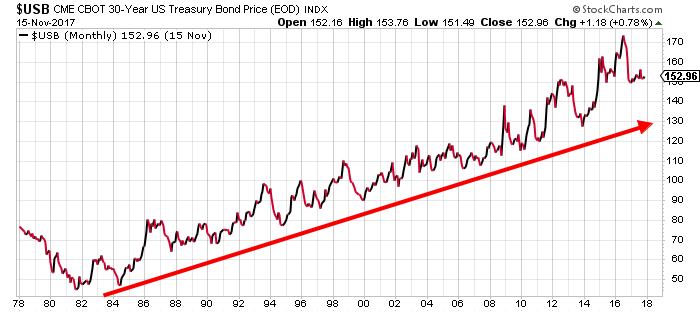

Bond Prices Remain at 35-Year High

Bonds remain extremely pricey as well.

Look at the chart below. It shows the price of 30-year U.S. bonds. They still trade near their 35-year high. Mind you, this is happening as interest rates are moving higher. Basic economics say that bond prices decline as interest rates increase.

Chart courtesy of StockCharts.com

Fine Art Market Is Breaking Records

Stocks and bonds aren’t the only assets witnessing this; look at the fine art market. Paintings are getting outright immense valuations.

On November 15, a painting by Leonardo di Vinci called “Salvator Mundi,” (Latin for “Savior of the World”), sold for $450.3 million (including fees) at a Christie’s auction in New York City. The bidding on this 500-year old painting began at $100.0 million, and now it is the most expensive painting ever sold. (Source: “‘Leonardo da Vinci artwork’ sells for record $450m,” BBC News, November 16, 2017.)

This painting was last sold in 2013, for $127.5 million. Doing the simple math, since 2013, the value of this painting increased by roughly 250%. Back in 1958, this painting was sold in London for only £45, which, using the current exchange rate, is just under $60.00!

Prior to this, the highest price paid for any single piece of artwork was $300.0 million, for Willem de Kooning’s “Interchange” painting, which was sold in 2015 by the David Geffen Foundation to Kenneth C. Griffin, a hedge fund manager. (Source: “Leonardo da Vinci painting sells for more than $450 million, breaking all-time art auction record,” CNBC, November 16, 2017.)

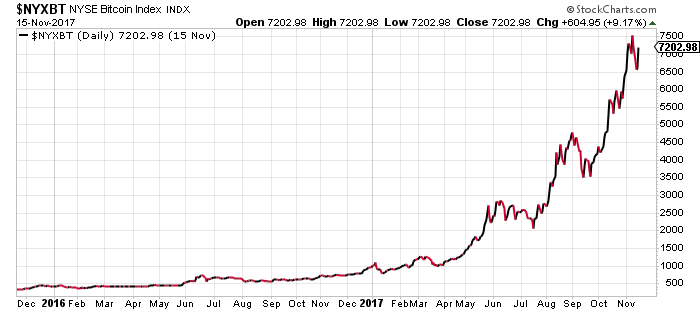

Bitcoin Continues to Surge

Don’t stop at the art market. Look at Bitcoin as well—a phenomenon that everyone seems to be talking about these days.

Just look at the chart below of Bitcoin prices.

Chart courtesy of StockCharts.com

In early 2016, Bitcoin traded at around $400.00. Now the price stands above $7,200. This represents an increase of 1700%.

Here’s the thing, it’s not too uncommon to hear calls for even higher Bitcoin prices. There’s a lot of buzz that suggests that Bitcoin prices could soar to $10,000.

Is This All Normal?

Dear reader, it’s important to know what a bubble really is. A bubble, as I see it, is when asset prices soar at an extraordinary pace when their fundamentals may not be as strong. What we are seeing now is not normal.

When I look at asset prices these days, I really can’t help but ask if we are seeing a giant bubble in almost every asset class out there.

What I also know is that bubbles can go on for a long time, but, when they pop, things don’t end well. Mark my words: we may be in a giant bubble right now, so investors shouldn’t get too comfortable.