Investor Euphoria Suggests Stock Market Crash Ahead

Optimism is usually one of best signs of a coming stock market crash. As it stands, we are seeing investors and market participants turning euphoric. Major losses could be ahead, investors beware.

Mark Twain said it best: “Whenever you find yourself on the side of the majority, it is time to pause and reflect.”

Investors may want to use caution going forward.

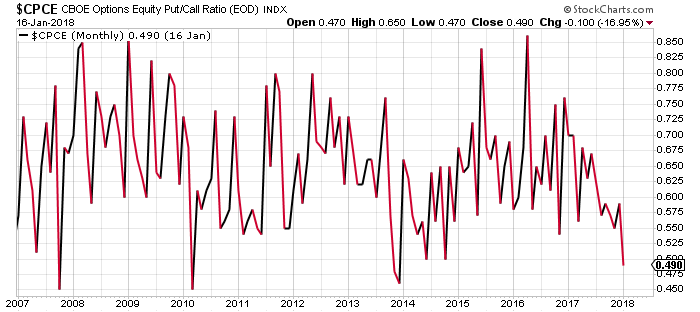

Put/Call Ratio Says Investors Becoming Euphoric

To see investor euphoria, look at the chart below. It shows the total equity put/call ratio. In simple words, when the ratio is under one, it means investors are bullish. When the ratio is above one, investors are bearish.

Chart courtesy of StockCharts.com

Notice something interesting?

In the last 10 years, the ratio has only reached this low three times. In other words; investors have been this optimistic about stocks just three times in the last 10 years.

Here’s the thing; it’s also important to see what happened after each of the times when investors turned severely bullish on stocks.

First, it reached around 0.45 in late 2007. This is when the markets were forming a top, and a stock market crash followed a few months later. If you recall, the end of 2007 was the period where those who said stocks are going to underperform were ridiculed.

Then, in March of 2010, the put/call ratio dropped to around 0.45. A couple of months later, we saw a sell-off in the markets. In April 2010, the S&P 500, for example, stood at around the 1,200 level. In July of the same year, it made a low of 1,010. This represents a decline of close to 16%.

Again, in late 2013, the put/call ratio dropped to roughly 0.47. This time around, we didn’t have a stock market crash a few months later. But if you recall, key stock indices’ performance was relatively subdued until mid-2016. Between 2014 and mid-2016, the S&P 500 increased by roughly 14% versus close to 30% in just 2013 alone.

The put/call ratio is currently hovering around similar levels. It must be asked: What’s next? Will we see a stock market crash, or we are headed for a period of low returns?

Stock Market Outlook; Don’t Rule Out a Stock Market Crash Just Yet

Dear reader, ruling out a stock market crash sooner than later could be a big mistake. Optimism indicators are screaming that investors are euphoric, and it may not end well. Mind you, the put/call ratio isn’t the only indicator saying this. There are other indicators that show euphoria among investors as well.

Obviously, with time, we will know more. I completely understand that no one wants to hear about a crash in times when everything looks good.

But I seriously suspect there are investors getting ready for a sell-off and putting bets on it.

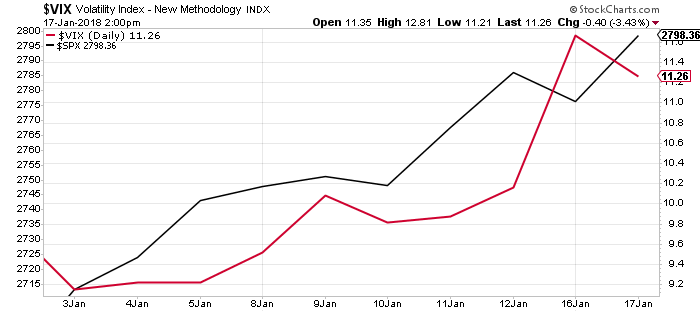

I will finish with the chart below. The black line represents the S&P 500 and the red line represents the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), often referred to as the “Fear Index.”

Chart courtesy of StockCharts.com

Since the beginning of 2018, as stock markets have soared, the VIX has increased significantly as well. This is usually not a good combination.