The U.S. National Debt Continues to Soar

It’s not talked much these days, but the U.S. national debt shouldn’t be taken lightly at all. It could cause severe damage to the U.S. dollar and send waves of uncertainty across the globe. This could happen sooner than later.

Before going into any details, it’s important to know a few facts.

The U.S. national debt has surpassed over $20.0 trillion.

Sadly, over the next 10 years at least, the U.S. government is expected to post budget deficits. So, don’t be shocked if the national debt figure is around $25.0 trillion by 2028.

Mind you, the $25.0-trillion figure is based on conservative estimates. If there’s a slowdown in the U.S. economy, you could expect the national debt figure to jump much higher. Also, we are not even talking about the items not on the balance sheets, like social security and other such things that U.S. government has to pay but doesn’t have enough money for.

The Biggest Creditor to the U.S. Government…

With that out of the way, it’s important to know who the biggest creditors are to the U.S. government.

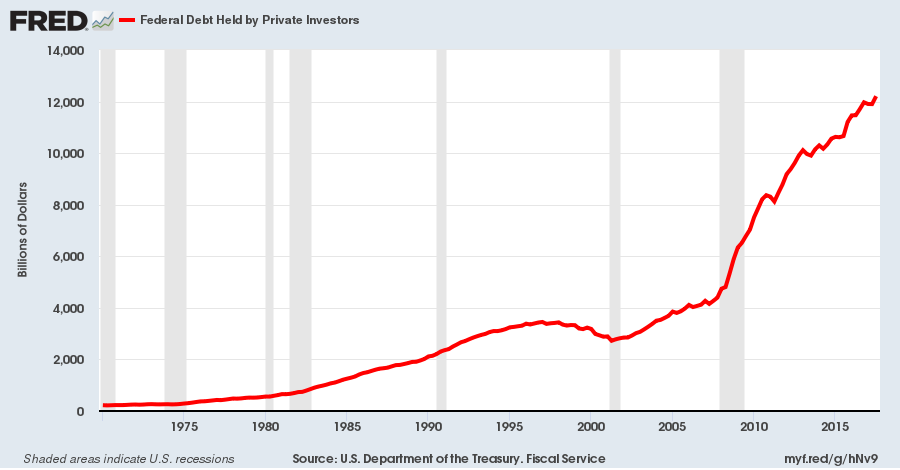

To see this, please look at the chart below.

(Source: “Federal Debt Held by Private Investors,” Federal Reserve Bank of St. Louis, last accessed January 25, 2018.)

The chart above shows how much of the U.S. national debt is held by private investors.

As of the third quarter of 2017, $12.2 trillion of the U.S. government debt was held by private investors. If you do simple math, more than 60% of the government’s debt is held by private investors.

Dear reader, the emphasis is on private investors here.

Understand that private investors are usually those who are there to make money. Their goal in lending to the U.S. government is very simple; lend (buy bonds), earn interest on the loan, and get back the principal at the end of the period.

What Happens When Private Investors Turn Pessimistic?

It really has to be questioned, what could happen if, all of a sudden, these investors turn pessimistic towards the U.S. national debt?

Truth be told, the U.S. government isn’t being run efficiently and the debt load continues to get much bigger every second. So there’s a chance that these investors could one day go, “We can’t lend you money anymore.”

Also, consider that not too long ago, a news story hovered around the mainstream media and went something along the lines of how China could be slowing down U.S bonds purchases. Although the story turned out to be fake, there was suddenly a panic and we saw U.S. bonds yield spike higher quickly. (Source: “Report on China slowing US bond purchases may be ‘fake,’ regulator says,” CNBC, January 10, 2018.)

Now, imagine if something like that actually happens. What do you think the investors will do?

It wouldn’t be surprising to see them step back. A lot of them could even consider selling what they hold. Don’t forget, they are investors. They are likely to sell when assets decline in value.

What comes next? If they turn pessimistic, this could result in the U.S. dollar plunging very quickly.

Know that if the U.S. dollar crumbles, it could cause a lot of problems in the global economy. Bear in mind, the U.S. dollar remains the dominant currency when it comes to trading between countries. If it drops suddenly, you could have trade deals failing and even financial systems could be under a lot of stress.