Price Action Suggests Stock Market Crash Could Be Likely

Over the past few weeks, key stock indices have been wild, to say the least. With this, there are a lot of questions regarding the future direction of the stock market. Investors are wondering if a stock market crash could become reality.

Why could there be a stock market crash? Because key stock indices are having a very hard time moving to the upside.

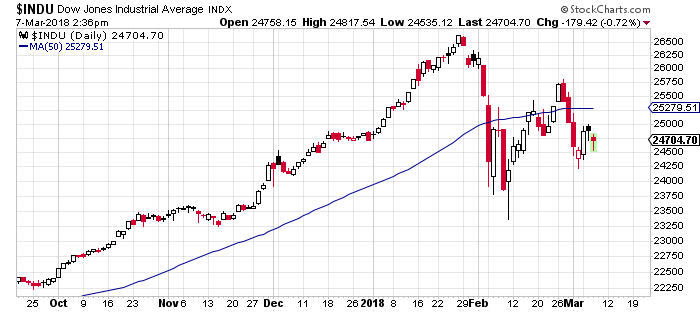

Look at the chart below of the Dow Jones Industrial Average (DJIA), for example. Pay close attention to the blue line drawn on the chart. It represents the 50-day moving average of the index.

The DJIA fails to remain above the 50-day moving average. Keep in mind, this moving average is an indicator of the intermediate-term trend. If the price is below it, this suggests that bearish sentiment prevails and the intermediate-term trend is pointing downwards.

Chart courtesy of StockCharts.com

In the last few weeks, we have seen the Dow touch that moving average several times, and it just drops from there. So it’s telling us that there are sellers and upside could be limited. Also, a sell-off could follow.

Options In the Case of a Stock Market Crash

Now, the big question: What should you do if there’s a stock market crash?

You see, there are three things that investors could do if there’s a stock market crash in the next term.

1. Cut Losses, And Have Stops in Place

Understand that if a position drops by 50%, it would have to increase by 100% for investors to just break even. In times of a stock market crash, losses could mount higher. If an investor has a position that has already generated massive losses, it may not be a bad idea to take the loss before it gets any bigger.

Mind you, by cutting their losses, investors essentially raise cash for the portfolio.

Also, it’s important that investors have stop-losses in place all the time. These are essentially insurance for the portfolio. Stops help reduce losses and protect investors’ wealth.

2. Bargain Hunting

A stock market crash is usually a great time for bargain hunters.

When there’s a sell-off, investors usually sell anything and everything in sight. So, all of a sudden, great companies start to sell for a massive discount.

One prime example of this was the stock market crash of 2008 and 2009. Investors panicked and sold companies that were not even remotely related to the financial sector. These companies were fundamentally strong. If investors had bought them then, they would have accumulated a lot of wealth.

3. Riskier Option; Make Money as Markets Drop

Thanks to financial innovations, there are instruments that let investors make money when there’s a stock market crash. Look at the ProShares Short S&P500 (NYSEARCA:SH) exchange-traded fund (ETF), for example. The ETF increases in value when the S&P 500 declines.

Please note that this is not a recommendation to buy, but rather, just an example of an opportunity that investors could look out for.

Dear reader, it’s important to keep portfolio management in mind. In times when stocks are falling and there’s a lot of uncertainty everywhere, investors forget the most basic things.

The three points mentioned above shouldn’t be forgotten in times when markets are falling.