European Banks to Cause the Next Financial Crisis?

This is a bold statement, but it’s worth making: we could be on the cusp of a financial crisis.

This financial crisis may not be triggered by the U.S. banks.

You see, after the financial crisis of 2008–2009, U.S. banks were supported by the Federal Reserve. Essentially, the Fed printed money, took the bad assets from the banks, and gave them cash.

As it stands, the banks seem well capitalized and have been making a lot of profits. As a result, their stock prices have been soaring.

Over the past five years, for example, JPMorgan Chase & Co. (NYSE:JPM) has soared close to 140%, Bank of America Corp (NYSE:BAC) has jumped by similar amount, Citigroup Inc (NYSE:C) has increased by 43%, and Goldman Sachs Group Inc (NYSE:GS) has grown by close to 60%.

You have to look elsewhere.

Pay attention to the European banks. As U.S. banks were saved by the Federal Reserve, European banks were backed by the European Central Bank (ECB). But problems at the European banks continue to persist.

Watch Deutsche Bank Very Closely

More specifically, look at Deutsche Bank AG (NYSE:DB). It is the biggest bank in Germany, and it has a massive global presence.

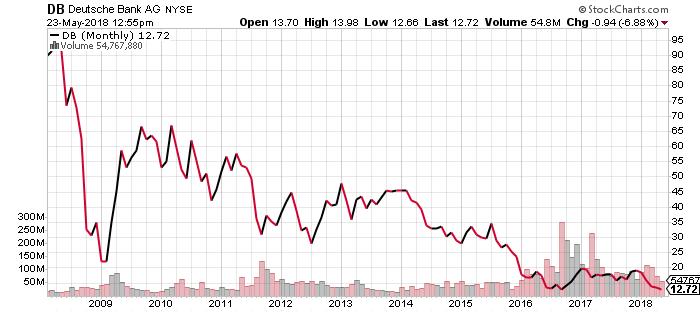

This bank is struggling. It has been reporting losses year-over-year. If you look at the DB stock price, it has been tumbling since the previous financial crisis.

Chart courtesy of StockCharts.com

The bank’s management team seems desperate.

Just recently, The Wall Street Journal reported that the executives at the bank are considering cutting the workforce by 10,000. That would be 10% of the employees at the bank. (Source: “Deutsche Bank Considers Plans for 10,000 Job Cuts,” The Wall Street Journal, May 23, 2018.)

Deutsche Bank is also looking to scale back its operations significantly.

Bloomberg says the bank is looking to “sharply reduce its presence in the U.S. market, and has also started cutting activity in the Central Europe, Middle East and Africa region.” (Source: “Deutsche Bank’s Withdrawal From Equities Goes Global,” Bloomberg, May 23, 2018.)

This still hasn’t convinced investors.

As each day goes by, the survivability of Deutsche Bank is being questioned.

What Does Deutsche Bank Have to Do with Financial Crisis?

Understand this: the global financial system is very interconnected.

If Deutsche Bank’s woes continue and it says it can’t survive, the financial system could come under severe stress. A financial crisis could become a likely scenario.

How? Here’s the thing: Deutsche Bank has massive derivative exposure. At the end of 2017, the bank’s notional derivative value was around €48.0 trillion. (Source: “Credit Exposure from Derivatives,” Deutsche Bank AG, last accessed May 23, 2018.)

This amounts to roughly $56.0 trillion.

To provide some perspective, in nominal terms, U.S. gross domestic product (GDP) was less than $20.0 billion at the end of 2017. (Source: “Gross Domestic Product,” Federal Reserve Bank of St. Louis, last accessed May 23, 2018.)

So, Deutsche Bank has notional derivatives that are worth almost three times the U.S. GDP.

Keep in mind, derivatives involve two parties. If all of a sudden, one party says we are not going to be in business anymore, what do you think will happen to those on the other side?

I can’t stress this enough: what’s happening at Deutsche Bank is worth watching closely. This bank could trigger the next financial crisis.