S&P 500 and Silver Correlation Says Silver Prices Could Surge

Silver remains one of the most overlooked assets out there. Mark these words: silver prices could be setting up for the next bull market. Major gains could be ahead.

It’s important that investors pay attention to the long-term correlation between silver prices and the S&P 500. It’s very powerful. This correlation is saying that the worst may be over for the gray precious metal, and that a massive upside could be ahead.

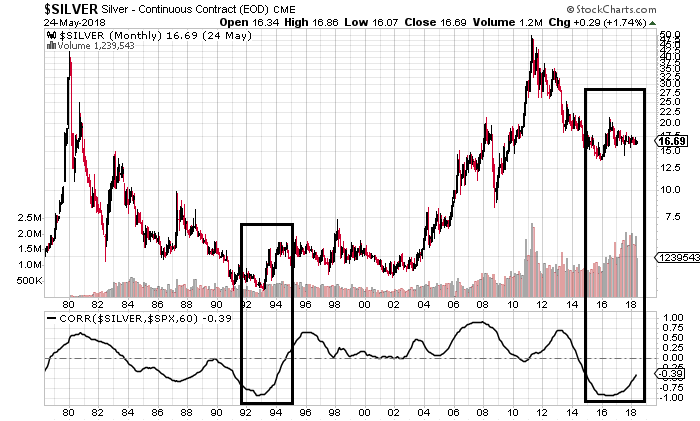

Look at the chart below and pay close attention to the highlighted areas.

Chart courtesy of StockCharts.com

At the top of the chart, silver prices are plotted. At the bottom of the chart, the five-year correlation between silver prices and the S&P 500 is plotted.

You see, whenever the five-year correlation between silver prices and the S&P 500 gets close to minus-one (extremely negatively correlated), we see a bottom form in the price of the precious metal.

We saw this happen in the late 1970s. The bottom in silver prices was formed then. A few years later, the gray precious metal was soaring to all-time highs.

This happened again in 1993. That was hands down the lowest silver price reached before making a run toward $50.00.

In 2016 and early 2017, this correlation became extremely inverse. One really must wonder if that was the bottom, and whether silver prices are setting up to soar big-time.

The Bottom May Already Be in Place

Understand this: tops and bottoms are impossible to predict. They are only identified once they are already in place.

With silver prices, it looks like a bottom could be in place already.

Why?

Look at the volume in the silver market, plotted behind the price. As this correlation was becoming extremely negative, volume surged and silver prices stabilized.

This says that buyers are increasing in number while sellers are diminishing—something you usually see near bottoms. If sellers were in large numbers, silver would continue to tumble lower.

How High Could Silver Prices Go?

In 1993, the last time that the correlation between silver and the S&P 500 dropped to near minus-one, the precious metal was trading at around $3.75. It went as high as $49.80 by 2011. That’s an increase of over 1,200% over 18 years.

If we assume that we will see similar gains this time around, we could be looking at silver prices in the triple-digits by 2036.

Here’s something to keep in mind as well: if there’s a sort of a financial crisis or shocks on the global level, expect the silver gains to be much quicker.

Silver is considered to be a precious metal, very similar to gold. It’s also a safe-haven asset. So, in crisis time, investors could rush toward it and send the price soaring.

Dear reader, I continue to be bullish on silver. At $16.50, I see the metal selling at extremely rock-bottom prices. Those who are patient could reap massive rewards.

Also, as silver trades at rock-bottom prices, silver mining company stocks are selling for pennies on the dollar.