This Trend Indicator Says a Stock Market Crash Could Be Looming

Don’t rule out a stock market crash just yet for 2018.

Know that, for the stock market to go higher, you need the majority of the companies to move higher too. That is not the case these days. Only a few companies are supporting the upside, while many are facing headwinds.

We are seeing a massive disparity, and it says that a stock market crash could likely happen sooner rather than later.

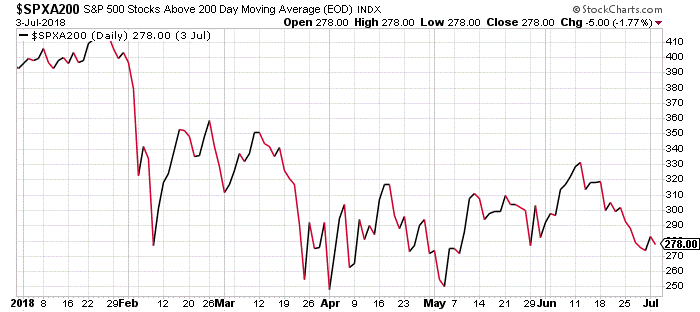

Look at the chart below. It shows the number of S&P 500 stocks that are trading above their 200-day moving average.

Chart courtesy of StockCharts.com

Before going into any details, I’ll explain what the 200-day moving average actually means. Technical analysts use this moving average as a trend indicator.

If a stock price is above the 200-day moving average, the stock is said to be in an uptrend. This means that investors are bullish about the stock and that upside could be likely.

If the stock is trading below its 200-day moving average, it means that the trend is pointing downward and that bearish sentiment is prevailing, meaning that more downside could be ahead.

As it stands, there are 278 S&P 500 companies trading above their 200-day moving average. At the beginning of 2018, this figure was around 410.

Doing simple math here, the number of companies trading above their 200-day moving average has dropped by over 32%. In different words, 222 S&P 500 companies are trading below or at their 200-day moving average.

Not too long ago, in May, just half of the S&P 500 companies were trading above the 200-day moving average.

At its core, this says that bearish sentiment on the stock market is building up, and that investors need to be cautious. Losses could follow.

Margin Debt Is Surging

As this is happening, it’s important to watch the margin debt figures as well. This is the money that investors have borrowed to buy stocks.

In May, margin debt stood at $668.9 billion. It has soared immensely over the past few years as the stock markets have rallied. In May 2010, it was just $268.6 billion. (Source: “Margin Statistics,” Financial Industry Regularity Authority, last accessed July 6, 2018.)

So, in eight years, margin debt has increased by close to 150%.

Why bother looking at margin debt? In the case that there’s a sell-off on the stock market, all of a sudden those who have borrowed to buy stocks could be getting margin calls, and this could result in making the sell-off even bigger.

What’s Next for the Stock Market?

Dear reader, don’t get too complacent.

The odds of a stock market crash are stacking up higher each day. The number of S&P 500 companies trading below their 200-day moving average is just one indicator. We see several others suggesting that massive losses could be ahead.

I will repeat what I have said in these pages before: the returns on the stock market in the next eight years may not be like the returns in the last eight years. We could see a massive stock market crash ahead, and it could wipe off a lot of wealth.

If you hold stocks, beware.