Odds of Financial Crisis at Highest Level Since 2008–2009

The odds of a global financial crisis are at their highest level since 2008-2009. Don’t get too complacent. There could be some very dire consequences.

Why have a such a dire outlook on the global financial system? Just pay attention to what’s happening.

You see, the world is fighting a pandemic at the moment. The coronavirus has started to hurt businesses. Nothing is as usual anymore. So, to fight the problem and make sure businesses have cash and are able to get credit, the U.S. Federal Reserve and other central banks around the world have lowered their benchmark interest rates.

And they are all saying they will do whatever it takes to get their respective economies out of this mess.

In the midst of all this, stock markets have tumbled. The rally that began in 2016 has been decimated. Oil prices have crashed. Crude oil now trades around $25.00 per barrel, a multi-decade low.

Commodities across the board are facing severe selling.

Here’s the thing: about two months ago, no one predicted that things would turn out to be this bad in such a short time.

Why a Financial Crisis Could Be Right Around the Corner

Now, back to why we could be on the cusp of a financial crisis.

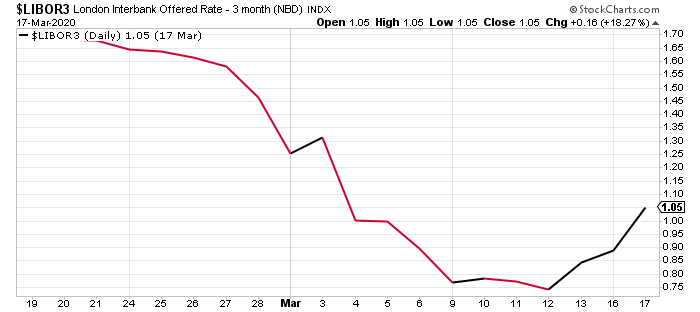

First, look at the chart below. It plots the London Interbank Offered Rate (LIBOR) over the past month. Think of LIBOR as the interest rate that banks charge each other for borrowing money. This rate goes up and down as central banks’ rates move.

However, whenever LIBOR starts to spike in a violent way, it says there’s some panic among banks, stress is building up in the financial system, and liquidity could be become an issue.

Chart courtesy of StockCharts.com

Notice something interesting in the above chart?

As central banks like the U.S. Federal Reserve, the Bank of Canada, and others lowered their rates, LIBOR also came down. But something broke on March 12. LIBOR started to jump. In just a matter of a few days, it surged 40% and it seems to be moving higher.

This says a financial crisis/liquidity crisis could be brewing.

Derivatives Market Is a Ticking $200-Trillion Time Bomb

But don’t just stop here. There’s one number that investors should keep in mind: $200.0 trillion.

At the top 25 U.S. banks alone, there is about $200.0 trillion notional worth of derivatives. This is not a misprint! Globally, this figure is much bigger. Mind you, an immense amount of these derivatives are backed by interest rates. Derivatives are ticking time bombs.

Why do derivatives matter? They are financial instruments that are essentially contracts between two parties based on a certain asset. Their value is dependent on the price of the asset. With this, you really have to wonder what will happen to the derivatives market as we see severe volatility across asset classes and in interest rates.

Won’t derivatives be impacted? It’s very likely, and since there are so many of them out there, they could bring the financial system crumbling to the ground.

Dear reader, I am worried. As the world fights off the coronavirus pandemic, there are bigger problems in the making: a financial crisis could be right around the corner.

What worries me the most? In the case there’s a bank failure, what will the central banks do? Mind you, it doesn’t have to be a U.S. bank that fails and sends shock waves through the global financial system. A bank in Europe, for example, could do an equal amount of damage.

All that said, be very careful.