Here’s Why an Economic Slowdown Might Be Right Around the Corner

American consumers are a major force behind the U.S. economy. In fact, it wouldn’t be wrong to say that consumers can make or break the country’s economic growth trajectory. Whenever consumers are faced with uncertainty, they pull back on spending. That puts the U.S. economy in a downward spiral, and an economic slowdown eventually follows.

In simple words, if you want to know where the U.S. economy is headed, you must watch consumer spending figures and consumer sentiment. It’s time to pause and reflect on whether the indicators related to consumer spending are taking wrong turns.

Here’s the worrisome part: as it stands, U.S. consumers are becoming pessimistic, and consumer spending statistics are showing cracks. Not good.

Could the U.S. economy be headed toward an economic slowdown?

Anemic Retail Sales Figures

For some perspective, look at the chart below. It plots the month-over-month changes in retail sales in the U.S. This chart gives us an idea of how much American consumers are spending.

You can’t just look at one month’s figures and determine how consumers are feeling; you must watch the trend. The U.S. retail sales trend says consumers aren’t happily spending their money.

(Source: “Retail Sales: Retail Trade and Food Services,” Federal Reserve Bank of St. Louis, last accessed December 15, 2021.)

Right after COVID-19 restrictions were lifted in late 2020, retail sales surged. A few months later, the spending dropped. Then, in early 2021, retail sales picked up again. However, since April, U.S. retail sales have been subdued, to say the least.

Between May and September 2021, retail sales dropped in two months (May and July). During the other months of that period, the sales increases weren’t that impressive.

American Consumers Are More Pessimistic Than in April 2020

What will happen next? Will consumers spend more?

To answer this, you must look at how consumers are feeling. Happy consumers go out and spend. Pessimistic consumers watch their spending and hold back a lot.

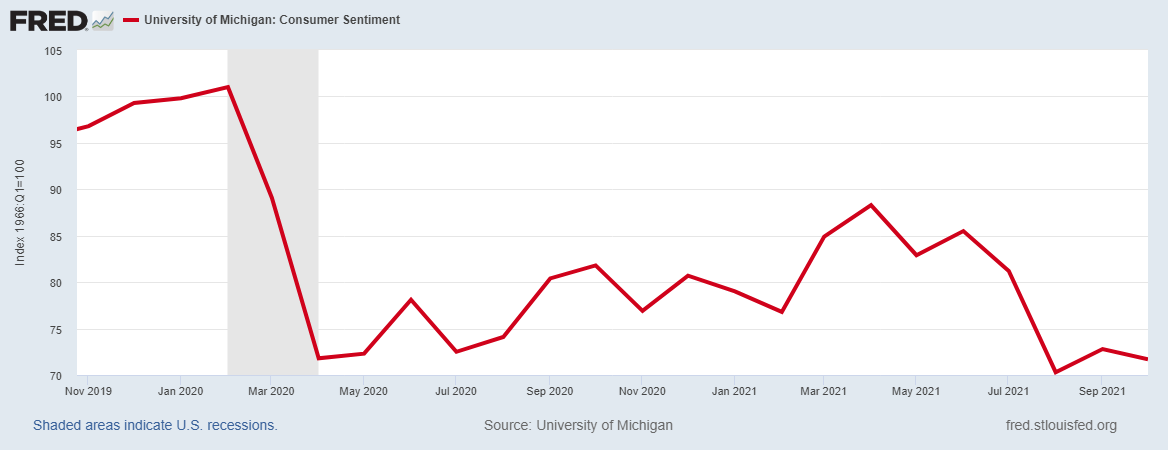

To assess consumer sentiment, check the following chart. It plots the University of Michigan’s consumer sentiment index.

(Source: “University of Michigan: Consumer Sentiment,” Federal Reserve Bank of St. Louis, last accessed December 15, 2021.)

As economic lockdowns started to spread in the U.S. in early 2020, consumer sentiment dropped like a rock. It improved until March 2021 and then changed direction. It currently stands at an even lower level than in April 2020!

To say the least, the U.S. consumer sentiment figures are hinting that spending is going to be dismal.

Why are U.S. consumers worried and pessimistic? They’re facing massive headwinds. We’re seeing multi-decade high inflation, income stagnation, the pandemic persisting, and so on.

U.S. Economic Outlook for 2022: Economic Slowdown Ahead

Dear reader, American consumers holding back spending and becoming pessimistic is bad news for the economy.

A few more months of what we’ve seen over the past few months could start to impact the overall U.S. economic data. We could be talking economic slowdown—or worse, a recession.

While this happens, the Federal Reserve is getting ready to raise interest rates. I think higher interest rates might be needed to tame the record-high inflation the U.S. economy is experiencing these days, but higher rates could drag down consumer spending further. With this, I can’t help but wonder if that will cause an economic slowdown sooner rather than later.

I will end with some food for thought: we entered 2021 with high hopes. Throughout the year, those hopes have faded. Could the current projections for 2022 hold? Or will growth estimates be revised lower?