Problems for U.S. Housing Market: Interest Rates Surge & Affordability Plummets

The U.S. housing market could be setting up for a big disappointment. The odds of huge home price declines are increasing. Real estate investors should be very careful. If you think the rest of 2022 and 2023 will be anything like 2020 and 2021, it might be time to pause and reflect.

It’s important to understand the basics: the housing market is highly reliant on interest rates and on Americans’ ability to afford homes. If interest rates go higher and affordability plummets, it means trouble is ahead for the U.S. housing market.

This shouldn’t be surprising to anyone.

Interest rates have been increasing, and the Federal Reserve has made it clear that it will raise interest rates no matter what, in order to tame inflation. This has an impact on mortgage rates. Look at the following chart. It plots 30-year fixed-rate mortgage rates in the U.S.

(Source: “30-Year Fixed Rate Mortgage Average in the United States,” Federal Reserve Bank of St. Louis, last accessed September 7, 2022.)

In early 2021, 30-year fixed mortgage rates were around 2.7%. Now, they’re closer to 5.7%. This represents an increase of more than 111%!

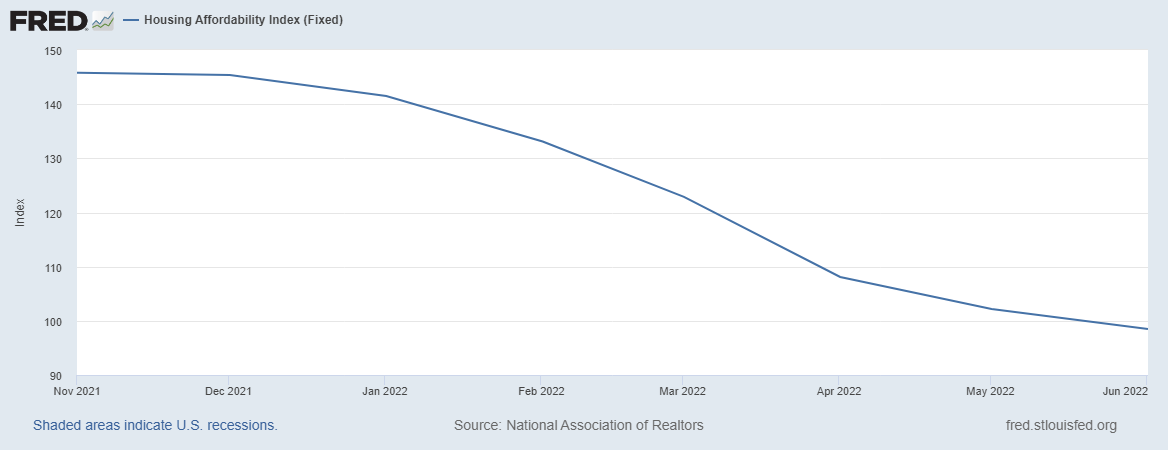

As mortgage rates surge, affordability has been taking a big hit. That’s because potential buyers now need more income to qualify for a mortgage. Take a look at the chart below; it plots the Housing Affordability Index, which is tracked by the National Association of Realtors.

(Source: “Housing Affordability Index (Fixed),” Federal Reserve Bank of St. Louis, last accessed September 7, 2022.)

A reading of 100 or more means a family has enough income to qualify for a mortgage on a median-priced home.

In late 2021, the Housing Affordability Index stood at about 145. This suggests that, at that time, American families had more than enough money to afford a house. A few months later, in June 2022, the index stood at 98.5. This means owning a home might not be easy for many Americans, as they don’t have enough income to afford a median-priced home.

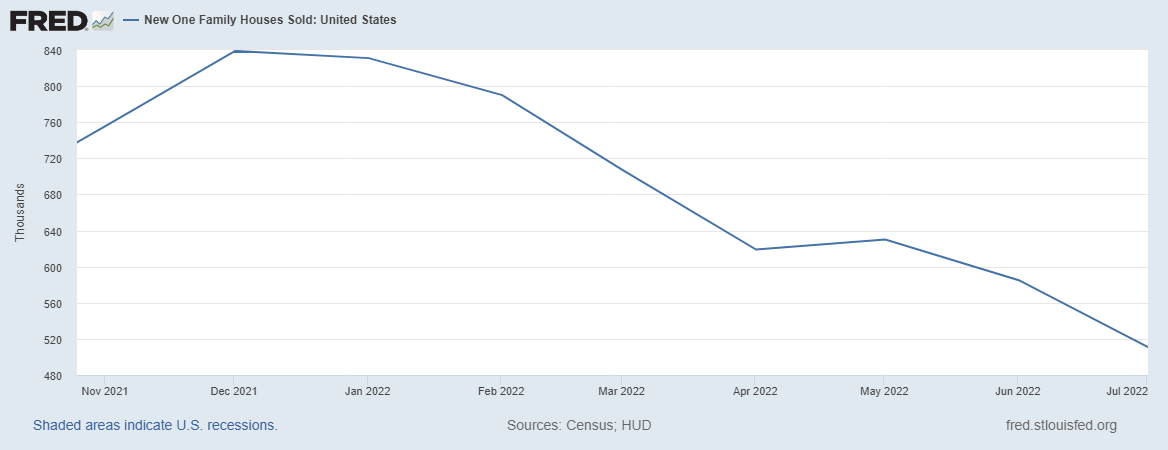

As interest rates surge and affordability tumbles, the housing sales data starts to become dire. Look at the following chart. It plots the annual pace of new home sales in the U.S.

(Source: “New One Family Houses Sold: United States,” Federal Reserve Bank of St. Louis, last accessed September 7, 2022.)

In December 2021, the annual pace of new homes sold in the U.S. was 839,000. In July, the figure was 511,000. This represents a decline of close to 40% within eight months.

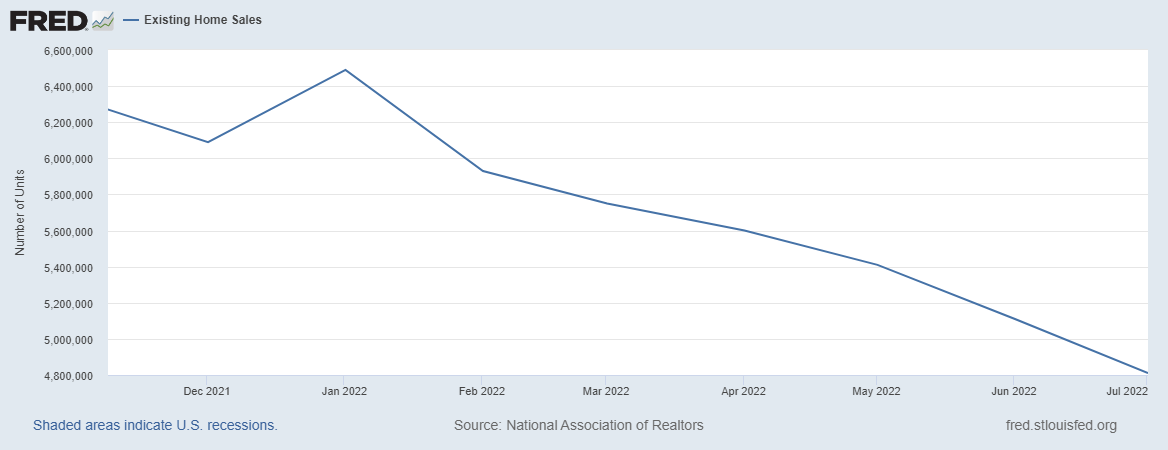

Sales of existing (already-built) homes in the U.S. have been falling as well. The following chart shows just that.

(Source: “Existing Home Sales,” Federal Reserve Bank of St. Louis, last accessed September 7, 2022.)

In January 2022, the annual pace of existing home sales in the U.S. was 6.5 million. In July, this pace was 4.8 million homes. This represents a decline of close to 26%!

Moreover, according to the National Association of Home Builders (NAHB) and the Wells Fargo Housing Market Index, in August 2022, home builders’ confidence dropped for eight consecutive months. (Source: “Builder Confidence Underwater After Falling for Eighth Consecutive Month,” National Association of Home Builders, August 15, 2022.)

The Wells Fargo Housing Market Index fell to 49 for the first time since May 2020. A reading of 50 on this index means home builders view the condition of the housing market as good.

What’s Next for U.S. Housing Market?

Dear reader, the conditions of the U.S. housing market are getting worse. Home sales have started to tumble, and home builder sentiment is becoming gruesome. The next shoe to drop could be a huge decline in home prices.

Here’s the thing: if the U.S. housing market struggles, it means a lot of problems for investors and, ultimately, the U.S. economy.

If home prices fall and you own shares of real estate investment trusts (REITs), all of a sudden, the value of the properties owned by the trusts could be in question. Investors might flee, and you could face losses. If you own home builder stocks, they could face severe headwinds as home sales plunge, ultimately hurting their share prices.

And don’t forget, banks hold many mortgages. If home values drop drastically, banks could end up holding mortgages with negative equity, wherein the value of the home is lower than the value of the mortgage. Furthermore, if there’s an increase in home foreclosures, banks’ earnings could fall.

Lastly, the housing market is a big value creator for the U.S. economy; many jobs and industries are reliant on it. If housing prices fall, it could lead to job losses and problems in other related industries. Eventually, this could drag the U.S. economy lower.