Why the Price of Gold Could Skyrocket to $4,000

Gold prices could really surprise in the coming years, so gold bugs who own the yellow precious metal could reap immense rewards.

There’s still time for investors who haven’t paid much attention until now. But I wouldn’t recommend waiting around too long: $4,000-an-ounce gold could become a reality sooner than later.

Certainly, the $4,000-an-ounce gold price target seems extremely bullish given that the yellow precious metal is only around $2,600 an ounce, but there are some interesting developments when you look at the precious metal from a price action point of view.

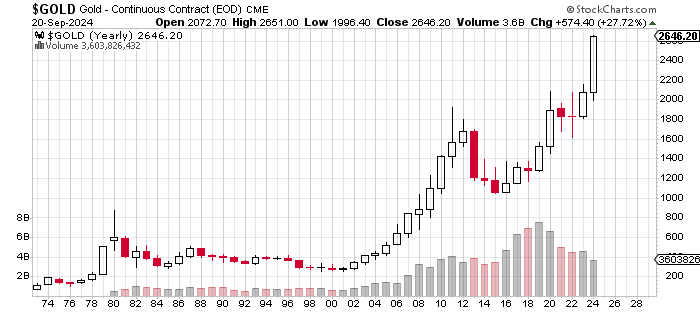

Take a look at the chart below. It plots yearly gold prices.

Chart Courtesy of StockCharts.com

See something interesting on the chart?

How Gold Did After Making All-Time Highs in 1980

You see, gold really started trading freely in early 1970s. Since then, there’s one pattern that has played out a few times, and gold prices shot higher every time.

Let’s dig into the details….

In 1980, the price of gold made an all-time high. After reaching those levels, there was a very long winter in the gold market. It was painful to say the least. During this time, gold prices dropped roughly 70% from all-time highs to bottom in 2001.

However, this was followed by a bull market in gold, and finally the highs made in the 1980s were broken in 2008. By broken, I mean that the price of gold closed above its previous all-time highs. It’s also worth noting that, between 2001 and 2008, gold prices rallied more than 200%.

That’s where it gets interesting: as soon as those highs were taken out, there was a massive run to the upside and gold made another all-time high in 2011 of just slightly below $2,000 an ounce. During this time, the price of gold more than doubled.

Gold Prices Break Above Their 2011 Highs

Then, once again, another painful winter in the gold market followed.

In 2015, gold made a low of around $1,050 an ounce. This represents a decline of roughly 50% between 2011 and 2015. In 2015, a definitive bottom was formed in the precious metal, and the price started to rally.

Now here’s the kicker: in 2023, the highs that were made in 2011 were broken.

Since then, gold prices have been shooting higher. But one has to wonder if we’ll see the pattern repeat itself and the yellow precious metal will double in price. If this does occur, it means we could be seeing $4,000-an-ounce gold.

What’s Ahead for Gold Prices?

Dear reader, as it stands, gold remains a significantly overlooked asset. The price action just mentioned earlier convinces me even more that the yellow precious metal isn’t done yet, and the bull market could go on for a while.

However, in the short term, I must say that the almost vertical move in the price of gold might be unsustainable. When you see a vertical move in asset prices, it hints at a lot of speculation, which is generally followed by profit-taking. So, it wouldn’t be surprising if gold prices were to drop a little bit, but I’d consider that to be a blessing in disguise rather than anything bad.

It may also be a great time to start paying attention to gold miners. At the current price of gold, many miners are already seeing their profits increase, but they could increase even more. As this happens, their stock prices are extremely suppressed; once investors realize this, they could be rushing to buy mining stocks. But investors who have been there already would receive the biggest windfall.