Gold Price Offers Massive Upside & Low Downside Risk

Investing 101: Look at the upside and downside risk of an investment. If there’s more upside potential and low downside risk, then it’s a great potential investment.

Gold right now presents that kind of opportunity. The price of gold has massive upside potential and low downside risk.

It’s important to understand the downside of an investment, because being a “blind bull” is dangerous. Gold prices have increased a lot lately—the yellow precious metal is currently hovering around its all-time high prices. It could go much higher, though this doesn’t mean it can’t go down.

Chart Says Price of Gold Could Drop 29%

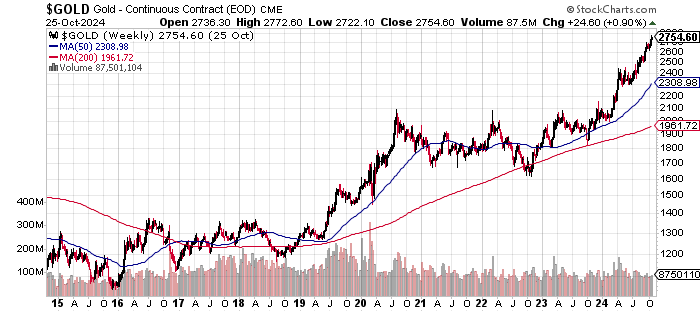

First, let’s assess the potential downside on the price of gold, looking at the chart.

Chart Courtesy of StockCharts.com

Over the past 10 years, the price of gold has found a lot of support around its 50-week moving average (MA) and 200-week MA. Currently, the yellow precious metal trades above these MAs; assuming it comes back to test them, then the price of gold could drop 16% to its 50-day MA, or roughly 29% to its 200-week MA.

Assuming these MAs mean nothing, and support levels matter more, then there’s a big support level for the price of gold just below $2,100 and also below that around $2,000. If that breaks, $1,850 could be in play.

What Could Trigger a Sell-Off

Now, for the price of gold to see that sort of drastic decline, there has to be some sort of problem happening in the background.

Gold tends to drop significantly in times of liquidity issues. It doesn’t have to be a problem in the U.S. financial sector; it could be something that sends shockwaves throughout the financial world. Since gold is very liquid, it gets sold to raise cash.

However, one shouldn’t forget that, after a liquidity event (if it happens), gold tends to do extremely well. In fact, it wouldn’t be wrong to say that a drop in gold prices during a liquidity crisis tends to be a blessing in disguise.

Another thing that could impact the price of gold is if central banks pull back on buying gold. Here’s the thing though: central banks’ gold holdings are currently at a record level. And their actions are speaking louder than words: they want more.

Lastly, don’t forget the big picture in the gold market: gold discovery, and production costs.

Over the years, gold discoveries have been declining. Even with miners now spending money on exploration, there hasn’t been anything major. This really put a huge constraint on the supply side of gold in the long term.

On top of this, the price of production is increasing. This ultimately puts a floor on the price of gold. Think of it this way: if gold prices drop below the average gold production price, will miners have any incentive to produce the metal?

As we all know, miners won’t produce until the price become reasonable for them to do so.

According to the World Gold Council, the all-in sustaining cost for miners as of the first quarter of 2024 was around $1,375 an ounce of gold. (Source: “Production costs,” World Gold Council, October 7, 2024.)

Price of Gold: Outlook Remains Shiny

Dear reader, I still see gold as one of the best opportunities out there. It only is starting to gain some traction now, but the upside potential is huge here, while the downside isn’t that significant. This makes it a great potential investment.

I think the price of gold could make run towards $3,000 an ounce soon. Once that happens, new buyers could come in and take it much higher. At this point, I’m actually even wondering if $5,000-an-ounce gold could be a possibility in the coming years.

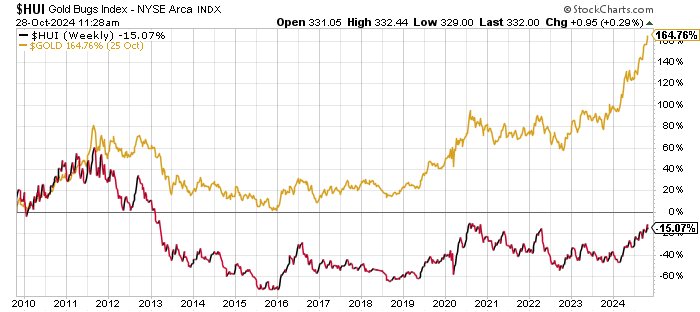

I want to leave with some food for thought in the form of a chart.

Chart Courtesy of StockCharts.com

Over the last 15 years, the price of gold has skyrocketed close to 165%, while mining stocks (tracked through the Gold Bugs Index) are down 15%. So, will gold miners eventually catch up?