These 3 Factors Suggest Barrick Gold Stock Setting Up to Soar

If you believe that gold prices could go much higher, then paying attention to Barrick Gold Corporation (NYSE:ABX) could be really worth it.

There are at least three reasons that make Barrick Gold stock a golden opportunity, as gold prices have fallen over the past few months.

1. Fundamentals of Barrick Gold are improving. One of the key factors that investors should be paying attention to is the long-term debt at the company. At the end of 2014, Barrick Gold had long-term debt of over $13.0 billion. By the end of 2015, the long-term debt stood at $9.96 billion. Simple math here: this represents a decline of little more than 23% year-over-year. (Source: “Barrick Gold Corporation Annual Report 2015,” Barrick Gold Corporation, last accessed December 5, 2016.)

But this isn’t all. At the end of the third quarter, long-term debt at Barrick Gold was $8.36 billion. In other words, it’s on track to reduce its debt by a similar amount (roughly 20%) this year as well. (Source: “Barrick Reports Third Quarter 2016 Results,” Barrick Gold Corporation, October 26, 2016.).

This is what you must understand: a lower debt load would mean lower debt expenses for Barrick Gold, and higher profitability. As gold prices rise, this factor alone could cause ABX stock to skyrocket.

2. Barrick Gold’s cost to produce an ounce of gold is very low relative to other gold miners. In 2013, the company produced an ounce of gold at all-in sustaining costs of $915.00. In 2014, it was reduced to $864.00. In 2015, it was $831.00.

While presenting its third-quarter results, the company provided guidance for the full-year of 2016. It’s on track to report all-in sustaining costs in the range of $740.00-$775.00 per ounce.

What does this mean for ABX stock? As gold prices soar, Barrick Gold’s profits will also soar, and thus, it could take the ABX stock value higher.

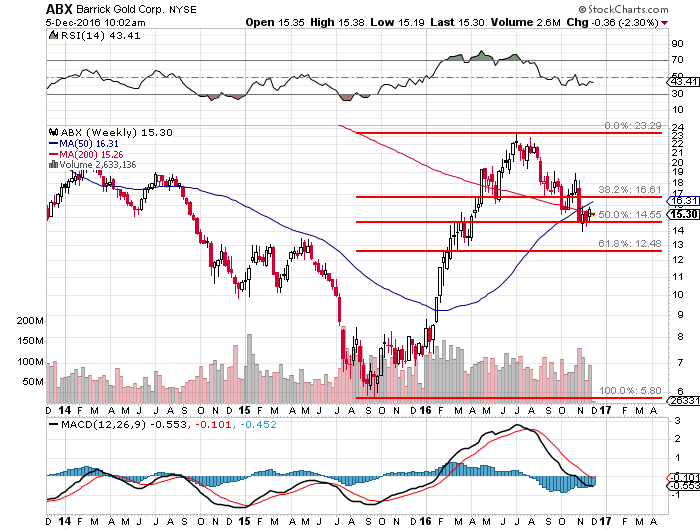

3. From a technical analysis perspective, ABX stock seems to be setting up for another bull run. Please look at the chart below and pay close attention to the red lines drawn on it.

Chart courtesy of StockCharts.com

In the chart above, I have drawn Fibonacci Retracements, which make up a technical analysis indicator that could tell possible reversal points. The most popular retracement levels used by technical analysts are 38%, 50%, and 62%.

Currently, ABX stock stands at a 50% retracement level, and finds support for the past several weeks. We must question whether it’s getting ready for another move to the upside.

ABX Stock Outlook

As gold prices rise, with fundamentals improving at Barrick Gold, we could see ABX stock go beyond the highs made in 2011. A move beyond $50.00 shouldn’t be ruled out just yet, in the long run. Mind you, it wouldn’t be shocking to see $50.00 ABX stock well before gold prices hit the 2011 highs.

This could be possible because the company has lower debt, is producing at much lower costs, and is one of the biggest gold miners in the world. As gold prices turn, we could see institutional money come in and buy.

Please note; this is not a recommendation to buy. Its just an analysis on what’s happening at the company.