These Indicators Suggest that Inflation in the U.S. Economy Could Soar

Let’s be very real here; inflation in the U.S. economy could be a major problem going into 2017. A significant number of indicators are suggesting that inflation is setting up to soar.

Before going into any details, let me define inflation. At its very core, inflation occurs when the general prices in an economy increase. Usually prices rise because of economic activity, and an abundance of money supply.

Dear reader, don’t be fooled by what you are told in the mainstream media. Look at the indicators yourself. They suggest that inflation is set to pick up in the U.S. economy.

With that said, if you look at the statistics like the Consumer Price Index (CPI), you could be misled. It will tell you that in the first 10 months of 2016, inflation in the U.S. economy was about 1.6%.

Remember; when it comes to investing and trying to project where the economy is heading, it’s all about looking forward. CPI is great when telling what happened in the past with inflation, not what could happen in the future.

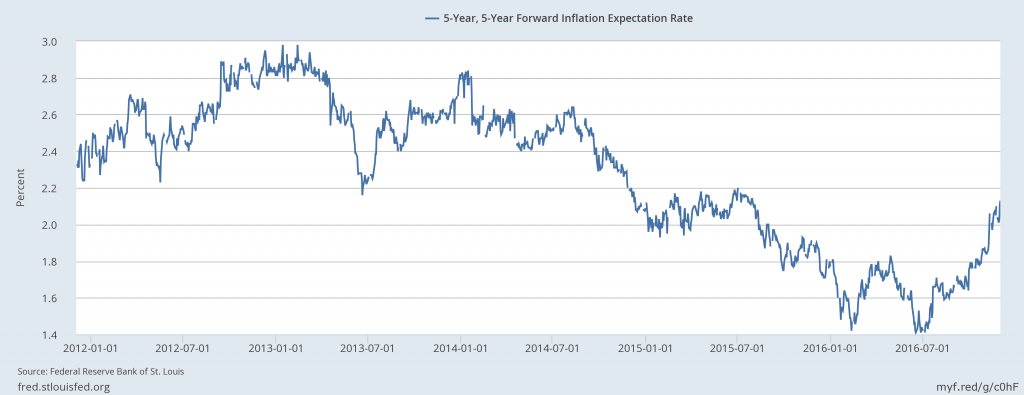

As it stands, we see the expectation of inflation in the U.S. economy shooting through the roof. Please look at the chart below, from the Federal Reserve Bank of St. Louis. It pretty much says what the inflation expectations are over the five-year period that begins five years from today.

Chart courtesy of Federal Reserve Bank of St. Louis

Investors should be paying attention to how fast the expectations are rising. Consider this: in July, the five-year forward inflation expectation in the U.S. economy was around 1.4% in July. Now it’s around 2.13%. The percentage may not sound so big, but if you look at the relative change, it’s huge; inflation expectations have soared 52% in a very short time!

But this isn’t all. There’s another thing that investors should be paying close attention to. It’s the velocity of money in the U.S. economy. At its very core, velocity measures how many times one dollar was used in the United States. If velocity is 2.0, it means one dollar was used two times.

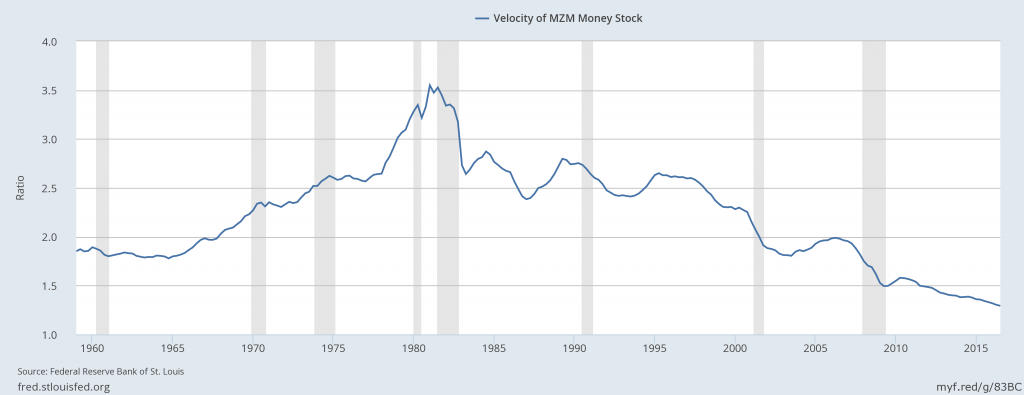

Chart courtesy of Federal Reserve Bank of St. Louis

Currently, the velocity of money sits at the lowest level in several decades; it stood at 1.23 in the third quarter of 2016.

It’s interesting to note that, as interest rates started to move lower in the 1980s, the velocity of money started to shrink as well. Now, there’s a significant amount of evidence that interest rates could be going higher. With this, it wouldn’t be surprising to see the velocity of money in the U.S. economy also move higher?

As velocity of money starts to move higher, it will mean much higher inflation.

What Could Investors Do As Inflation Rises?

To me—and this is contrary to popular belief—it wouldn’t be shocking if we see a spike in prices in the U.S. economy sooner, rather than later. The year 2017 could be when this happens.

It’s important for investors to understand that not all sectors do well when inflation rises. One of the best places to be when prices are increasing—and taking a toll on wealth—would be gold. The yellow precious metal has hedged against inflation much better than other asset classes.