3 Factors Suggest U.S. Economy Could Struggle

The U.S. economy could run into trouble in 2017. Recession could become a reality. If not recession, we could see severe stagflation.

If you listen to the mainstream, it will have you convinced that stock markets remaining at their all-time highs is a sign of a strong U.S. economy. Ignore this. The key stock indices aren’t representing the true side of the economy.

Why could recession or stagflation be ahead for the U.S. economy?

Before going into details, let me make it very clear what recession and stagflation actually mean.

Recession: a decline in a country’s gross domestic product (GDP) for two consecutive quarters.

Stagflation: a period of higher unemployment, high inflation, but dismal demand. In other words, economic activity slumps as prices increase and jobs are being lost.

What brings me to this conclusion while everything in the U.S. economy looks rosy?

Dear reader, it’s important to pay attention to the data closely. If you do just that, it says the U.S. economy is going on a path to recession, or slower growth ahead.

There are three things that must be remembered:

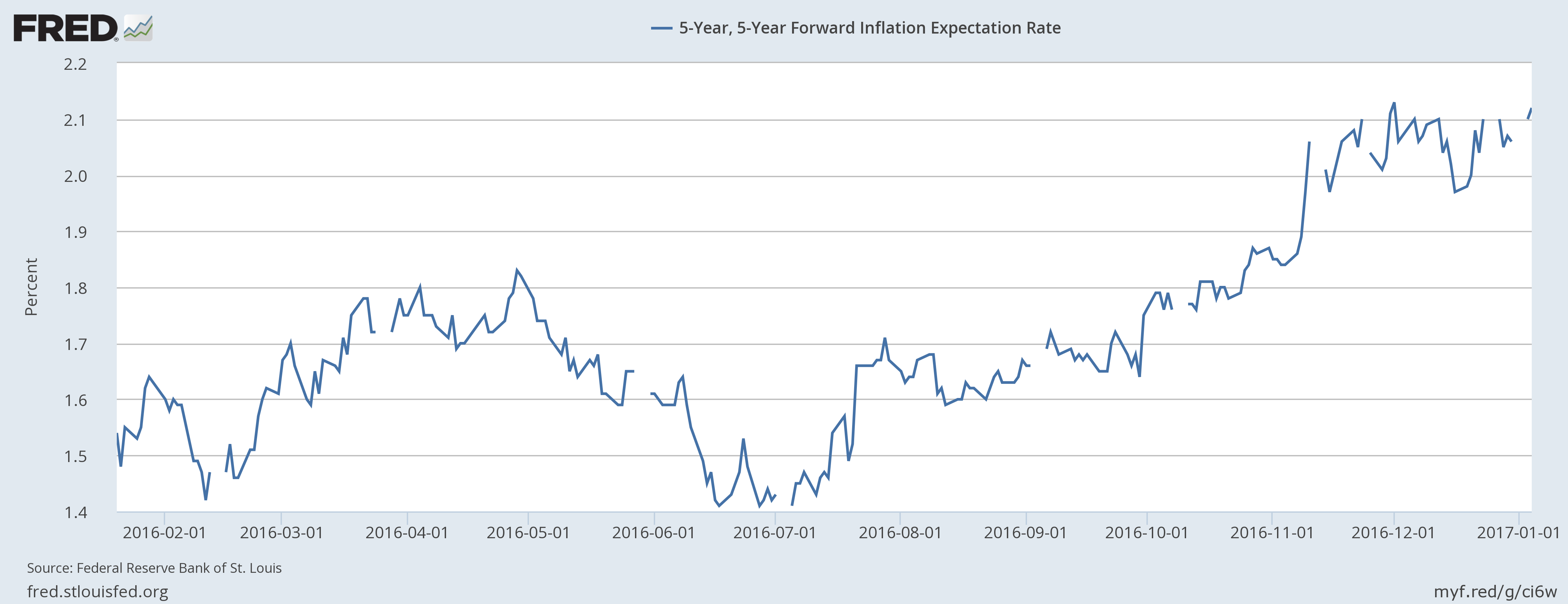

- Inflation could really be a problem ahead in 2017 and beyond. Consider the chart below. It shows inflation expectations for the five-year period that begins five years from today, posted by the Federal Reserve Bank of St. Louis.

The chart above says inflation will be much higher than it is today. In the past few months, inflation expectations have soared over about 50%!

Remember this; higher prices could impact consumption. With the same amount of money, Americans would buy fewer things. This could turn out to be devastating for businesses. They may be forced to cut production, and reduce the workforce to remain solvent.

- The Federal Reserve wants to raise interest rates, but sadly, it looks as if economists and investors have forgotten the most basic economics. Understand that higher interest rates impact consumption, and eventually lead to a lower GDP.

Looking at this, I ask, won’t consumption in the U.S. economy be impacted? It’s very likely, and it wouldn’t be shocking to see a much lower growth rate than currently being projected across the board. A decline in demand due to higher interest rates could easily cause a recession.

- The unemployment situation already looks dire. In December of 2015, 156,000 jobs were added to the U.S. economy. This rate is well below what we were seeing not too long ago—even though jobs are being added, it’s at a slower pace.

This isn’t all; we continue to see many Americans working part-time because they can’t find full-time work, labor force participation remains gruesome, and not many jobs are being added to sectors that pay well.

Know this; when jobs are not being created or their rate is declining, it says corporate America could be struggling, and the U.S. economy could slow down.

U.S. Economy in 2017: Dire Future Ahead

Looking at the data, it’s very hard to believe we could see robust growth in 2017. The fact is, the U.S. economy remains in a fragile state. There are factors that could take it in the wrong direction, and investors should keep a close eye on them.

A recession in the U.S. economy could be the trigger that causes a stock market crash.