Are We Heading for Another Great Depression?

Many wonder if another 1929-like economic depression could happen. The better question is not if, but when will the next great depression happen? Indeed, there is no question that another recession will happen. But the causes of major financial collapses are always best analyzed in hindsight.

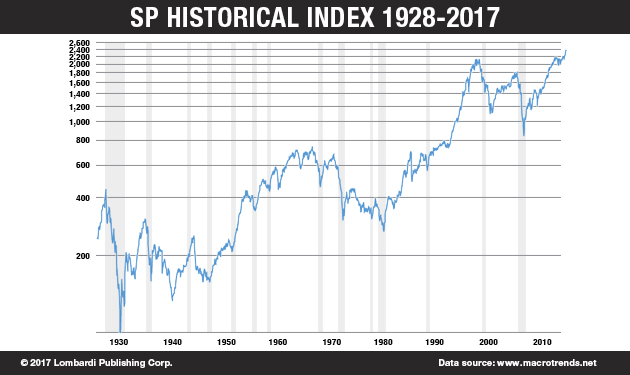

The euphoria and momentum of the markets tend to push higher by their very nature. The Standard & Poor’s index is currently much higher than it was in 1928, despite having experienced at least four major crashes. Some of those led to recessions and depressions. Still, it’s not possible to predict depressions or recessions with pinpoint accuracy and on the basis of facts.

Markets, in the sense of stock markets, represent an aggregate of bets. To pinpoint a market crash and the start of an economic depression is not possible. If it were possible to predict them, some people would be even more fabulously rich than they already are. George Soros has made interesting bets that challenged consensus opinion.

Soros has won, as happened in 1992 with the British pound and the Italian lira. But Soros has also lost on some of his bets. Most recently, he lost a billion dollars betting before Donald Trump’s election on stocks that would have gained had Hillary Clinton won. But, as the graph above shows, crashes always come after record highs.

Isaac Newton did not mention it, but he should have reminded everyone that gravity—what goes up must come down—does not solely apply to the physical world. The markets have a rather Newtonian outlook of their own. Like most stock market predictions, much relies on instinct; history merely helps refine our instinct for market performance.

Warren Buffett has honed his instinct for reading the markets by accumulating knowledge. He doesn’t just read the business pages; he reads about history and culture, which gives him a more global understanding of the markets. This allows Buffett to develop his opinions on stock market performance based on a full picture rather than in isolation.

Market crashes sometimes come from the market itself (i.e. 1987), but often they are external, with roots in faraway lands and distant conflicts. For example, nobody would consider the U.S. economic outlook for 2017 in the context of the United States alone. Any outlook would have to examine the United States in its global context, even more as the world—Donald Trump aside—is still highly interconnected.

We Are Ignoring History and Heading into Another Great Depression

Thus, understanding the Great Depression causes and the Great Depression effects is important. In fact, it’s essential for anyone wanting to entertain an informed assessment about the distance or proximity of the next Great Depression. One sign might be the U.S. housing bubble in 2017 or U.S. mortgage rates. But, there’s more.

Before taking a brief journey to examine the causes and effects of the main recessions of the last 100 years, there are some more immediate hints that should raise concerns. There are two indicators that can reliably anticipate financial crisis based on specific economic trends. They can’t predict the date, but they signal trouble.

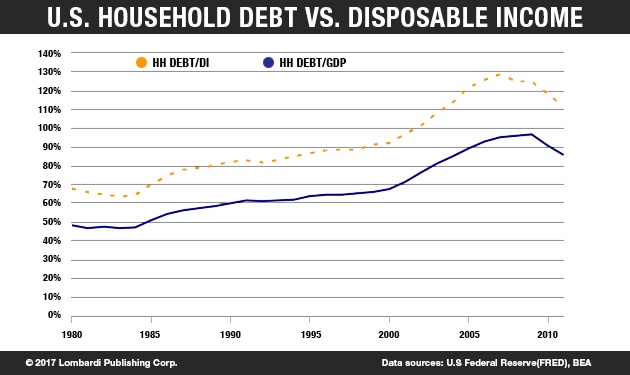

The first indicator is the gap between credit and gross domestic product (GDP). In other words, anyone with a stake in the markets should understand how private sector debt relates to GDP. The second indicator is the debt service ratio (DSR)—or more simply, U.S. public debt. This is defined as the percentage of interest payments and mandatory principal repayments in relation to GDP.

This has proven to be a highly effective indicator within two years from the financial crisis trigger event. The problem is that hindsight is always better. What Americans need to understand is that, in both cases, the United States is past due. The credit-to-GDP ratio has increased uncontrollably while public debt has been hovering at a dangerous level for years.

U.S. debt almost doubled during the Obama years. There was some progress made, but the Trump policies risk pushing that debt higher.

Trump’s infrastructure program and military expansion could push debt much higher. Especially considering the proposed relaxation of taxes while pushing for higher spending. Debt predictions are especially effective in the two years before the crisis event. Unfortunately, only hindsight can determine when.

Suffice it to say, the U.S. is overdue for a massive, depression-inducing correction. The rising gap between GDP and debt in the United States is a major source of concern. It reflects an unhealthy gap between economic growth and the amount of debt assumed by non-financial enterprises and households.

In other words, it suggests that the real economy, which many people forget has little to do with Wall Street, is suffering. Sooner or later, that debt explodes and drags the markets down with it. The 2007/2008 subprime crisis is but the latest example. As for the debt service ratio (DSR), it usually shows its ugly head just before the explosion of a financial crisis.

Recent recessions—or, better, depressions—in 2008–2009 worldwide or in 2010–2012 in Europe seemed to coincide with the DSR gap. The phenomenon has come to be known as the Frenkel Cycle. It has been used to explain the European crisis, which, especially in southern Europe, has been a veritable depression.

The eurozone crisis, as many in Europe have suggested, started because of an enormous increase in private debt. This was especially the case in the southern countries, because of capital transfers from the North. That’s the essence of the Frenkel Cycle, so named after the Argentine economist who identified it, Roberto Frenkel.

The excess credit stimulated the creation of bubbles and debt that could not be repaid. If it sounds familiar, it’s because it strikes a resemblance to the subprime crisis of 2007–2008. Thus, countries like Spain or Italy—and of course, Greece—have faced much harsher effects from the global financial crisis than Germany.

That’s because Germany happens to be the nation that has had the least growth of private indebtedness (households and businesses) in the West in the years before the great crisis. Thus, it saved itself. The United States now is in a situation similar to southern Europe, except that it’s monetarily independent and better able to confront those imbalances.

Still, that makes the risk of a crisis and another Great Depression no less significant. A financial collapse can cause massive unemployment, for instance. The U.S. unemployment forecast for 2017 might be far worse than many believe. But if that doesn’t raise your concern enough, consider this.

The three greatest economic crises or “great depressions” of the last century can be associated to an event dated to a particular day, but they can’t be predicted. Thus, you should always be informed and on alert as to the overall picture. An informed person would not simply cheer at the current scenario of the Dow Jones setting daily record highs.

The Great Depression Summary

The overall picture warrants caution as the following brief historical analysis suggests. The three big depressions occurred in 1929, 1973, and 2008. There was a major financial crash in 1987, but it did not produce a depression, So, one of the first things to know is that crashes, which have few explanations in hindsight, don’t necessarily result in a recession or depression.

However, the elements discussed above have proven to be “depression triggers.” That’s why the U.S. economy in 2017 faces such high stakes, similar to the the Great Depression causes. But first, it’s useful to note the Great Depression effects. Massive unemployment was certainly part of it, but one surprising aspect was that after 1933 (the depression started in 1929), employment in Europe started to rise again.

The latest 2008 depression had no such effect. Employment has generally been stagnant in Europe and, relatively speaking, in the United States as well. The Great Depression was triggered by a series of events that started on October 24, 1929. It became known as “Black Thursday.” The reason to worry is that this dark day, marked by a 13% collapse of stock values on the Wall Street stock exchange, came just weeks after the September 19 record high.

Still over-confident, the big banks intervened with massive purchases. This helped Wall Street make a recovery, such that Black Thursday ended the day with a 2.1%, rather than 13%, loss. After a lackluster Friday, the crash made a big noise the following Monday, October 28, 1929, culminating on Tuesday, October 29.

The post-World War I scenario appeared to have produced a virtuous circle. There was high productivity and high investment in the United States. But purchasing power did not improve to match the investment. If that sounds familiar, it’s because the current situation is similar. Such are the Great Depression facts that investors should understand now. Because they are repeating.

The post-war situation had been fueled largely by bank savings accumulated during the war years, and low interest rates. The alarm bells should be ringing loudly for anyone who has feared the effects of the current low-interest-fueled economy. Meanwhile, the financial system was in full unregulated speculation mode.

There were no limits on banks speculating their clients’ savings on the stock exchange. Meanwhile, investors were not after the security of the dividend. They wanted big gains in the roaring twenties. But the value of the real economy, actual production and actual earnings, did not correspond in any way to the astronomic valuations on Wall Street.

Thus, stock values had increased artificially. It was all one giant bubble and it screeched to a halt as it forced a massive sell-off on Wall Street. The effects of the crash led to the Great Depression, characterized by the collapse of almost a quarter of listed enterprises. It also meant the collapse of real estate, world trade while credit dried up.

Ultimately, a similar process happened in 2007. The warning signs for the next Great Depression are already there. The events and conditions that triggered the 1929 crash are being repeated before our eyes. Add to that the financial deregulation being pursued as part of the Trump policies, and anyone with a stake on Wall Street or the U.S. economy should be scared.

The next major depression after 1929 happened in the fall of 1973, when the oil-producing Arab states (OPEC members) increased oil prices by 120%. They were a retaliation against Western countries that supported Israel as a political pretext in the wake of the fourth Arab-Israeli war that broke out on October 6 of that year.

That was an unpredictable event because it began with a surprise attack. Its effects were massive inflation—and stagflation—because it pushed the price of production of all goods and energy higher. There’s less risk of that now, because North American oil production can, on demand, increase to match anything coming out of Saudi Arabia.

Certainly, the 2008 financial crisis repeats the model of 1929. On Monday, September 15, 2008, Lehman Brothers Holdings, Inc. collapsed. The images of that bank’s employees leaving their offices in haste with their cardboard boxes full of personal effects have become a symbol of that day and crisis.

The interconnectivity of the world economy magnified the effects of the crisis, increasing instability. But, unlike the 1930s, the recovery has been financial, rather than purely economic. In other words, the stock markets and speculation have resumed their bullish course. But, the real economy has stayed behind.

In other words, the conditions exist for the next financial meltdown to bring the global economy to its knees.