This Shocking Insider Trading Scandal Put All Others to Shame

Insider trading scandals are nothing new. They preceded the days of the stock ticker tape and Jesse Livermore. It’s simply human nature to succumb to the temptations of instant wealth. But this shocking insider trading scandal of all time will blow your mind. It makes the Enron scandal look like a walk in the park.

On July 25, 2013, in one of the largest insider trading cases ever, the U.S. Attorney for the Southern District of New York announced the indictment of S.A.C. Capital Advisors (SAC). The indictment was for infractions committed over the period of a decade, 1999 to 2010, which were unparalleled among Wall Street hedge funds. The indictment described the situation as “Insider trading that was substantial, pervasive and on a scale without known precedent in the hedge fund industry.” (Source: “U.S. charges SAC Capital with insider trading crimes,” Reuters, July 25, 2013.)

SAC wasn’t just another in the hodgepodge of hedge funds operating in Manhattan; it was among its largest and most influential. At its zenith, SAC had over $50.0 billion in assets under management and generated over $300.0 million annually for investment banking firms selling them research. SAC owned a book which could move markets in orders of magnitude when it decided to buy or sell stock. Even a rumor of SAC purchasing or liquidating could spark a rally or purge in milliseconds.

Its founder, Steven Cohen, wasn’t just your run-of-the-mill snake oil salesman either. He was a driven and talented trader whose star shone early in his career. From a young age, Cohen was determined to rise above the middle-class existence provided for him on Long Island. He worked uncommonly hard, obtained an economics degree from the Wharton School at the University of Pennsylvania, and entered the workforce as a junior trader at Gruntal & Co. He rose quickly in the boutique investment bank, running his own trading group by the age of 28. He would eventually amass a mini-fortune, which he used to start SAC in 1992.

For even the best of traders, however, the sheer size and consistency of the returns generated by SAC seemed impossible. Cohen wasn’t just a passive trader who had gotten lucky for a few years; he was an active trader who placed large bets on big-news events. Cohen’s edge was to “get as much information as possible… to make money either on the upside or the down side depending on how a company’s earnings come out.” (Source: “Chart of the Day: The SAC Advantage,” FRONTLINE, January 7, 2014.)

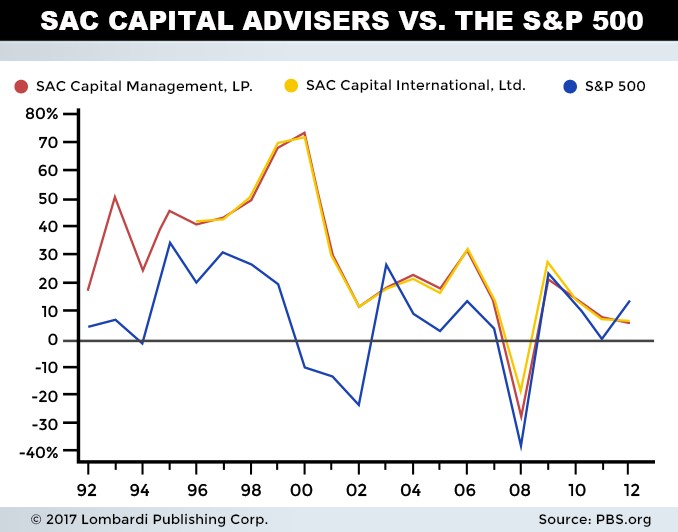

Cohen’s edge also caught the attention of the U.S. Attorney for the Southern District of New York, and others. In the time between 1992 and 2010, SAC’s two biggest funds combined for an average net return of almost 29% per year, compared to less than eight percent for the broader stock market. In one year, gains reached as high as 73% while the S&P 500 was down 12%. The government issued an “extraordinarily broad” subpoena in November 2010 to learn more.

It turns out there were plenty of nefarious activities taking place. Damaging information was surfacing everywhere, and this ultimately led to SAC’s quick and decisive downfall.

In February 2011, two former employees were charged with insider trading. U.S. prosecutors charged SAC portfolio managers Noah Freeman and Donald Longueuil with insider trading. A SAC analyst pled guilty of insider trading a few weeks later. In December 2012, a grand jury indicted former SAC portfolio manager Mathew Martoma, in what prosecutors called the “most lucrative” insider trading scandal ever. Another top executive, Michael Steinberg, was charged with insider trading in shares of computer maker Dell Inc. (NASDAQ:DELL), which netted about $1.4 million in ill-gotten gains. (Source: “Timeline – SAC and the long, winding insider trading probe,” Reuters, July 19, 2013.)

It was game over shortly thereafter for SAC.

In July 2013, the U.S. Securities and Exchange Commission (SEC) filed suit against SAC for failing to properly supervise its traders. After initially insisting that the company would fight the charges, SAC agreed to plead guilty to all indictment counts and to stop managing outside money.

The end result is that SAC was ordered to pay a $1.2-billion fine, not including the more-than-$600.0-million that SAC affiliate CR Intrinsic Investors, LLC paid to settle charges pertaining to the Martoma investigation. That’s an unbelievable $1.8 billion in total fines. As part of the guilty plea with the SEC, SAC wound down operations completely in mid 2014, officially being assigned to the dustbin of history. It was a monumental collapse for one of America’s largest hedge funds, proving once again that greed can infect any organization willing enough to jump into bed with it.

Cohen’s discreetness and deep pockets spared him indictment, but his name will forever live in infamy as the founder of SAC.

List of Insider Trading Scandals

The SAC insider trading scandal is just one of many to occur throughout the years. They happen to be the biggest, but many others have destroyed thriving careers and prominent institutions along the way. My Top 5 list of biggest insider trading scandals of all time is just a snippet of notable Wall Street greed-mongers. They certainly won’t be the last.

5. Martha Stewart and ImClone

$230,000. That’s the value of ImClone Systems Incorporated shares that Martha Stewart sold to land her in hot water with the Federal authorities. America’s homemaking sweetheart risked her vast empire—worth over $2.o billion at its height—for a mere pittance, and it came back to damage her badly.

When ImClone CEO Samuel D. Waksal learned through the grapevine that the U.S. Food and Drug Association (FDA) approval for cancer drug “Erbitux” wasn’t getting expected approval, he sang. Waksal’s daughter, father, company executives, and others all rushed to sell shares before the news became public. News of the impending calamity also reached the desk of Merrill Lynch broker Peter Bacanovic, who just happened to be Martha Stewart’s broker. Stewart was tipped off, and instructed Bacanovic to divest of her few-thousand-share position the day before the FDA ruling.

Bad move.

One of the examples of an insider trading case bringing down an empire, the news set off a cascade of losses and sales declines at Stewart’s parent company, Martha Stewart Living. Advertisers wanted no part of the brand and fled. So did her vast consumer base of stay-at-home moms and upper class suburbanites. Stewart’s subsequent public denials and unhinged moments captured in the media didn’t help either. Neither did the societal shift to online shopping, on which the company was well behind the curve.

Stewart was sentenced on July 16, 2004 to five months in prison, her brand now in tatters. She eventually pieced off her Martha Stewart Living empire to Sequential Brands Group Inc (NASDAQ:SQBG) for $353.0 million in cash, about a fifth of its peak worth.

4. Joseph Nacchio and Qwest Communications

On March 15, 2005, the SEC charged Joseph Nacchio, former CEO of Qwest Communications and eight other officers with fraud and other violations of federal securities law. They were accused of a $3.0-billion financial fraud between 1999 and 2002 by giving exaggerated earnings guidance and selling into the Wall Street herd that was lapping it up. Estimates were that Nacchio pocketed at least $52.0 million in illegal gains.

Nacchio tried to plead his innocence by suggesting that the charges were in retaliation for refusing to cooperate in a surveillance program requested by the National Security Agency (NSA). But the court was having none of it. Nacchio’s defense was rejected and, not only was he forced to forfeit his profits, he was slapped with a $19.0 million fine and six years jail time to boot. He was released in 2013 after four years served.

3. Raj Rajaratnam and Galleon Group

Like SAC, Galleon Group was one of the world’s largest hedge funds, with over $7.0 billion in assets under direction. That was until founder and CEO was Raj Rajaratnam was arrested on several counts of insider trading charges. In October 2009, Rajaratnam and five others were arrested and charged and, in December of that year, he was indicted. In May 2011, Rajaratnam was found guilty on 14 charges and sentenced to 11 years in prison, the longest prison sentence ever handed out in an insider trading case.

The U.S. Attorney’s Office estimated the total illicit proceeds to be over $60.0 million.

2. Ivan Boesky and Ivan F. Boesky & Company

It was a colossal fall from grace for former TIME magazine cover man Ivan Boesky. Once one of the most respected Wall Street arbitrageurs around, Boesky amassed over $200.0 million speculating on corporate takeovers. That changed quickly when it was learned that his success was based on purchasing insider information. The SEC eventually charged and convicted Boesky, who received a 42-month prison sentence, $100.0 million fine, and permanent disbarment from the securities industry. At the time, it was the biggest insider trading scandal ever.

Considering that Boesky is credited as the source of the now-infamous “greed is healthy” quote, it is a twist of irony that excessive greed ultimately led to his downfall.

1. Mathew Martoma and S.A.C Capital Advisors

We finish off with an addendum to our earlier-profiled insider trading scandal, the one involving SAC portfolio manager, Mathew Martoma. The particular incident that sealed his fate involved two pharmaceutical companies, Wyeth Limited and Elan Corporation (ADR). Martoma was convicted of providing Steven Cohen with non-public information about both companies that would net SAC $276.0 million, making them possibly the largest insider trades of all time.

Martoma gained $9.38 million by Cohen, but it was all forfeited upon conviction, and a harsh nine-year prison sentence was handed down. Prosecutors failed to prove that Cohen knew Martoma’s information was non-public, hence evading charges.