The New Debt Bubble No One’s Talking About

There’s a new debt bubble in the making, but few people are talking about it. Of course, I’m talking about the unprecedented auto loans bubble.

The Federal Reserve Bank of New York reported that, in the fourth quarter of 2016, $142.0 billion worth of new auto loans were originated. This was the highest auto loan origination quarter on record. (Source: “Quarterly Report On Household Debt And Credit February 2017,” Federal Reserve Bank of New York, last accessed March 28, 2017.)

Auto loans have ballooned over time, especially after the financial crisis of 2008–2009.

Between the third quarter of 2010 and now, auto loans have seen exponential growth, from $708.0 billion to $1.1 trillion at the end of 2016. This represents an increase of 55%.

Dear reader, rising auto loans in themselves are not the problem but, as always, the devil is in the details. I see three big problems with this current increase in auto loans.

1. Auto Loans Are Being Issued to Borrowers with Low Credit Ratings

In the fourth quarter of 2016, of the $142.0 billion in auto loans issued, $45.0 billion (32%) were originated to those with low credit scores. The number of auto loans to people with poor credit (a credit score of 620 or less) is increasing substantially. In the third quarter of 2010, loans given to those with poor credit amounted to $15.4 billion. By the fourth quarter of 2016, the number was $27.2 billion, an increase of 77%.

2. The Delinquency Rate on Auto Loans Is Increasing

In the first quarter of 2016, $16.81 billion worth of auto loans were delinquent. By the end of the fourth quarter of 2016, this figure reached $23.27 billion. Delinquent loans increased by 38% in less than a year! That $23.27 billion in delinquent loans is the highest such figure since the financial crisis.

3. Interest Rates Are Heading Higher

The U.S. Federal Reserve has made it very clear that it wants to raise its interest rates two more times this year. Of course, this will mean interest rates for auto loans will also rise.

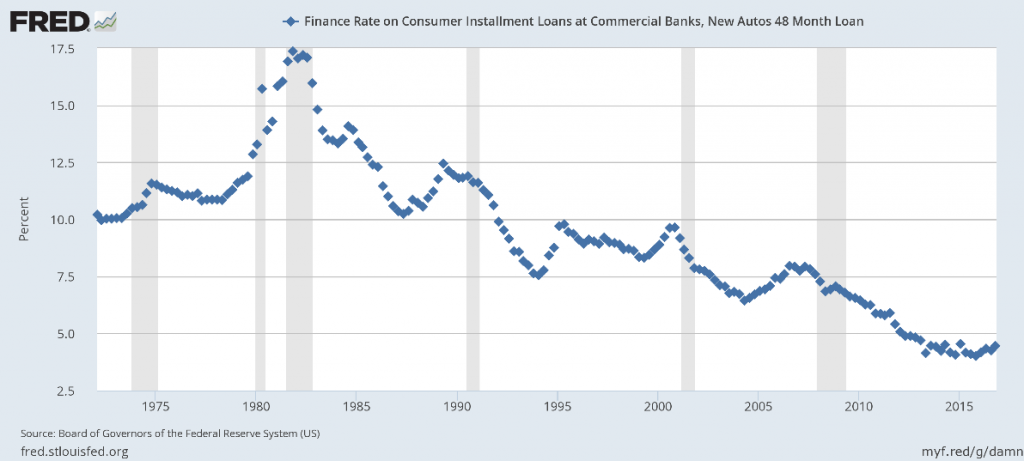

The chart below clearly shows how interest rates on auto loans have collapsed since the early 1980s.

You can see on the above chart that auto loan interest rates started to rise in late 2015. As interest rates continue to move higher, so will the auto loan payments. Will consumers be able to afford higher auto loan payments? My guess is that rising interest rates will accelerate the already-dangerous increase of auto loan delinquencies.

Auto Loans Bubble Bursting: The Aftermath

The risks related to the auto loans bubble shouldn’t be overlooked. When this bubble bursts, it’s going to end very badly, and there will be victims. First in line to catch fire will be the companies that created the auto loans bubble in the first place: the automakers, the banks, and the auto loan companies. Of course, the U.S. economy will take a severe hit because the auto loans bubble popping will impact the U.S. growth rate.

When looking at the stock price charts of major automakers like Ford Motor Company (NYSE:F) and General Motors Company (NYSE:GM), you will see that the stocks of these companies started topping out at the beginning of 2017. As the stock market is a six-month to 12-month leading indicator, the topping-out of the stocks of major automakers may foretell an auto loans bubble that’s close to bursting.