Bank of Japan Raises Rates: Odds of Financial Crisis Increasing?

On July 31, the Bank of Japan raised its key interest rate from 0.10% to 0.25%, a relatively obscure move in a grand scheme of things. A few days later, the financial world was in full panic mode. The Japanese yen skyrocketed, the stock market plummeted, and there were calls from famous economists here in the U.S. for the Federal Reserve to make an emergency interest rate cut.

Just to give you an overview: as this was happening, major key stock indices started to tumble. Between August 1 and August 5 (in three trading days), the S&P 500 tumbled about 6.4% and the NASDAQ Composite Index dropped 8.2%. The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), often referred to as the “fear index,” soared to 65.73 on August 5, its highest level since March 2020.

Since then, there has been some recovery in the financial world. Key stock indices have wiped out all the losses. The fear index has dropped below 20, and it seems like nerves are calmer than they were at the start of August.

More Trouble Around the Corner

Now the big question: are we out of trouble?

In simple terms: no. In fact, more trouble could be around the corner.

For simplicity’s sake, let’s forget everything and just focus on the currency aspect of things. The interest rate hike by the Bank of Japan caused an instant spike in the Japanese yen compare to other major currencies.

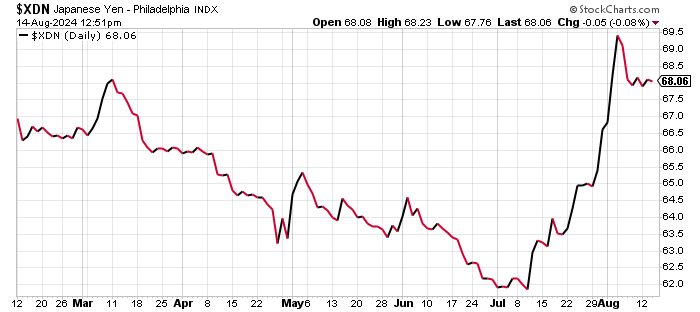

Take a look at the chart below of the yen index. It shows the performance of the Japanese yen compared to other major currencies.

Notice the spike?

From early July lows to August 5th highs, the yen spiked over 12%. Between July 30 and August 5, the Yen Index jumped 8.8%. And it remains close to those highs.

Chart courtesy of StockCharts.com

Don’t Ignore the Derivatives

Extrapolating a little here…

Big banks usually deal with and hold a large amount of currency-related derivatives. One has to wonder what will happen to those derivatives with the currency world just becoming volatile due to what the Bank of Japan did. It’s also worth noting that this move was relatively “out of nowhere;” not many had anticipated this sort of reaction.

For some perspective, at the end of the first quarter of 2024, the top 25 banks in the U.S. had currency derivatives with a notional value of $49.8 trillion. (Source: “Quarterly Report on Bank Trading and Derivatives Activities: First Quarter 2024,” Office of the Comptroller of the Currency, last accessed August 14, 2024.)

What happens if a small portion of these derivatives goes bad?

Banks are usually hedged, but for an unexpected move, it is possible for some bank or even a big enough fund to get caught off guard. This could really go from bad to worse in no time.

What Should an Investor Do?

Did the Bank of Japan force the odds of a financial crisis much higher?

Here’s something to consider: we are getting into a phase of the global economic cycle where major central banks are starting to cut interest rates. The Bank of Canada, Bank of England, European Central Bank, and others have made cuts several times, and the Federal Reserve is set to cut in September. This could only increase the volatility in the currency markets and put more derivatives on the line.

If there’s some sort of financial event, it won’t be a pretty sight. I will go as far as saying that what we saw early in August could just be a trailer for what’s to come, so it’s important to be cautious.

Lastly, know that great opportunities could show up due to this situation. I have learned that the greatest time to invest is when there’s extreme uncertainty. We are not there yet, but if we do, it would be time to buy rather than panic.