Gold Mining Stock List 2017

Gold mining stocks were on fire in 2016. Investors turned their attention back to gold as a safe-haven investment, as stocks tanked in the beginning of the year and climbed steadily higher on fears of a global recession and concerns that the U.S. Federal Reserve raised its key lending rate prematurely. Gold was also bullish on the Brexit vote, collapsing oil prices, and simmering geopolitical tensions.

2017 is shaping up to be the year that the gold bull market breaks out and provides the best gold mining stocks with massive gains. Below is a list of some of the best gold mining stocks on the New York Stock Exchange (NYSE), Toronto Stock Exchange (TSX or TSE), TSX Venture Exchange (TSXV), National Association of Securities Dealers Automated Quotations (NASDAQ), and the Johannesburg Stock Exchange (JSE).

| Company | Ticker |

| Aben Resources Ltd | CVE:ABN |

| Agnico Eagle Mines Ltd | NYSE:AEM |

| Agnico Eagle Mines Ltd | TSE:AEM |

| Alacer Gold Corp | TSE:ASR |

| Alamos Gold Inc | TSE:AGI |

| Alamos Gold Inc | NYSE:AGI |

| AngloGold Ashanti Limited | JSE:ANG |

| AngloGold Ashanti Limited | NYSE:AU |

| Antioquia Gold Inc | CVE:AGD |

| Argonaut Gold Inc | TSE:AR |

| Arizona Mining Inc | TSE:AZ |

| Asanko Gold Inc | TSE:AKG |

| Ascot Resources Ltd. | CVE:AOT |

| Aurania Resources Ltd | CVE:ARU |

| Aurizon Mines Ltd | NYSEMKT:AZK |

| Avino Silver and Gold Mines Ltd | CVE:ASM |

| B2Gold Corp. | TSE:BTO |

| B2Gold Corp | NYSEMKT:BTG |

| Balmoral Resources Ltd | TSE:BAR |

| Barkerville Gold Mines Ltd | CVE:BGM |

| Barrick Gold Corp | TSE:ABX |

| Barrick Gold Corp | NYSE:ABX |

| Bearing Resources Ltd | CVE:BRZ |

| Caledonia Mining Corporation PLC | TSE:CAL |

| Canuc Resources Corp | CVE:CDA |

| Centamin PLC | TSE:CEE |

| Centerra Gold Inc. | TSE:CG |

| China Gold International Resrcs Corp Ltd | TSE:CGG |

| Coeur Mining Inc | NYSE:CDE |

| Compania de Minas Buenaventura SAA (ADR) | NYSE:BVN |

| Comstock Metals Ltd | CVE:CSL |

| Continental Gold Inc | TSE:CNL |

| Coral Gold Resources Ltd. | CVE:CLH |

| Corvus Gold Inc | TSE:KOR |

| Dalradian Resources Inc | TSE:DNA |

| Detour Gold Corporation | TSE:DGC |

| DRDGOLD Ltd. | JSE:DRD |

| Dynacor Gold Mines Inc. | TSE:DNG |

| Eco Oro Minerals Corp | TSE:EOM |

| Eldorado Gold Corp | TSE:ELD |

| Eldorado Gold Corp | NYSE:EGO |

| Endeavour Mining Corp | TSE:EDV |

| Erdene Resource Development Corp. | TSE:ERD |

| Exeter Resource Corp | TSE:XRC |

| First Majestic Silver Corp | NYSE:AG |

| Franco Nevada Corp | TSE:FNV |

| Freeport-McMoRan Inc | NYSE:FCX |

| Gold Fields Limited (ADR) | NYSE:GFI |

| Gold Fields Limited | JSE:GFI |

| Gold Resource Corporation | NYSEMKT:GORO |

| Goldcorp Inc. | TSE:G |

| Goldcorp Inc. | NYSE:GG |

| Goldfield Corp | NYSEMKT:GV |

| Golden Star Resources Ltd. | NYSEMKT:GSS |

| Goldquest Mining Corp | CVE:GQC |

| Gran Colombia Gold Corp | TSE:GCM |

| Guyana Goldfields Inc. | TSE:GUY |

| Highway 50 Gold Corp | CVE:HWY |

| Harmony Gold Mining Co. (ADR) | NYSE:HMY |

| Harmony Gold Mining Company Ltd | JSE:HAR |

| Hecla Mining Company | NYSE:HL |

| IAMGOLD Corp | TSE:IMG |

| IAMGOLD Corp | NYSE:IAG |

| International Tower Hill Mines Ltd | TSE:ITH |

| Jaguar Mining Inc | TSE:JAG |

| Kerr Mines Inc | TSE:KER |

| Kinross Gold Corporation | TSE:K |

| Kinross Gold Corporation | NYSE:KGC |

| Kirkland Lake Gold Ltd | TSE:KL |

| Leagold Mining Corp | CVE:LMC |

| Lion One Metals Ltd | CVE:LIO |

| Marathon Gold Corp | TSE:MOZ |

| Mawson Resources Ltd | TSE:MAW |

| McEwen Mining Inc | TSE:MUX |

| McEwen Mining Inc | NYSE:MUX |

| Midas Gold Corp | TSE:MAX |

| Millrock Resources Inc. | CVE:MRO |

| Moneta Porcupine Mines Inc. | TSE:ME |

| Monarques Gold Corp | CVE:MQR |

| NGEx Resources Inc | TSE:NGQ |

| Nevada Exploration Inc. | CVE:NGE |

| Nevsun Resources | TSE:NSU |

| New Gold Inc. | TSE:NGD |

| New Gold Inc. | NYSEMKT:NGD |

| Newcrest Mining Limited (ADR) | OTCMKTS:NCMGY |

| Newmont Mining Corp | NYSE:NEM |

| Nippon Dragon Resources Inc | CVE:NIP |

| Northern Vertex Mining Corp | CVE:NEE |

| NovaGold Resources Inc. | TSE:NG |

| NovaGold Resources Inc. | NYSEMKT:NG |

| OceanaGold Corporation | TSE:OGC |

| Orvana Minerals Corporation | TSE:ORV |

| Osisko gold royalties Ltd | TSE:OR |

| Osprey Gold Development Ltd | CVE:OS |

| Pan American Silver Corp. | NASDAQ:PAAS |

| Paramount Gold Nevada Corp | NYSEMKT:PZG |

| Precipitate Gold Corp | CVE:PRG |

| Premier Gold Mines Ltd. | TSE:PG |

| Pretium Resources Inc | TSE:PVG |

| Primero Mining Corp | TSE:P |

| Primero Mining Corp | NYSE:PPP |

| Probe Metals Inc | CVE:PRB |

| Randgold Resources Ltd. | NASDAQ:GOLD |

| Richmont Mines Inc. | TSE:RIC |

| Riverside Resources Inc. | CVE:RRI |

| Royal Gold, Inc | NASDAQ:RGLD |

| Rubicon Minerals Corp. | TSE:RMX |

| Rupert Resources Ltd | CVE:RUP |

| Sabina Gold & Silver Corp | TSE:SBB |

| Sandstorm Gold Ltd | TSE:SSL |

| Sandstorm Gold Ltd | NYSEMKT:SAND |

| Seabridge Gold Inc | TSE:SEA |

| Seabridge Gold, Inc. | NYSE:SA |

| Semafo Inc. | TSE:SMF |

| Sibanye Gold Ltd (ADR) | NYSE:SBGL |

| Sibanye Gold Ltd | JSE:SGL |

| Silver Standard Resources Inc. | NASDAQ:SSRI |

| Silver Wheaton Corp. | NYSE:SLW |

| Silvercorp Metals Inc | TSE:SVM |

| SilverCrest Metals Inc | CVE:SIL |

| Starcore International Mines Ltd. | TSE:SAM |

| Stillwater Mining Company | TSE:SWC.U |

| Tahoe Resources Inc | TSE:THO |

| Tanzanian Royalty Exploration Corp | TSE:TNX |

| Torex Gold Resources Inc | TSE:TXG |

| Trimetals Mining Inc Class B | TSE:TMI.B |

| Turquoise Hill Resources Ltd | NYSE:TRQ |

| Wesdome Gold Mines Ltd | TSE:WDO |

| Yamana Gold Inc. | TSE:YRI |

| Yamana Gold Inc. | NYSE:AUY |

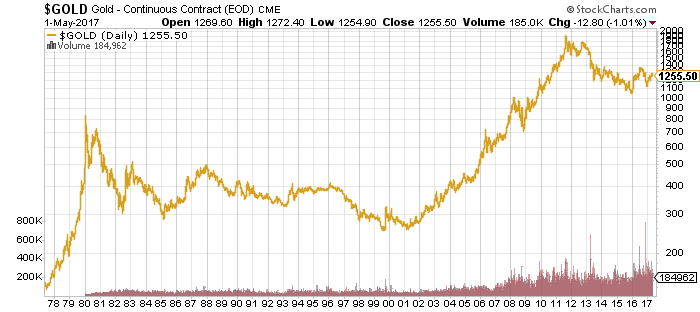

Gold as a Safe-Haven Investment 2000-2011

Gold prices soared from around $260.00 an ounce in late 2000 to $1,923 an ounce in 2011. While gold prices have retreated a little, gold continues to be in the spotlight as a safe-haven investment.

There are many factors that contribute to a gold bull market, including fears of inflation, an overvalued stock market, a devalued dollar, weak economic data, and geopolitical tensions, to name just a few.

Investors turn to physical gold and the best gold mining stocks because gold, as a currency, has a proven history as a safe-haven asset and store of value. Gold prices were strong in 1980 as the U.S. dealt with high inflation, strong oil prices, the Soviet intervention in Afghanistan, and the lingering effects of the Iranian Revolution.

After climbing above $800.00 an ounce in 1979, gold prices retreated and settled in a range of between $300.00 and $400.00 an ounce for much of the 1990s. Gold came back into fashion as investors sought safety in the aftermath of the September 11, 2001 attacks and the Great Recession, and—in particular—the Lehman Brothers Holdings Inc. bankruptcy in September 2008.

Chart courtesy of StockCharts.com

In April 2006, gold prices broke through the $600.00-per-ounce level (the first time since December 1980), as investors and funds looked for safety amidst a weak dollar, strong oil prices, and ongoing geopolitical tensions. By May 2006, gold prices hit $730.00 an ounce, the highest level since January 1980.

Like all good rallies, gold prices tumbled, by more than 25% in June to under $445.00 an ounce as investors took some well-deserved profits. But the retreat was short-lived; by November, the spot price of gold hit a 28-year high of $845.40 an ounce and—on January 8, 2008—gold broke above $850.00 an ounce for the first time since 1980. Less than one week later, gold broke through the $900.00-an-ounce barrier.

For the next three years, gold remained bullish, peaking at $1,923 per ounce in September 2011. Between November 2000 and September 2011, gold prices increased 625%, from around $265.00 per ounce to $1,923 per ounce.

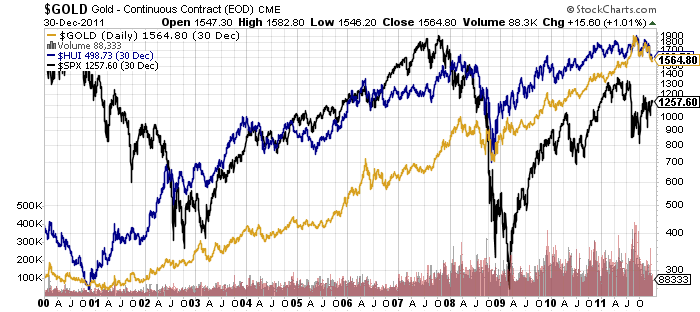

Those who invested in gold mining stocks did even better. During the same period, the NYSE Arca Gold Bugs Index (NYSEARCA:HUI, INDEXNYSEGIS:HUI) advanced approximately 1665%. The S&P 500, on the other hand, fell by around 10%.

Chart courtesy of StockCharts.com

The 10+ year gold bull market came to an end in September 2011 and, over the next four years, gold prices slid lower as stocks marched to record levels and economic indicators pointed, prematurely, to a strengthening U.S. economy.

As a hedge against uncertainty, there seemed to be little reason for investors to pour back into gold. After all, non-yield-bearing assets like gold aren’t quite so attractive when stocks are soaring and the U.S. dollar is strong.

Despite this, physical gold prices found strong support near $1,100 in 2015. Even though the gold bull market ended in 2011, investors still weren’t about to let gold prices slide too low.

Gold as a Safe-Haven Investment 2017-????

Gold was back in the spotlight as a safe-haven investment in 2017. The big question is, how high will gold prices climb? There is a lot of uncertainty with the U.S. economy and U.S. politics, as well as economic weakness in Asia and parts of the European Union (EU). There is increased tension in the Middle East and North Korea. Meanwhile, relations between the U.S. and Russia have never been weaker.

Investor optimism is high, along with stock prices, but economic indicators and quarterly and annual gross domestic product (GDP) numbers suggest that the U.S. economy is stalling. All of this is positive for gold as a safe-haven investment.

This doesn’t mean that gold won’t experience a correction. Gold is like any equity; it goes in cycles: boom, bust, repeat. It’s just up to gold bugs to decide if they want to take profits or hold on for additional gains. With the gold bull market in its infancy, it’s not a stretch to suggest that gold prices, in the coming years, will cross over the $2,000 mark, with $2,300 in the crosshairs.

Three Best Ways to Invest in Gold

Whether for economic, geopolitical, or other reasons, demand for gold remains strong. No matter your investment approach, there are a lot of different ways to invest in gold.

1. Physical Gold

When it comes to owning and investing in gold, nothing is as visceral as physical gold. When it comes to physical gold, we have been trying to get our hands on as much of it as possible, for thousands of years. In fact, we have been mining gold for over 6,000 years. All the gold that has been mined is still in existence today.

The first gold coins were minted around 550 BC under King Croesus of Lydia, now a province in Turkey. It didn’t take long for gold to be accepted as a reliable currency around the Mediterranean.

Fast forward more than 2,500 years, and gold continues to be the most sought-after precious metal. But, like all commodities, there is an infinite amount of gold. Warren Buffett has said that the total amount of gold that has, so far, been mined, could fit in a cube with sides of just 20 meters, or 67 feet, and would easily fit in the middle of a baseball infield. (Source: “BUFFETT: Guess How Big A Cube All The Gold In The World Would Make—And How Much It Is Worth,” Business Insider, February 13, 2012.)

Is Buffett right? According to the World Gold Council, around 183,600 tonnes of gold has been mined since the dawn of time, 66% of which has been mined since 1950. If you put every single ounce next to each other, the cube of pure gold would be just 70 feet per side. It’s been a few years since Buffett made that claim but, yes, he is still correct. (Source: “How much gold has been mined?” World Gold Council, last accessed May 1, 2017.)

According to the U.S. Geopolitical Survey, there are 57,000 tonnes of gold in the ground that could be mined. Thanks to modern technology, more will be discovered and that number will rise. (Source: “Gold statistics and information,” U.S. Geological Survey, last accessed May 1, 2017.)

There is a limit to how much gold you can get your hands on. But, with the value in the trillions of dollars, there is enough to meet your needs if you want to invest in physical gold.

Keep in mind, when you buy bullion, it is going to cost a little more than what is quoted online. This is because there is a premium over the spot price of gold. The two best ways to buy physical gold are gold coins and bars. Coins are the easiest and most popular ways to buy physical gold. Some of the best gold coins can be purchased from the U.S. Mint, the Canadian Mint, and the Perth Mint.

Gold bars can be purchased in weights of less than an ounce, all the way up to 5-kilo and 400-ounce bars.

2. Gold Exchange-Traded Funds

Exchange-traded funds (ETFs) trade on the stock market like a gold mining stock does, but an ETF is made up of a number of gold mining stocks. It is the best way to get access to a large number of gold mining stocks all at once, and it allows you to hold gold mining stocks that you might not otherwise be able to afford.

There are gold ETFs that track physical gold, gold mining companies, large-cap gold mining stocks, mid-cap gold mining stocks, etc.

3. Gold Mining Stocks

When it comes to leveraging the rising value of gold in 2017, gold mining stocks are the best way to profit. While you don’t own physical gold when you buy the best gold mining stocks or a gold mining stock index, investors are able to realize gains that significantly outpace the price of physical gold.

In 2016, physical gold prices increased 8.4%, but the Market Vectors Gold Miners ETF (NYSE:GDX)—also known as VanEck Vectors Gold Miners ETF—ended 2016 up 48.5%. Why is that? If it costs a gold mining company $700.00 to mine an ounce of gold that is trading hands at $1,000 an ounce, the mining company realizes a $300.00 profit.

But, if gold rises to $1,300 an ounce, the gold mining company makes a $600.00 profit on each ounce of gold. That represents a 100% increase in profits off a 30% increase in gold prices.

There are hundreds of gold mining stocks to invest in. Some are exploratory, some are in the development stage, and others are producing. Location is important; there are gold mining stocks that operate in market-friendly countries like Canada, Australia, South Africa, and the United States. Then there are gold mining stocks that operate in countries that are less favorable to gold mining companies.

When considering the top gold mining stocks to invest in, it’s important to look for companies with huge cash flows. It costs a lot of money to mine for gold, so avoid gold mining companies with lots of debt. Not only does this mean they have less financial flexibility, rising interest rates also mean that the debt is going to get costlier to carry.

Five of the largest gold mining stocks in the world are Barrick Gold Corp (NYSE:ABX, TSE:ABX), Newmont Mining Corp (NYSE:NEM), AngloGold Ashanti Limited (NYSE:AU, JSE:ANG), Goldcorp Inc. (NYSE:GG, TSE:G), and Kinross Gold Corporation (NYSE:KGC, TSE:K).

Pros & Cons of Investing in Gold & Gold Mining Stocks

Before you go looking for the top gold mining stocks to invest in, it’s important to be aware of the pros and cons of investing in gold mining stocks.

Gold bugs know the pros of investing in gold and gold mining stocks. It’s an excellent way to hedge uncertainty. In the midst of chaos, gold holds its value or goes up. This is a lot more reassuring than holding paper money, the value of which can go down.

In times of uncertainty and the unknown, gold shines. If you’re a good bug though, gold and the top gold mining stocks are still attractive, because they are trading at a discount. And, because gold is a “fear” investment, investors know that reasons to be bullish on gold are never far away.

People often say that one of the downsides to owning physical gold is that it’s difficult to store, but the fact of the matter is that few people own so many bars of gold that they need a forklift to move them. Most gold investors might have a shoebox or two full of one-ounce gold bars, which—while heavy—is still easy to move. It’s also easy to sell. There are more people willing to purchase single-ounce bars of gold than, say, a 400-ounce bar of gold.

One of the difficult things about owning physical gold is that it takes a little effort to offload. Unlike the top gold mining stocks, which can be bought and sold very easily, physical gold takes more effort to sell. But, frankly, not much more effort. There are banks and brokers that are happy to take that gold off your hands. Whether you’re happy with the price is a different matter.

When it comes to investing in general, it’s important to have a diversified portfolio. This includes making space for gold. If you’re a conservative investor, you might want to have 10% of your portfolio in gold, whether that’s physical gold, gold mining stocks, gold ETFs, gold mutual funds, or gold options and futures. If you’re a more aggressive investor, gold might make up 20% to 30% of your portfolio.

There continue to be a lot of reasons why investors should be bullish on gold mining stocks in 2017. Most importantly, a new bull market in gold is just getting started, so those who find the best gold mining stocks to invest in will likely be rewarded with excellent profit opportunities.