Dow Jones Industrial Average’s Long-Term Trend Worth Watching

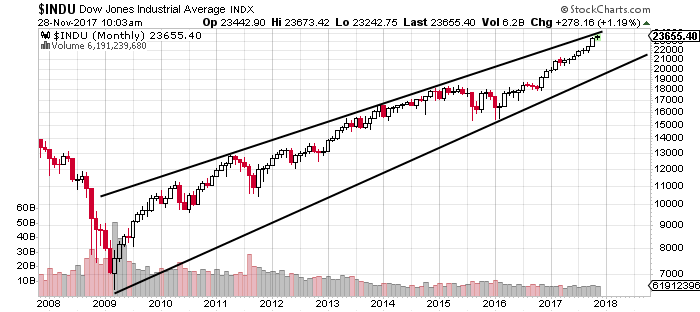

You may have heard the idiom that states, “A picture is worth a thousand words.” With this in mind, look at the below Dow Jones Industrial Average chart. Technical analysis suggests that the index could be setting up to drop 3,000 points.

Before going into any details, know the most basic rule of technical analysis: the trend is your friend until it’s broken. And, an uptrend is when a price makes consecutive higher highs and higher lows.

Chart courtesy of StockCharts.com

You see, the Dow Jones Industrial Average has been trending higher since 2009. It’s not that difficult to see on the chart above. But, again, you have to remember: for an uptrend, there are higher highs and higher lows.

Over the past few months, the Dow Jones Industrial Average has continued to make new highs. Over the past seven months, the index has closed higher than it opened.

We have to ask: what’s next?

In the chart above, there are two lines drawn. The one line at the bottom shows the uptrend, and the line at the top shows the progression of the trend. It shows the upper resistance level. Each time the Dow Jones Industrial Average hit that line, it found a resistance.

Currently, the index stands awfully close to that line.

If we follow the trend, one would say that the Dow would have to fall back to the long-term trend line—i.e. make a higher low.

For the Dow Jones Industrial Average to fall back to the long-term trend and make a higher low, it would have to drop about 3,000 points from where it current stands—that’s roughly 11% from where it currently sits.

What Happens if the Dow Actually Drops 3,000 Points?

Dear reader, let me ask one question: If all of a sudden, the Dow Jones Industrial Average drops 3,000 points in a matter of a few weeks, how do you think investors will handle it?

To me, if the Dow does drop 3,000 points, it wouldn’t be shocking to see investors panic.

Understand this: the last time there was a sell-off, it was back in early 2016. Investors have really gotten used to markets going higher. The complacency is impressive, to say the least. If they find markets dropping, they could be looking to exit.

With this in mind, I also wonder if the long-term uptrend will be questioned if the Dow drops 3,000 points. In times of panic, investors tend to forget everything and run for the exits. The sell-off could continue. Don’t forget; if the trend breaks, a major move to the downside could follow.

Obviously, with time we will know more.

Mind you, this is not a recommendation to sell, or a prediction that a top is in place. Tops and bottoms are impossible to pinpoint, and are only known once they have been formed.