Sellers Taking Over, Stock Market Could Go a Lot Lower

Over the past few weeks, the stock market has faced severe selling. Major indices like the S&P 500 are edging close to becoming a bear market, down by about 20% from their recent highs.

With all this, investors could be wondering what’s next.

Warning: if you think what we have seen over the past few weeks is bad, it could just be the trailer of what’s ahead. A stock market crash is a real possibility.

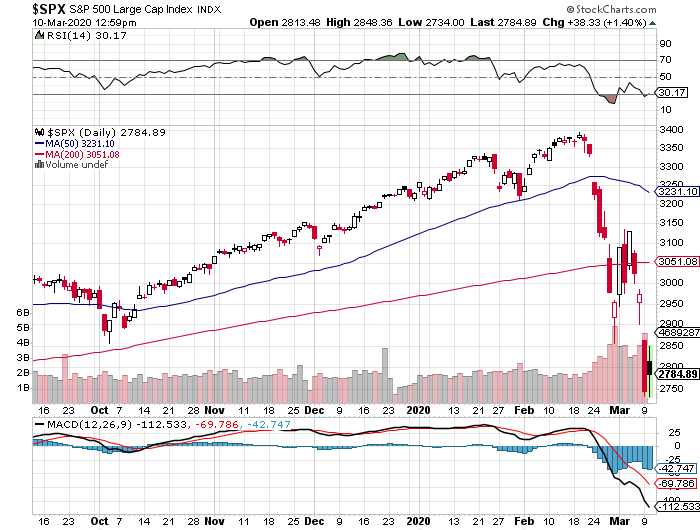

Look at the chart below. It plots the daily chart of the S&P 500.

Right off the bat, notice the 50-day moving average (blue line) and the 200-day moving average (red line) of the S&P 500. The index has dropped below those moving averages. It says the short-term and long-term trends are pointing lower.

Mind you, this is the first time since late 2018 that the S&P 500 has traded below its 200-day moving average for this long.

Chart courtesy of StockCharts.com

But this isn’t the only important thing on this chart.

Also look at the moving average convergence/divergence (MACD), a momentum indicator plotted at the bottom of the chart. Currently, the MACD is trending lower, and it sits in negative territory. It tells us that sellers are dominating the stock market. They are selling, which could take the S&P 500 much lower.

Lastly on the above chart, look at the volume. It’s plotted right behind the S&P 500 price. Since mid-February, we have seen a massive spike in volume traded as the stock market has gone down. More participation at a time when stock markets are declining is a sign that there could be panic selling.

Putting all this in simple words, the S&P daily chart says the selling on the stock market isn’t done yet.

Long-Term Charts Make Even More Bearish Case

Look beyond the daily S&P 500 chart.

You see, when it comes to technical analysis, there’s one rule that shouldn’t be ignored: if there’s a sell-off, prices tend to drop to a major support level.

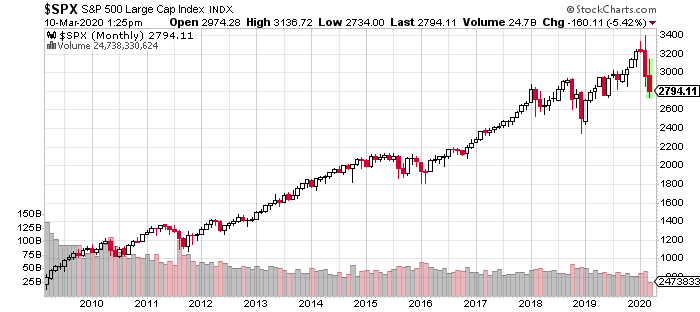

With this in mind, look at the long-term chart of the S&P 500 below.

Chart courtesy of StockCharts.com

Assuming the stock market continues to fall and sellers dominate, know that the next biggest support level on the S&P 500 isn’t until 2,400. That’s roughly 14% below where it currently trades, and it would be roughly 29% below the highs made in early February.

Worse, if the S&P 500 doesn’t find any support around 2,400, the next big support level isn’t until 2,175. That’s about 22% below where the S&P 500 currently trades and about 36% below the all-time highs.

Dear reader, the sell-off we are seeing now is nothing unexpected. I have been talking about how the stock market is severely expensive relative to historical averages and how the economic conditions are deteriorating very quickly.

The outbreak of the coronavirus in recent weeks became a trigger that initiated selling from investors who had been waiting to take profits.

I believe that the selling may not be over yet. Sure, we could see indices fluctuate on a daily basis, but the trend seems to be downward. The worst will be over when you see headlines in the mainstream media along the lines of “stocks are bad for your portfolio.”