When the Fed Pauses Interest Rate Hikes, It’s Never Good News

We’ve been told there’s going to be a soft landing for the U.S. economy, and that the fears that investors might have about a stock market crash could be overblown. Certainly, there’s some data to back up the resilient economy, and stock indices soaring suggests there’s buying.

It’s important, however, to pay attention to what’s been happening with interest rates. It’s giving hints about what could be next. If history is any indicator, a stock market crash and economic crisis could be just around the corner.

So, what’s happening with interest rates?

Not too long ago, the Federal Reserve announced that it would be pausing its rate hikes. Mind you, the Fed was in the midst of hiking interest rates at a very fast speed to curb inflation in the U.S. economy.

Why does this matter?

In the past, whenever the Federal Reserve stopped raising interest rates, an economic slowdown and stock market crash followed very soon after. With this in mind, could we see something similar in the near future?

The Dotcom Bubble & Burst

In the late 1990s, investors had become irrational. They were investing in companies without a thought. All a company had to do was mention “Internet,” and its shares were bought by traders like hotcakes. This was eventually called the dotcom bubble. The economy was doing great, and inflation started to heat up.

This prompted the Federal Reserve to jump in. In 1999, the federal funds rate was about 4.6%, and by early 2000, it stood at about 6.5%. That was an increase of 41%.

At that point, the Fed paused its interest rate increases. Soon after that pause, the dotcom bubble burst and many of the high-flying Internet stocks that investors were chasing cratered, and a recession followed.

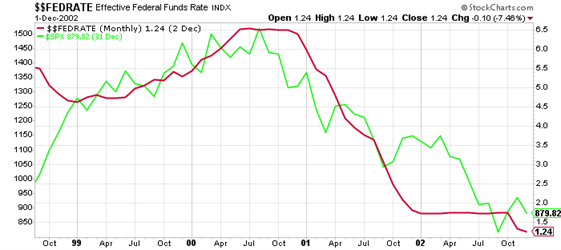

Look at the chart below. It plots the federal funds rate (in red) and the S&P 500 (in green) during that period.

Chart courtesy of StockCharts.com

What’s worth noting here is that, after the Federal Reserve paused its interest rate increases, it was eventually forced to lower its benchmark interest rates quickly. By 2002, the Fed’s benchmark rate was down to about 1.25%.

The Housing Market Mania & Financial Crisis

A few years after the dotcom crash, in 2004, the Federal Reserve started to raise interest rates once again. Its benchmark interest rate went from about one percent that year to about 5.25% in early 2006. That was an increase of 425%. The rate hikes happened over the course of nine quarters or so.

The Fed then paused its rate increases again. At that time, the housing market was booming, the U.S. economy was flourishing, and the stock market was making all-time highs.

Like clockwork, after several months of a pause in interest rate hikes, it became clear that the U.S. economy’s fundamentals were tormented. The economy went into a severe recession, there were a bunch of bank failures, and the stock market plummeted.

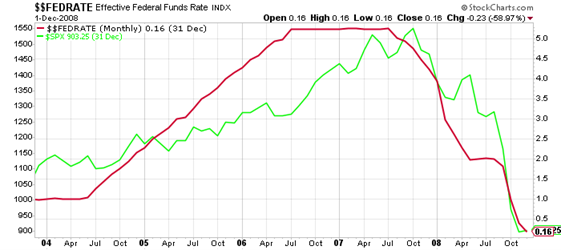

This time around, the crisis was so bad that the Federal Reserve was forced to cut its interest rates down to about zero percent.

Look at another chart below. It plots the federal funds rate (again in red) and the S&P 500 (again in green) during that period.

Chart courtesy of StockCharts.com

Fast-forward to now.

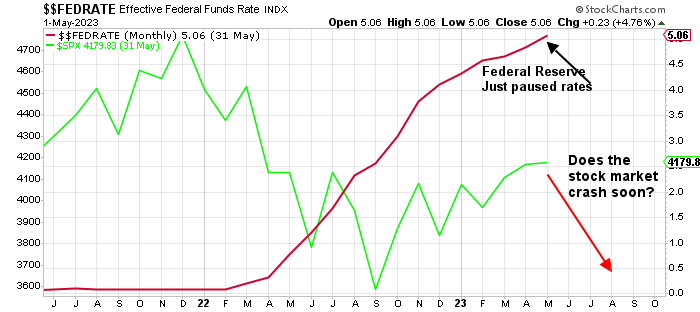

In 2023, the Fed has raised its benchmark interest rate from near-zero to five percent in just a few months. This represents an increase of 500%, and the speed at which the rate increased was extremely fast.

The Federal Reserve has stated it will pause its interest rate increases for now. However, in its projections, the Fed has said it will raise interest rates some more in 2023 and that it’s projecting rate cuts in 2024. Odd.

Chart courtesy of StockCharts.com

What’s Ahead for U.S. Economy & Stock Market?

Dear reader, we could be walking a very fine line here. Will robust interest rate increases and a pause end in a soft landing for the U.S. economy and the stock market?

I beg to differ from the mainstream view. I believe that what we saw in 2022 on the stock market could just be a trailer for what’s to come. Getting complacent could be a very bad idea for investors. It could be time to be very selective about investments and focus on capital preservation.

And I have to wonder whether interest rates will remain at their current level for long. Will the Federal Reserve be forced to bring them down again soon?