Investor Sentiment Could Be Foretelling a Stock Market Crash

Investors are extraordinarily bullish these days. Don’t take this lightly, whatsoever. It could lead to a stock market crash.

Why pay attention to investor sentiment? It’s an important indicator of how investors could react. From a historical perspective, whenever investors have become euphoric, even on the slightest headwind, panic selling has followed in the stock market.

In fact, investor sentiment has proven to be a great contrarian indicator of the stock market over the years. When investor sentiment suggests that investors are pessimistic, it’s usually time to get aggressive and buy. And when the indicators suggest that investors have become euphoric, it may be time to pause and reflect. In those times, being aggressive could lead to disappointment because a stock market crash could be brewing.

Now some perspective.

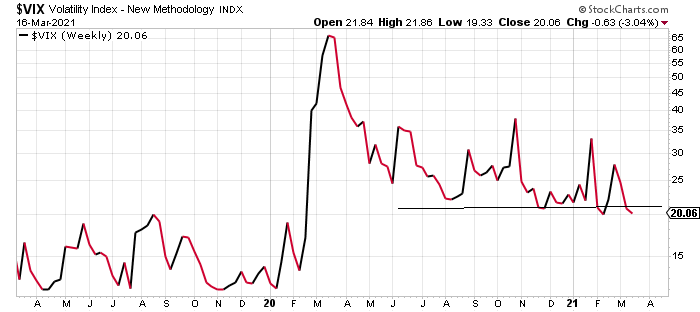

Look at the chart below. It plots the Chicago Board Options Exchange (CBOE) Volatility Index (VIX). It’s often referred to as the “fear index.” When the VIX moves higher, it’s a sign that stock investors are becoming scared. When the VIX drops, it’s a sign that investors are becoming bullish.

Chart courtesy of StockCharts.com

In early 2020, the VIX bounced higher. Throughout 2020, it dropped, indicating that investors were becoming somewhat calm. Now the fear index is breaking below a major level (20). This says investors are becoming really comfortable and that they may not be too fearful anymore. The lower the VIX goes, the higher the euphoria.

Bullish Stock Investors Increase in Numbers; Bears Dwindle

Look beyond the VIX, too.

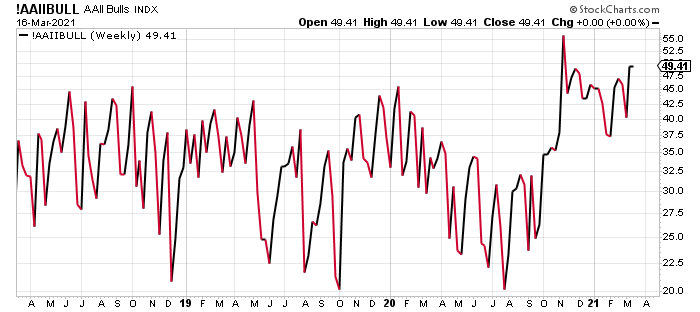

The chart below plots the percentage of bullish respondents in the American Association of Individual Investors (AAII) Investor Sentiment Survey.

Chart courtesy of StockCharts.com

As per the most recent data, nearly 50% of the respondents of the survey that tracks the sentiment of individual investors were bullish. The last time the respondents were this bullish was in November 2020, when nearly 55% of the participants said they thought the stock market would soar.

Looking at the general level, investors’ bullishness toward the stock market is at its highest levels in three years.

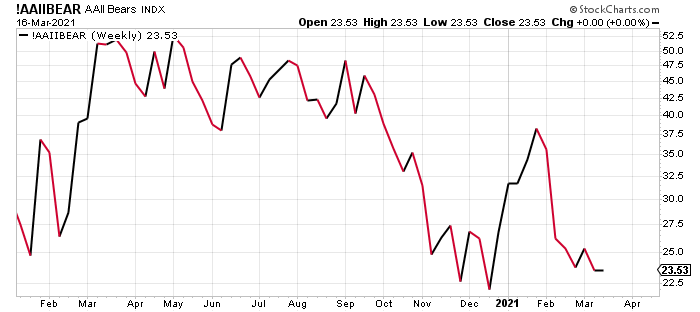

Here’s the kicker: look at the chart below. This one plots the percentage of bearish investors. The bearish investors have really dwindled over the past year or so, to about 23%. This is probably a more telling sign of euphoria among stock investors than anything else.

Chart courtesy of StockCharts.com

When Market Euphoria Prevails, Be Careful

Dear reader, I could go on and list more indicators that investor sentiment is becoming euphoric, but I want to stop here and repeat what I said earlier: don’t take this lightly.

I can’t help but quote what Sir John Templeton has said: “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Could there be a stock market crash ahead? It’s possible. If we see a minor hiccup in the stock market, and when euphoric investors realize they’re losing money, we could see a mass exodus. All of a sudden, there could be a broad market sell-off.

Not too long ago, we saw something like this happen with hot stocks—those that rose by several hundred percent over the past year and were investor darlings. Many of them crashed by 30% in a matter of a few days. We could see that happen again.