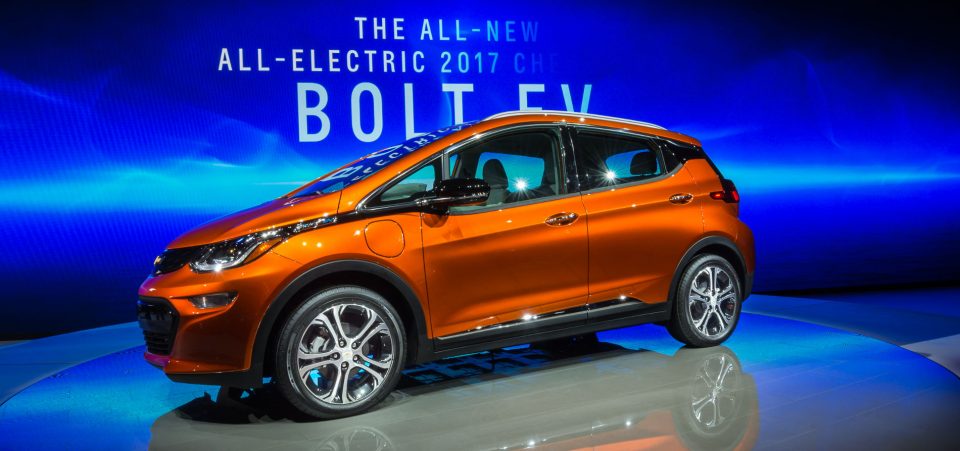

GM Stock Bullish as General Motors’ Chevrolet Bolt Beats Tesla to the Affordable EV Punch

General Motors Company (NYSE:GM) was trading at its highest point year-to-date. In fact, GM stock was trading at a year high of $37.35 on Tuesday. The enthusiasm comes from the fact GM delivered its first ever mass-produced electric vehicle (EV). In fact, given the numbers, consumers and investors might as well consider it the first-ever mass-produced electric car in the United States. Tesla stock is officially on notice.

Indeed, while Tesla Motors Inc (NASDAQ:TSLA) has been selling its “Model S” for about five years, its price and availability put it beyond the reach of the mass market. Tesla stock is also up, but its “electric car for the people” is not due until the end of 2017, at the earliest. So GM will get a welcome head start.

Indeed, three Californian customers have taken delivery of a new “Chevrolet Bolt EV.” One of the GM electric car’s new customers lives in Fremont, California. Why is that special or even relevant? It’s where Tesla has its headquarters.

Given the one-year advance on the Tesla “Model 3” release—likely delays not withstanding—the Chevrolet Bolt offers everything that the Model 3 has promised. Except, it offers it now. The Chevrolet Bolt has about 238 miles (380 km) of range and is equipped with state-of-the-art technology.

GM’s Chevrolet Bolt Performs Like a Model 3. Unlike the Tesla, You Can Buy it Now!

With optimistic targets of $35,000, the Tesla Model 3 comes in cheaper than the Bolt’s $37,495. In both cases, buyers can benefit from $7,500 in tax credits for so-called clean cars. But while Tesla is solving glitches with prototypes, GM expects to accelerate the pace of deliveries in 2017.

GM stock should continue to perform, as the company has come up with a convincing product. GM has shown it can adapt and transform to meet the ever more specialized needs of the modern automobile market.

As GM starts to sell more Chevrolet Bolt models, it will make electric cars more “democratic.” Tesla has dominated this niche for the past few years because few mainstream manufacturers had the cars to challenge it. Certainly, they could not beat it. So they joined the electric car revolution, in a sense, taking over the pioneer.

Tesla will have a year to get back in the game. Any delays with the Model 3, and it will hand over the affordable all-electric car market to GM. Unlike Tesla, GM has been making cars for over a century. Thus, it is far better equipped to handle the pesky production issues that so many upstarts—even with Tesla’s cult following—inevitably face.

Credits: Flickr.com/Movilidadelectrica.com

The Ford Motor Company (NYSE:F) is already working on an entry-level all-electric car, but Ford stock was down on Tuesday, outshined by GM’s electric car.

Ford’s electric car, the “Model E” is patented and merely the first of 13 new all-electric vehicles that the company plans to launch by 2020. If that’s not enough, Mercedes Benz, the VW Group, BMW, and Porsche will also have all-electric cars.

In other words, should Tesla fail to get the Model 3 out on time, it will face an avalanche of competition at the low and high ends of the market. If that’s not enough, Fisker Automotive, Inc. is preparing to launch a direct rival to the Model S. It’s called the “EMotion,” and it promises Model S looks, Mercedes luxury, and 400 miles of range. Tesla Motors Inc and its Tesla stock (TSLA) will face a barrage of competition from all angles.