Gold Prices Could Reach $1,500 Before the End of 2017

Gold price predictions for September are decidedly bullish. Many would have refused to believe that the gold price forecast for September could be so hot, given the Dow’s record bull run. Yet, risks abound and gold shot past $1,320 per ounce on August 30. That’s the highest level since Donald Trump’s election. Gold broke past the $1,300 resistance.

And all it took to turn the September—or rather, the 2017—gold price trend was a North Korean missile flying over the Sea of Japan. It turns out that gold is still a safe haven when geopolitical risks increase. But gold price futures are also up because of another serendipitous development. The U.S. dollar has been dropping like a brick on the world currency markets.

Also Read: The Gold Price Forecast 2018 Might Surprise You

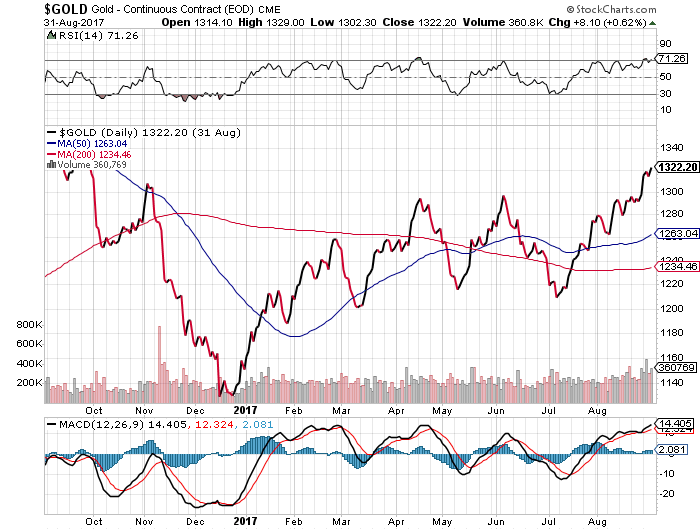

The movement of gold is accentuated by the decline of the dollar. The fact that the Federal Reserve has decided to hold off on raising interest rates has done two things. It has prolonged the so-called quantitative easing (QE) that has made investing in stocks attractive since at least 2012. But that has also raised risks because the Dow is hitting numbers that the real economy “can’t cash.” Meanwhile, geopolitical risk levels are such that investors are also looking for safe havens and gold is just that now, as the chart shows:

Chart courtesy of StockCharts.com

The decline in real interest rates in the United States is linked to the rise in inflation. That, too, has made gold attractive even as stocks continue to draw investors. Yet, there is a sense that the market euphoria will come to an abrupt end. That’s because gold has not been the only safe haven to make big moves. The Swiss franc and the Japanese yen have also moved higher. Again, just as with the case of gold, we have Kim Jong-Un of North Korea to “thank.”

The Momentum for Safe Havens Like Gold Investments Remains Bullish

Gold could get even stronger in the days leading up to the middle of September and beyond. Indeed, nervousness will intensify around September 9, North Korea’s Day of national celebrations. In 2016, Pyongyang launched a nuclear test on this occasion. The level of fear is such that many expect at least another missile launch from Pyongyang, perhaps one that will reach closer to Guam. Should that happen, the gold price forecast for 2017 will jump. A range of between $1,400 and $1,500 per ounce seems entirely reasonable to expect. (Source: “North Korea May Be Getting Ready For Its Sixth Nuclear Test, According To South Korean Spies,” Newsweek, August 28, 2017.)

Trump will exploit the North Korean situation. The threat of war is an excellent tool to distract Americans from domestic problems. Times are tense. But the media has shown that a good old-fashioned Russia spy story—mixed in with a lot of North Korea, terrorism, and Middle East risks—gets people’s attention. It also gets investors’ attention. I do not propose any different course of action; investors might want to stick with the defense sector.

Meanwhile, the market is setting new historical highs but, given the risk, long-term investors should focus on the longer term. That means paying attention to geopolitical crises, foreign recessions, and domestic tensions. What really separates the good investments from the bad and ugly ones is long-term performance.

The markets are too high and I expect a correction. No stocks are immune to the unexpected, which is why it is important to focus on market leaders and major social, political, and environmental trends when looking for the ones to buy. In times like these, gold looks like a safer bet.