This Chart Pattern Says Gold Price Could Jump to $3,000 Per Ounce

Gold prices could be setting up to do something that’s unimaginable to many, hit a price of $3,000 per ounce—and this could happen soon.

Here’s why.

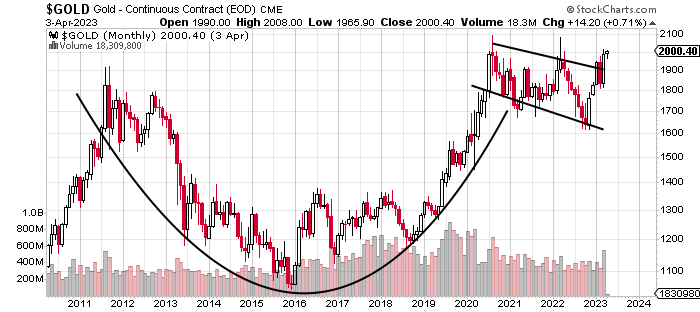

First, look at the chart below. This isn’t a new type of chart for long-term readers of Lombardi Letter, but there are new developments that have made my convictions stronger regarding the likelihood of higher gold prices.

Over the past decade or so, gold prices have formed a technical-analysis chart pattern called a “cup and handle.” This pattern develops when prices trade in a U-shaped “cup” shape and then they drift downward and form a “handle” shape. You can see it drawn on the chart below.

Technical analysts consider a cup and handle pattern to be a bullish signal. Once this pattern is mature, technical analysts wait for the price to trade out of the downward drift. This tends to be a great buying point. Usually, after the price breaks out of the downward drift, it rallies immensely.

Chart courtesy of StockCharts.com

Over the past few weeks, the price of gold has broken out of the downward drift (cup shape) part of the cup and handle pattern. Now the question is: How high could gold prices go?

When it comes to technical analysis, there are targets with every chart pattern. With a cup and handle pattern, once the price breaks out of the downward drift, you set the target by measuring the distance between the right peak and the bottom of the cup and then adding that to the breakout point.

In this case, the breakout point is around $2,000 and the distance between the right peak and the bottom is a little over $1,000. So, the chart is saying the price of gold is headed toward $3,000 per ounce.

5 More Reasons Gold Prices Could Skyrocket

Don’t get too fixated on the gold price chart alone. There are several factors that could send gold prices skyrocketing in the coming months and quarters. Here are five of them:

1. The Federal Reserve has been trying to fight inflation by raising interest rates. It has succeeded a little, as inflation has come down by a bit, but it also remains somewhat persistent. The Fed increasing its interest rates has caused the U.S. economy to slow down, and we’re now seeing cracks in the financial system.

It’s starting to look like the Fed might be close to ending its rate-hike regime and is about to start cutting interest rates. You also have to wonder if money-printing could be on the table soon, too. Lower interest rates and money-printing would both be good for gold prices.

2. There’s a global movement these days in which countries (mainly those with emerging economies) are trying to de-dollarize themselves. Several headlines have suggested that countries like Saudi Arabia are fine with trading their oil for Chinese yuan. Brazil has also agreed to trade with China in yuan. Some fear that this could hurt the value of the U.S. dollar.

For gold bugs, this is good news. That’s because gold is one of the best hedges against currency devaluation.

3. Central banks continue to buy gold at a record pace. They’re trying to diversify their reserves as the currency market has gotten volatile. Central banks likely won’t stop doing this anytime soon, which makes the case for owning gold stronger.

4. The investment demand for gold remains robust. You just have to look at the gold bullion sales figures at mints and look at how much of the yellow precious metal gold-backed exchange-traded funds (ETFs) own. There’s a gold rush happening, but you don’t really hear this being discussed much.

5. The supply side of the gold market is dismal, to say the least. As the demand for the yellow metal surges, miners might not be able to produce gold fast enough to meet that demand. Furthermore, there haven’t been many huge gold discoveries as of late. So, that makes the long-term supply picture of gold bleak.

Word of Caution for Gold Bugs

Dear reader, Lombardi Letter might be one of the only publications that was bullish on gold when no one else was. I still see gold as a tremendous investment opportunity. Its value has increased by a lot from its lows in 2015, but it’s not done increasing yet.

We could be setting up for $3,000/ounce gold prices sooner than previously expected, so stay tuned.

In the meantime, speculative investors should pay attention to the gold miners. As the price of gold moves higher, the prices of gold miner stocks might try to play catch-up. Gold mining stocks provide returns that are leveraged to gold prices.

I want to end with a word of caution: remember, all that glitters isn’t gold. I’ve been following the price of gold for some time, and I can tell you that whenever the price of the yellow precious metal soars, you start to see a lot of “pretenders” show up. So, be careful.