Gold Trading Interest Rising as COMEX Contracts Trade at Record Pace

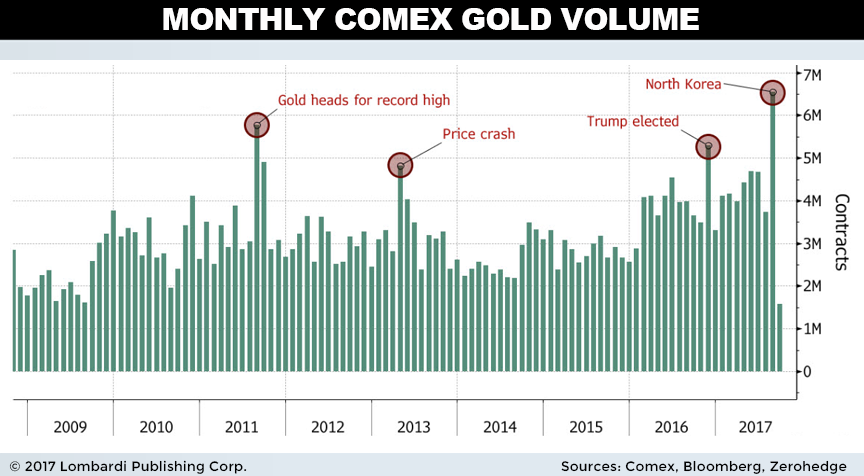

It appears everything isn’t so awesome after all. Interest in gold trading, as judged by gold futures contracts traded on COMEX, has reached record highs. This isn’t supposed to happen if everything is “all good” in the real economy.

This is all the more telling since gold trading reached a record high in August, not traditionally a month where volumes are strongest. Some 6.55 million contracts changed hands during the month, which works out to around $900.0 billion notional value. (Source: “Gold Trading Volumes Hit Record High As Dollar Crashes,” Zero Hedge, September 8, 2017.)

To put that into perspective, the entire gold market is valued at around $8.0 trillion. That’s based on a calculation of 5.9 billion ounces multiplied by $1,350/oz spot prices. As we can see, gold trading turnover on COMEX was about a ninth of world supply in August alone.

Also Read: The Gold Price Forecast 2018 Might Surprise You

Yes, there have been catalysts fueling the move. Specifically, escalation on the North Korean peninsula has put gold’s “fear hedge” characteristics back in play. The debt ceiling negotiations on Capitol Hill held everyone’s attention for awhile. But there’s evidence gold’s 12% move off the July 2016 lows is being propelled by more than just these catalysts.

For example, when news hit that Donald Trump bypassed Republican party leaders to forge his own debt ceiling extension, gold sold off a measly $8.00/oz (-0.6%). One of the biggest catalysts leading into the fall was “solved”—only if temporarily—and gold hardly flinched. Gold immediately marched higher during the next session, touching two-month highs that same day.

That’s bullish price action.

What’s Fueling the Move in Gold?

That’s really an open question at this point. After all, the Commerce Department just revised GDP growth upward to three percent on August 30—the quickest pace in two years. Gold is many things, but a strong investment in good economic times is not one of them.

There’s no question a weak U.S. dollar is providing some impetus for the move. The U.S. dollar index is down another three percent off the August highs, touching 32-month lows. Trump’s platitudes about eliminating the debt ceiling didn’t help King dollar, as people fear unlimited spending in the future. This sentiment may be overblown, but it helped propel gold higher in the immediate aftermath.

There’s also the curious case of Treasury Secretary (TS) Steve Mnuchin’s visit to Fort Knox last month. It was the first time a TS had visited the secretive vault in 70 years, prompting many to ask “Why now?” Perhaps it was a fail-safe maneuver to revalue gold higher (increasing capital reserves) if debt ceiling negotiations floundered. Perhaps it was something else. But the optics of the visit seem quite peculiar to us.

The fact that gold futures are smashing volume records in August speaks…volumes. Steep price appreciation combined with strong volume is the recipe for vigorous breakouts. Whatever the dynamics right now, gold prices are on fire. It could be a simple case of a weak dollar meeting favorable technical conditions.

But it also could be something far more significant at play.